Answered step by step

Verified Expert Solution

Question

1 Approved Answer

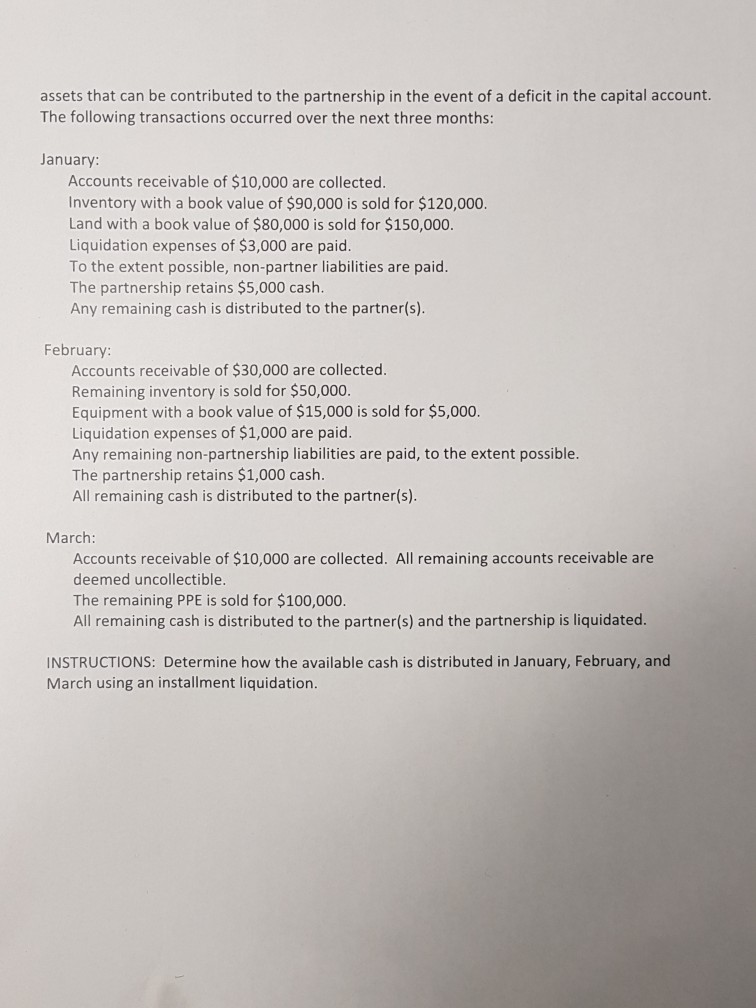

Instructions: Determine how the available cash is distributed in January, February, and March using an installment liquidation. Advanced Accounting- Chapter 14 Assignment Due no later

Instructions: Determine how the available cash is distributed in January, February, and March using an installment liquidation.

