Answered step by step

Verified Expert Solution

Question

1 Approved Answer

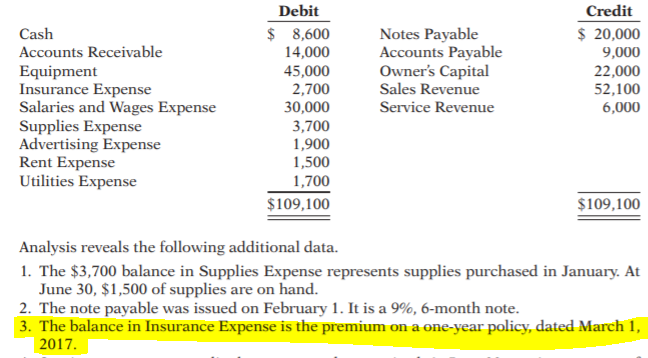

Instructions (a) Journalize the adjusting entries at June 30. (Assume adjustments are recorded every 6 months.) The question is highlighted. Based on Chegg for answer

Instructions (a) Journalize the adjusting entries at June 30. (Assume adjustments are recorded every 6 months.)

The question is highlighted. Based on Chegg for answer number 3 is this:

[($2,700 12) X 8] = 1,800

My question is why it is 8? From which month do we have to count? If it is counted from March, then it should be "[($2,700 12) X 10]" instead of

[($2,700 12) X 8] = 1,800

Please help, thank you

Debit Credit Notes Payable Accounts Payable Owner's Capital Sales Revenue Cash $8,600 14,000 45,000 2,700 30,000 3,700 1,900 1,500 1,700 $20,000 9,000 Accounts Receivable Equipment Insurance Expense Salaries and Wages Expense Supplies Expense Advertising Expense Rent Expense Utilities Expense 22,000 52,100 6,000 Service Revenue $109,100 $109,100 Analysis reveals the following additional data. 1. The $3,700 balance in Supplies Expense represents supplies purchased in January. At June 30, $1,500 of supplies are on hand 2. The note payable was issued on February 1. It is a 9%, 6-month note. 3. The balance in Insurance Expense is the premium on a one-year policy, dated March 1, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started