Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A. Your company (company ABC) will receive $27 million in one year, which will be exchanged it into pounds (). There are three

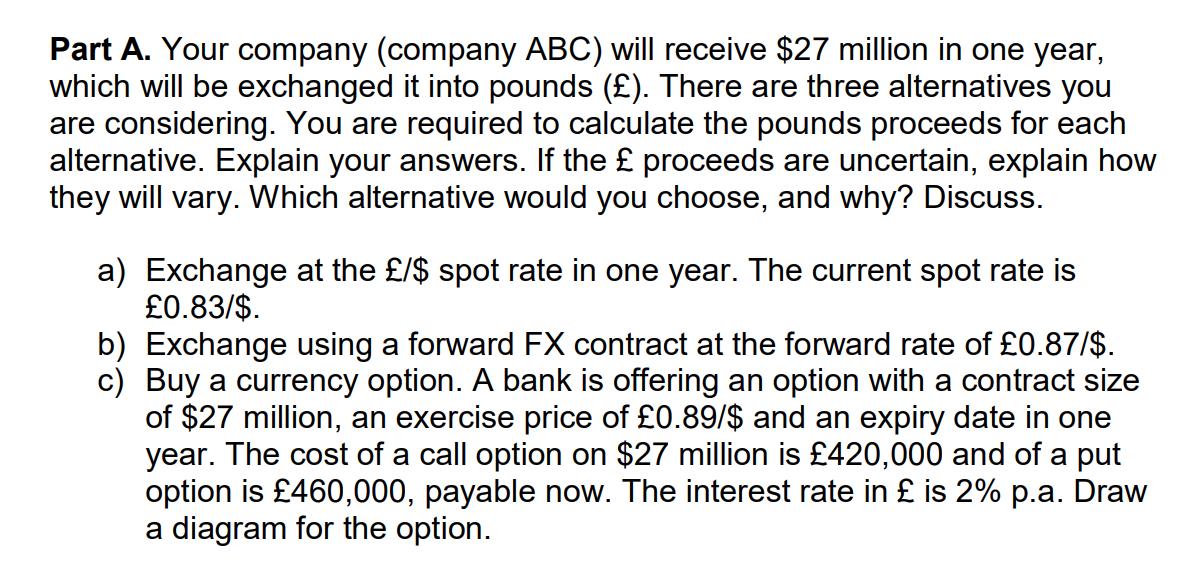

Part A. Your company (company ABC) will receive $27 million in one year, which will be exchanged it into pounds (). There are three alternatives you are considering. You are required to calculate the pounds proceeds for each alternative. Explain your answers. If the proceeds are uncertain, explain how they will vary. Which alternative would you choose, and why? Discuss. a) Exchange at the /$ spot rate in one year. The current spot rate is 0.83/$. b) Exchange using a forward FX contract at the forward rate of 0.87/$. c) Buy a currency option. A bank is offering an option with a contract size of $27 million, an exercise price of 0.89/$ and an expiry date in one year. The cost of a call option on $27 million is 420,000 and of a put option is 460,000, payable now. The interest rate in is 2% p.a. Draw a diagram for the option.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a converting into Rate at spot 083 27 million 083 x 27 million 2241 million b use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started