Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Answer the following questions using your own scrap paper or in Excel. Be sure to mark the question number and your final answer.

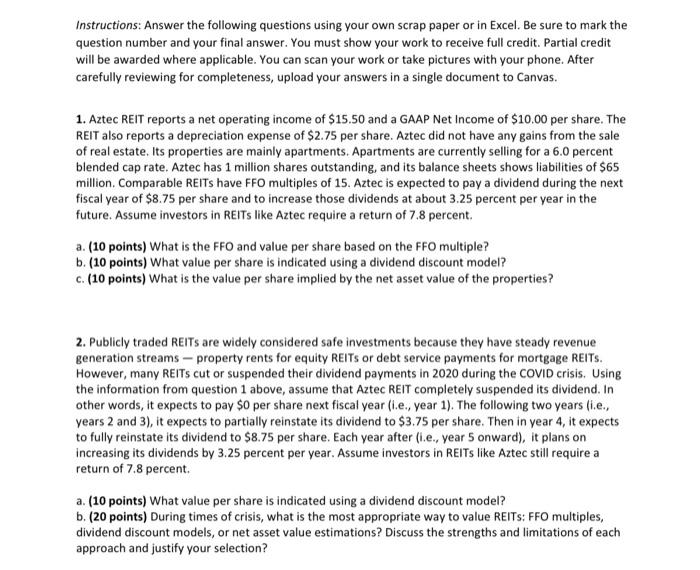

Instructions: Answer the following questions using your own scrap paper or in Excel. Be sure to mark the question number and your final answer. You must show your work to receive full credit. Partial credit will be awarded where applicable. You can scan your work or take pictures with your phone. After carefully reviewing for completeness, upload your answers in a single document to Canvas. 1. Aztec REIT reports a net operating income of $15.50 and a GAAP Net Income of $10.00 per share. The REIT also reports a depreciation expense of $2.75 per share. Aztec did not have any gains from the sale of real estate. Its properties are mainly apartments. Apartments are currently selling for a 6.0 percent blended cap rate. Aztec has 1 million shares outstanding, and its balance sheets shows liabilities of $65 million. Comparable REITS have FFO multiples of 15. Aztec is expected to pay a dividend during the next fiscal year of $8.75 per share and to increase those dividends at about 3.25 percent per year in the future. Assume investors in REITS like Aztec require a return of 7.8 percent. a. (10 points) What is the FFO and value per share based on the FFO multiple? b. (10 points) What value per share is indicated using a dividend discount model? c. (10 points) What is the value per share implied by the net asset value of the properties? 2. Publicly traded REITS are widely considered safe investments because they have steady revenue generation streams-property rents for equity REITS or debt service payments for mortgage REITS. However, many REITS cut or suspended their dividend payments in 2020 during the COVID crisis. Using the information from question 1 above, assume that Aztec REIT completely suspended its dividend. In other words, it expects to pay $0 per share next fiscal year (i.e., year 1). The following two years (i.e., years 2 and 3), it expects to partially reinstate its dividend to $3.75 per share. Then in year 4, it expects to fully reinstate its dividend to $8.75 per share. Each year after (i.e., year 5 onward), it plans on increasing its dividends by 3.25 percent per year. Assume investors in REITs like Aztec still require a return of 7.8 percent. a. (10 points) What value per share is indicated using a dividend discount model? b. (20 points) During times of crisis, what is the most appropriate way to value REITs: FFO multiples, dividend discount models, or net asset value estimations? Discuss the strengths and limitations of each approach and justify your selection?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started