Question

Instructions: Current Years data are available in the 10K you retrieved. Please calculate Proposed Results Amounts and fill out the table below as indicated. A)

Instructions:

Current Years data are available in the 10K you retrieved. Please calculate Proposed Results Amounts and fill out the table below as indicated.

A)

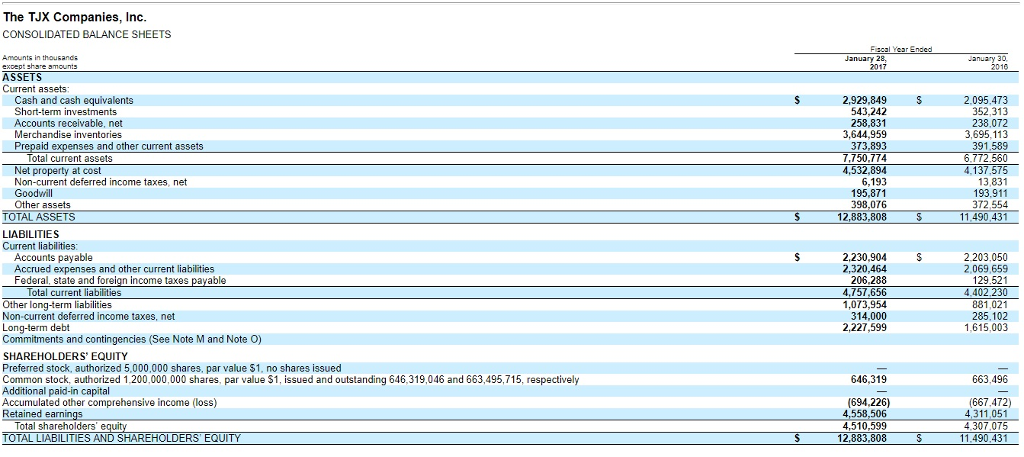

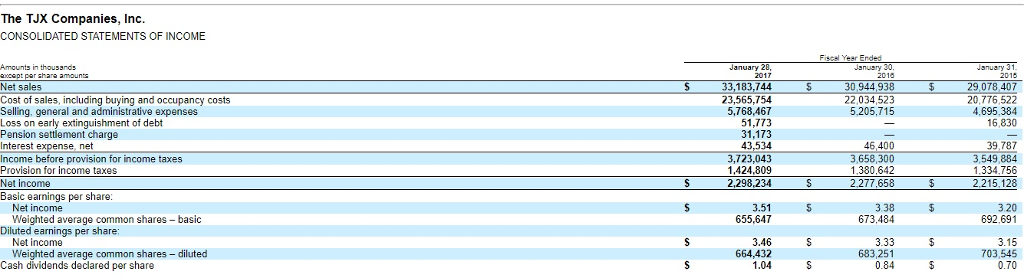

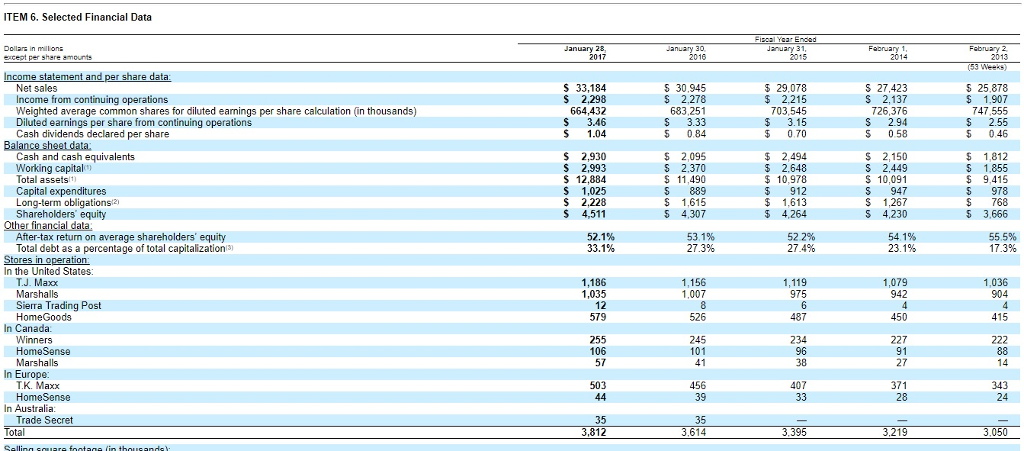

| (In thousands) | Current Results | Proposed Results without Cannibalization | Proposed Results with Cannibalization |

| Sales Revenue | Current years sales $...... | $....Increase of 30% from current years sales | $....Increase of 10% from current years sales |

| Net Income | Current years net income $......... | $... Increase by 8% from current years net income | $....Same as current years net income |

| Average total assets | $....(Beginning Assets Balance + Ending Assets Balance)/2 | $...Same as current years Average Total Assets | $...Same as current years Average Total Assets |

B) Identify the chosen company, its products/services and simulate or create a lower margin product or service for it. Do not determine price, cost or margin for the product; just name and describe it.

C) Compute your chosen companys return on assets, profit margin, and asset turnover; both with and without cannibalization of the new product or service.

D) Discuss the implications that your findings in parts (A, B and C) have on each Executives assessment of performance and final decision.

E) Are there any other options that the Company and Executives should consider? What impact would each of these alternatives have on the above ratios?

TJ MAXX Link to 10K Form

https://www.sec.gov/Archives/edgar/data/109198/000119312517099642/d269088d10k.htm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started