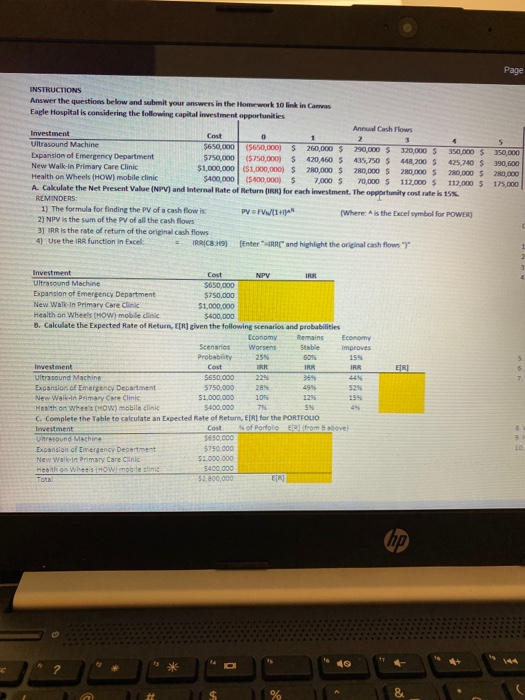

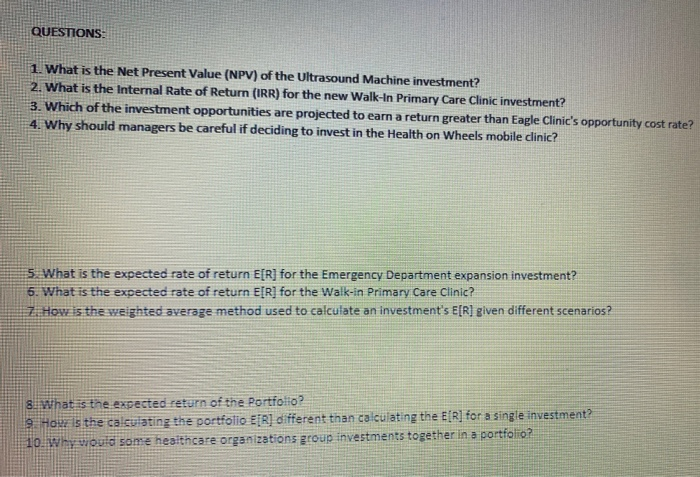

INSTRUCTIONS Answer the questions below and submit your answers in the Homework 10 nin Caras Fade Hospital is considering the following capital i n epportunities Anu Cash Flows Investment Cast 0 Ultrasound Machine $650 000 5650 DOODS 260,000 $ 210.000 $ 320,000 150.000 $ 350,000 Expansion of Emergency Department $750,000 $750,000 $ 420,460 $ 450 $ 200 $ 5.740 10600 New Walk-in Primary Care Clinic $1.000.000 51 500 000 $ 20.00 $ 20 000 $ 20.0005 20 000 $ 20.000 Health on Wheels DOW) mobile S400000 54000 5 7 000 5 70.000 112000 $ 112.000 $ 175.000 A. Calculate the Net Present Valee (NPV) and internal Rate of turn ) for each investment. The opportunity cost rate is 15% REMINDERS 1) The formula for finding the PV of a cash flow is PV=FV141] (Where is the Excel symbol for POWER) 2) NPV is the sum of the PV of all the cash flows 3 IRR is the rate of return of the original cash flows 4) Use the function in Excel TRICS. S t r a nd light the original cash flows Cost Investment Ultrasound Machine $650.000 Expansion of Emergency Department $750.000 New W in Primary Care $1.000.000 Health W o wmobile din $400.000 3. Calculate the expected Rate of Return, given the following seals and probab Remains Economy Scenario Worsens Stable Improves Probability westiment sound Machine Denon often becament New Wohan Primary Care Clinic 51.000.000 Heath on W C HOW) mobile clinit $400000 C. Complete the table to calculate an Expected Rate of Return, R) for the PORTFOLIO cost of Portolo al from abovel vestment trasound Machine NEW Who 51.000.000 SEO 52 800,000 QUESTIONS: 1. What is the Net Present Value (NPV) of the Ultrasound Machine investment? 2. What is the internal Rate of Return (IRR) for the new Walk-In Primary Care Clinic investment? 3. Which of the investment opportunities are projected to earn a return greater than Eagle Clinic's opportunity cost rate? 4. Why should managers be careful if deciding to invest in the Health on Wheels mobile clinic? 5. What is the expected rate of return E[R] for the Emergency Department expansion investment? 6. What is the expected rate of return E[R] for the Walk-in Primary Care Clinic? How is the weighted average method used to calculate an investment's E[R] given different scenarios? 8. What is the expected return of the Portfolio? 19Hour is the calculating the portfolio EFR] different than calculating the E[R] for a single investment? 10. Why would some healthcare organizations group investments together in a portfolio