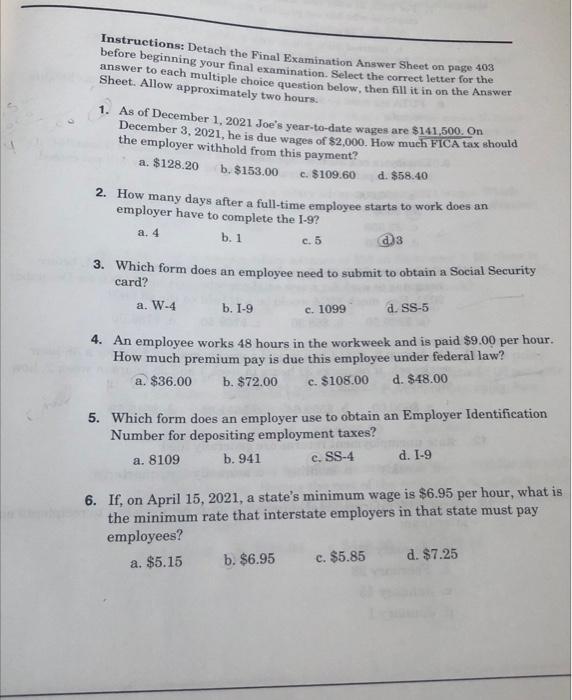

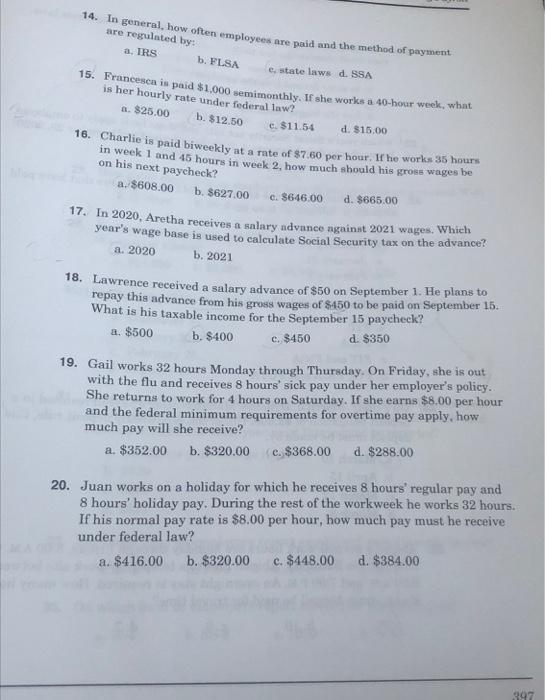

Instructions: Detach the Final Examination Answer Sheet on page 403 before beginning your final examination. Select the correct letter for the answer to each multiple choice question below, then fill it in on the Answer Sheet. Allow approximately two hours. 1. As of December 1, 2021 Joe's year-to-date wages are $141,500. On December 3, 2021, he is due wages of $2,000. How much FICA tax should the employer withhold from this payment? a. $128.20 b. $153.00 c. $109.60 d. $58.40 2. How many days after a full-time employee starts to work does an employer have to complete the 1-9? b. 1 a. 4 c.5 3 3. Which form does an employee need to submit to obtain a Social Security card? a. W-4 b. 1-9 e. 1099 d. SS-5 4. An employee works 48 hours in the workweek and is paid $9.00 per hour. How much premium pay is due this employee under federal law? a. $36.00 b. $72.00 c. $108.00 d. $48.00 c 5. Which form does an employer use to obtain an Employer Identification Number for depositing employment taxes? a. 8109 b. 941 e. SS-4 d. 1-9 6. If, on April 15, 2021, a state's minimum wage is $6.95 per hour, what is the minimum rate that interstate employers in that state must pay employees? a. $5.15 b. $6.95 c. $5.85 d. $7.25 14. In general, how often employees are paid and the method of payment are regulated by: a. IRS b. FLSA estate laws d. SSA 15. Francesca in paid $1,000 semimonthly. If she works a 40-hour week, what is her hourly rate under federal law? B. $25.00 b. $12.50 16. Charlie is paid biweekly at a rate of $7.60 per hour. It he works 35 hours in week 1 and 45 hours in week 2. how much should his gross wages be on his next paycheck? a. $608.00 b. $627.00 d. $665.00 e $11.54 d. $15.00 C. $646.00 17. In 2020, Aretha receives a salary advance against 2021 wages. Which year's wage base is used to calculate Social Security tax on the advance? a. 2020 b. 2021 18. Lawrence received a salary advance of $50 on September 1. He plans to repay this advance from his gross wages of $450 to be paid on September 15. What is his taxable income for the September 15 paycheck? a. $500 b. $400 d. $350 19. Gail works 32 hours Monday through Thursday. On Friday, she is out with the flu and receives 8 hours' sick pay under her employer's policy. She returns to work for 4 hours on Saturday. If she earns $8.00 per hour and the federal minimum requirements for overtime pay apply, how much pay will she receive? a. $352.00 b. $320.00 e. $368.00 d. $288.00 c. $450 20. Juan works on a holiday for which he receives 8 hours' regular pay and 8 hours' holiday pay. During the rest of the workweek he works 32 hours. If his normal pay rate is $8.00 per hour, how much pay must he receive under federal law? a. $416.00 b. $320.00 c. $448.00 d. $384.00 297