Answered step by step

Verified Expert Solution

Question

1 Approved Answer

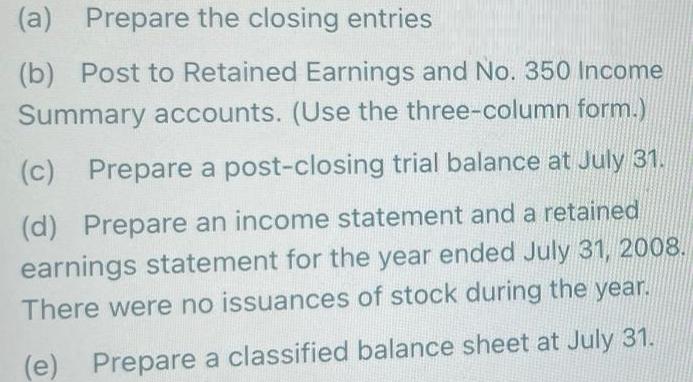

(a) Prepare the closing entries (b) Post to Retained Earnings and No. 350 Income Summary accounts. (Use the three-column form.) (c) Prepare a post-closing

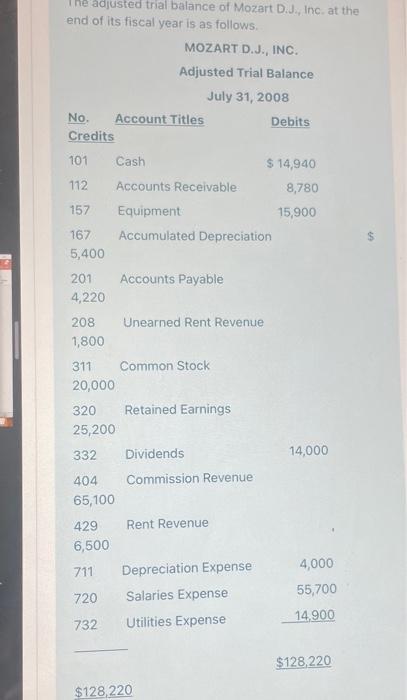

(a) Prepare the closing entries (b) Post to Retained Earnings and No. 350 Income Summary accounts. (Use the three-column form.) (c) Prepare a post-closing trial balance at July 31. (d) Prepare an income statement and a retained earnings statement for the year ended July 31, 2008. There were no issuances of stock during the year. (e) Prepare a classified balance sheet at July 31. he adjusted trial balance of Mozart D.J., Inc. at the end of its fiscal year is as follows. MOZART D.J., INC. Adjusted Trial Balance July 31, 2008 No. Account Titles Credits 101 112 157 167 5,400 201 4,220 208 1,800 311 20,000 429 6,500 711 720 732 Cash Accounts Receivable Equipment Accumulated Depreciation Accounts Payable Unearned Rent Revenue Common Stock 320 Retained Earnings 25,200 332 404 65,100 Dividends Commission Revenue Rent Revenue Depreciation Expense Salaries Expense Utilities Expense Debits $128,220 $ 14,940 8,780 15,900 14,000 4,000 55,700 14,900 $128,220

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Closing entries 1 Close all revenue accounts to Income Summary Debit Commission Revenue 65100 Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started