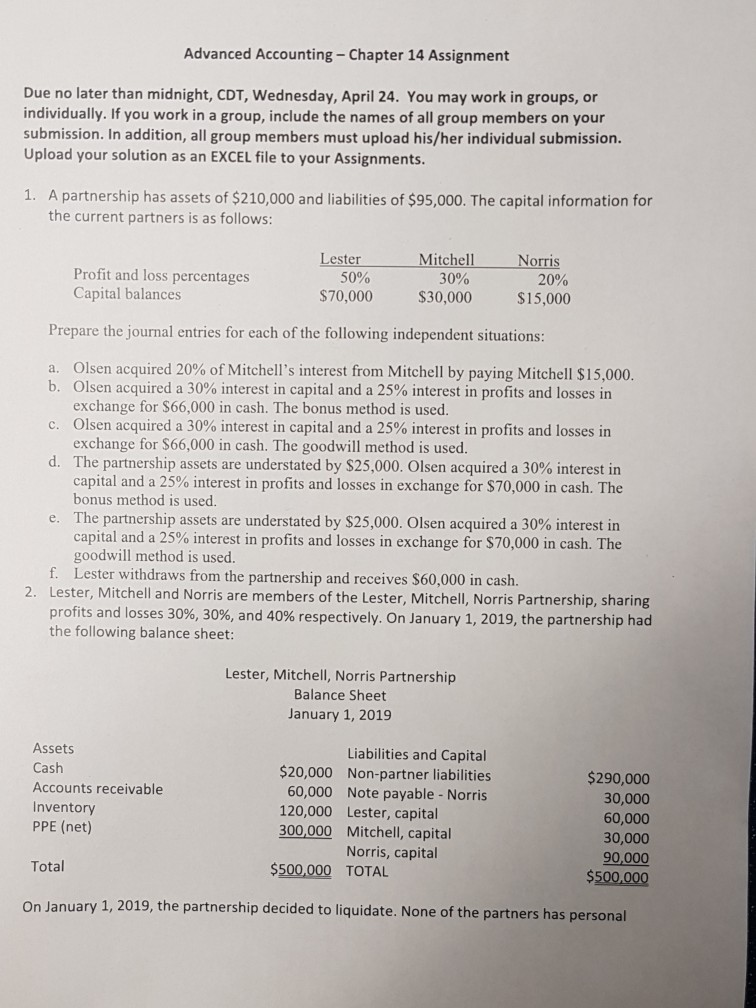

Advanced Accounting- Chapter 14 Assignment Due no later than midnight, CDT, Wednesday, April 24. You may work in groups, or individually. If you work in a group, include the names of all group members on your submission. In addition, all group members must upload his/her individual submission. Upload your solution as an EXCEL file to your Assignments. A partnership has assets of $210,000 and liabilities of $95,000. The capital information for the current partners is as follows 1. LesterMitchellNorris Profit and loss percentages Capital balances 50% S70,000 30% 20% $15,000 $30,000 Prepare the journal entries for each of the following independent situations: Olsen acquired 20% of Mitchell's interest from Mitchell by paying Mitchell $15,000 Olsen acquired a 30% interest in capital and a 25% interest in profits and losses in exchange for $66,000 in cash. The bonus method is used. Olsen acquired a 30% interest in capital and a 25% interest in profits and losses in exchange for $66,000 in cash. The goodwill method is used. The partnership assets are understated by $25,000. Olsen acquired a 30% interest in capital and a 25% interest in profits and losses in exchange for $70,000 in cash. The bonus method is usecd The partnership assets are understated by $25,000. Olsen acquired a 30% interest in capital and a 25% interest in profits and losses in exchange for S7O,000 in cash. The goodwill method is used. Lester withdraws from the partnership and receives $60,000 in cash. a. b. c. d. e. f. Lester, Mitchell and Norris are members of the Lester, Mitchell, Norris Partnership, sharing profits and losses 30%, 30%, and 40% respectively. On January 1, 2019, the partnership had the following balance sheet 2. Lester, Mitchell, Norris Partnership Balance Sheet January 1, 2019 Assets Cash Accounts receivable Inventory PPE (net) Liabilities and Capital $20,000 Non-partner liabilities 60,000 Note payable- Norris 120,000 Lester, capital 300,000 Mitchell, capital $290,000 30,000 60,000 30,000 90,000 Norris, capital Total $500,000 TOTAL anuary 1, 2019, the partnership decided to liquidate. None of the partners has personal On J assets that can be contributed to the partnership in the event of a deficit in the capital account The following transactions occurred over the next three months: January: Accounts receivable of $10,000 are collected. Inventory with a book value of $90,000 is sold for $120,000 Land with a book value of $80,000 is sold for $150,000. Liquidation expenses of $3,000 are paid. To the extent possible, non-partner liabilities are paid. The partnership retains $5,000 cash. Any remaining cash is distributed to the partner(s). February: Accounts receivable of $30,000 are collected. Remaining inventory is sold for $50,000. Equipment with a book value of $15,000 is sold for $5,000. Liquidation expenses of $1,000 are paid. Any remaining non-partnership liabilities are paid, to the extent possible. The partnership retains $1,000 cash. All remaining cash is distributed to the partner(s). March: Accounts receivable of $10,000 are collected. All remaining accounts receivable are deemed uncollectible The remaining PPE is sold for $100,000. All remaining cash is distributed to the partner(s) and the partnership is liquidated. INSTRUCTIONS: Determine how the available cash is distributed in January, February, and March using an installment liquidationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started