Answered step by step

Verified Expert Solution

Question

1 Approved Answer

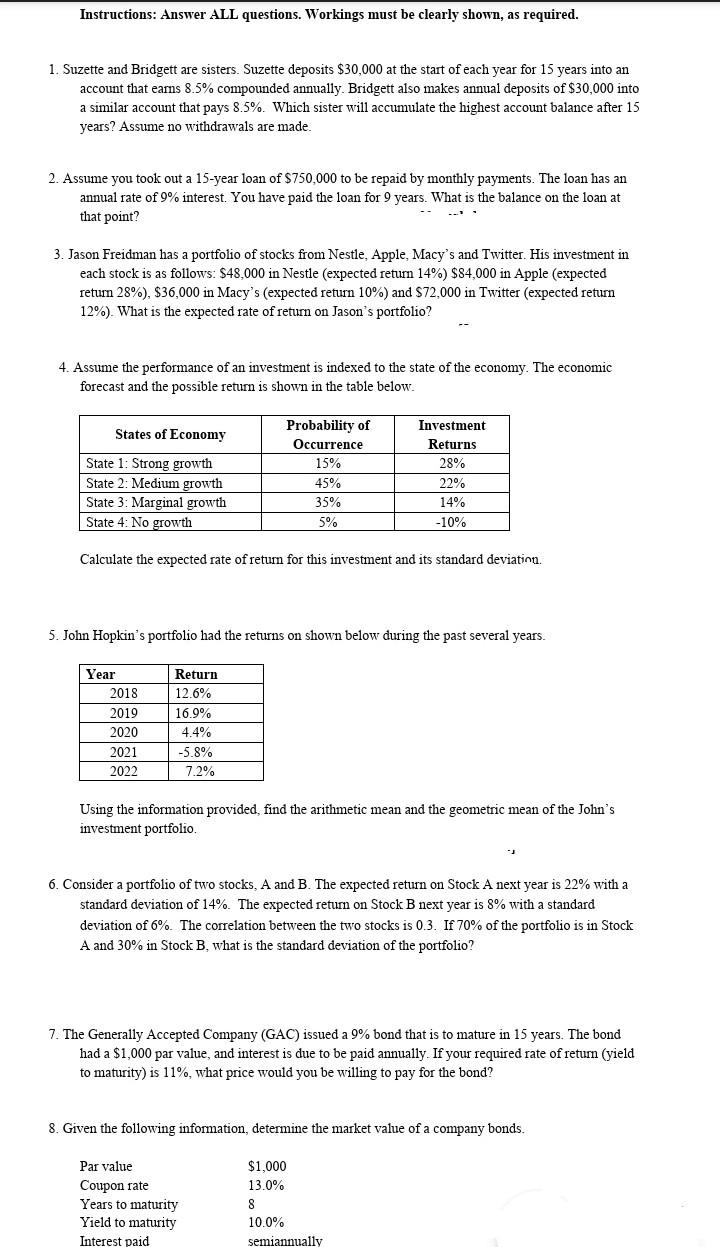

Instructions: Answer ALL questions. Workings must be clearly shown, as required. 1. Suzette and Bridgett are sisters. Suzette deposits $30,000 at the start of each

Instructions: Answer ALL questions. Workings must be clearly shown, as required. 1. Suzette and Bridgett are sisters. Suzette deposits $30,000 at the start of each year for 15 years into an account that earns 8.5% compounded annually. Bridgett also makes annual deposits of $30,000 into a similar account that pays 8.5%. Which sister will accumulate the highest account balance after 15 years? Assume no withdrawals are made. 2. Assume you took out a 15 -year loan of $750,000 to be repaid by monthly payments. The loan has an annual rate of 9% interest. You have paid the loan for 9 years. What is the balance on the loan at that point? 3. Jason Freidman has a portfolio of stocks from Nestle, Apple, Macy's and Twitter. His investment in each stock is as follows: $48,000 in Nestle (expected return 14\%) $4,000 in Apple (expected return 28\%), $36,000 in Macy's (expected return 10\%) and $72,000 in Twitter (expected return 12%). What is the expected rate of return on Jason's portfolio? 4. Assume the performance of an investment is indexed to the state of the economy. The economic forecast and the possible return is shown in the table below. Calculate the expected rate of return for this investment and its standard deviatinn. 5. John Hopkin's portfolio had the returns on shown below during the past several years. Using the information provided, find the arithmetic mean and the geometric mean of the John's investment portfolio. 6. Consider a portfolio of two stocks, A and B. The expected return on Stock A next year is 22% with a standard deviation of 14%. The expected return on Stock B next year is 8% with a standard deviation of 6%. The correlation between the two stocks is 0.3. If 70% of the portfolio is in Stock A and 30% in Stock B, what is the standard deviation of the portfolio? 7. The Generally Accepted Company (GAC) issued a 9% bond that is to mature in 15 years. The bond had a $1,000 par value, and interest is due to be paid annually. If your required rate of return (yield to maturity) is 11%, what price would you be willing to pay for the bond? 8. Given the following information, determine the market value of a company bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started