Question

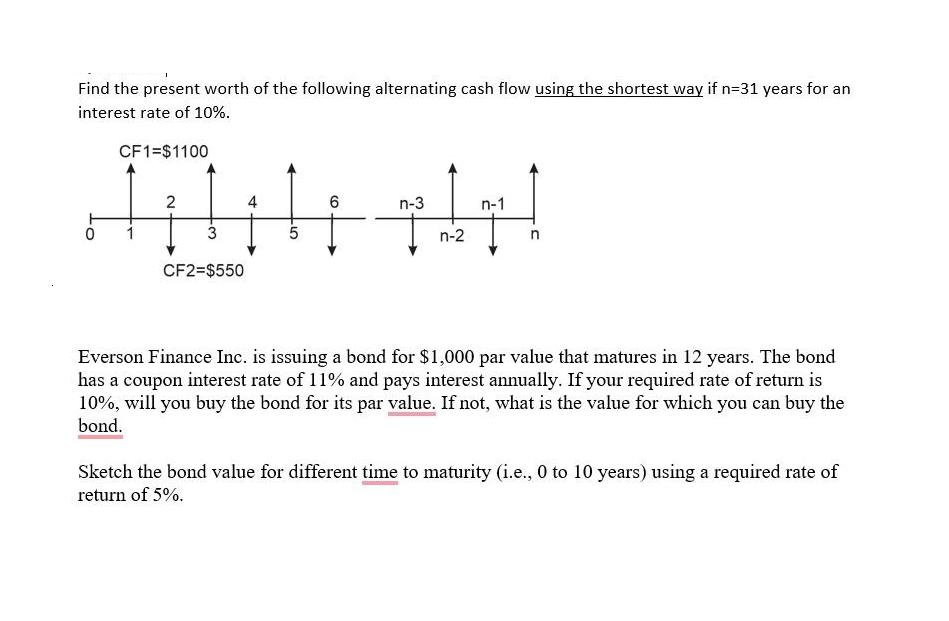

Find the present worth of the following alternating cash flow using the shortest way if n=31 years for an interest rate of 10%. CF1=$1100

Find the present worth of the following alternating cash flow using the shortest way if n=31 years for an interest rate of 10%. CF1=$1100 Jibili+ly! 4 6 5 2 3 CF2=$550 n-3 n-2 n-1 Everson Finance Inc. is issuing a bond for $1,000 par value that matures in 12 years. The bond has a coupon interest rate of 11% and pays interest annually. If your required rate of return is 10%, will you buy the bond for its par value. If not, what is the value for which you can buy the bond. Sketch the bond value for different time to maturity (i.e., 0 to 10 years) using a required rate of return of 5%.

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

2 A Value of Bond Interest PVAF1012 years Principal PVF10 12 years 11068137 1000 03186 106811 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso

12th edition

1119132223, 978-1-119-0944, 1118875052, 978-1119132226, 978-1118875056

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App