Answered step by step

Verified Expert Solution

Question

1 Approved Answer

instructions Complete the assignment by filling in the highlighted sections in the Excel spreadsheet. Be sure to explain your calculations in the column provided. FIN

instructions Complete the assignment by filling in the highlighted sections in the Excel spreadsheet. Be sure to explain your

calculations in the column provided.

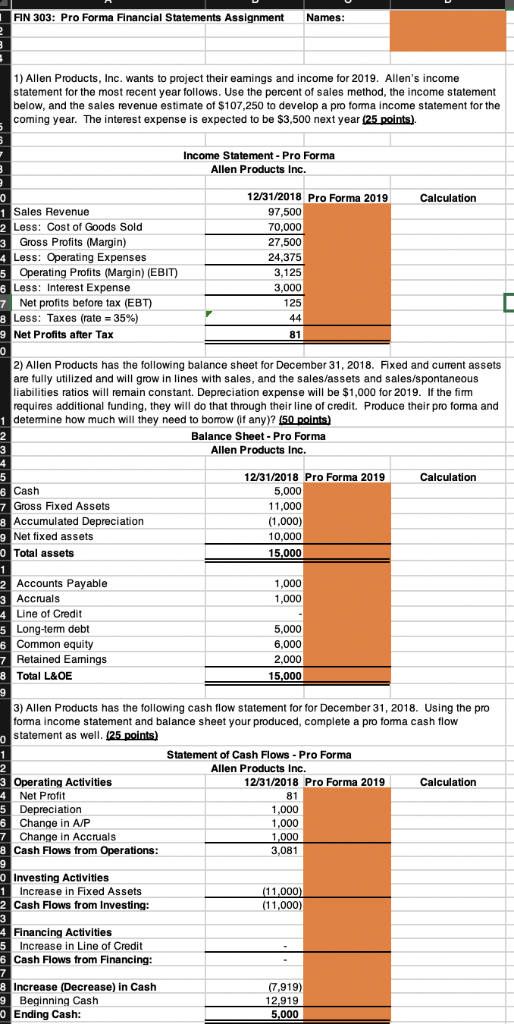

FIN 303: Pro Forma Financial Statements Assignment Names: 1) Allen Products, Inc. wants to project their earnings and income for 2019. Allen's income statement for the most recent year follows. Use the percent of sales method, the income statement below, and the sales revenue estimate of $107,250 to develop a pro forma income statement for the coming year. The interest expense is expected to be $3,500 next year (25 points) Income Statement - Pro Forma Allen Products Inc. Calculation 1 Sales Revenue 2 Less: Cost of Goods Sold 3 Gross Profits (Margin) 4 Less: Operating Expenses 5 Operating profits (Margin) (EBIT) 8 Less: Interest Expense 7 Net profits before tax (EBT) 8 Less: Taxes (rate = 35%) 9 Net Profits after Tax 12/31/2018 Pro Forma 2019 97,500 70,000 27.500 24.375 3,125 3,000 125 81 2) Allen Products has the following balance sheet for December 31, 2018. Fixed and current assets are fully utilized and will grow in lines with sales, and the sales/assets and sales/spontaneous liabilities ratios will remain constant. Depreciation expense will be $1,000 for 2019. If the firm requires additional funding, they will do that through their line of credit. Produce their pro forma and 1 determine how much will they need to borrow (if any)? (50 points) Balance Sheet - Pro Forma Allen Products Inc. Calculation 6 Cash 7 Gross Fixed Assets 8 Accumulated Depreciation 9 Net fixed assets Total assets 12/31/2018 Pro Forma 2019 5,000 11,000 (1,000) 10,000 15.000 1,000 1,000 Accounts Payable 3 Accruals Line of Credit 5 Long-term debt Common equity Retained Earnings Total L&OE 5,000 6.000 2,000 15,000 3) Allen Products has the following cash flow statement for for December 31, 2018. Using the pro forma income statement and balance sheet your produced, complete a pro forma cash flow b statement as well. (25 points) Statement of Cash Flows - Pro Forma Allen Products Inc. Operating Activities 12/31/2018 Pro Forma 2019 Calculation Net Profit 5 Depreciation 1,000 s Change in AP 1,000 7 Change in Accruals 1,000 8 Cash Flows from Operations: 3,081 81 Investing Activities 1 Increase in Fixed Assets 2 Cash Flows from Investing: (11.000) (11,000) 4 Financing Activities 5 Increase in Line of Credit 6 Cash Flows from Financing: 8 Increase (Decrease) in Cash 9 Beginning Cash 0 Ending Cash: (7,919) 12.919 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started