Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INSTRUCTIONS Determine the following measures for both 20Y8 and 20Y9, rounding percentages and ratios other than per-share amounts to one decimal place. Briefly explain how

INSTRUCTIONS

- Determine the following measures for both 20Y8 and 20Y9, rounding percentages and ratios other than per-share amounts to one decimal place. Briefly explain how or why management would use this information and comment on the trend from 20Y8 and 20Y9.

- Working capital

- Current ratio

- Quick ratio

- Accounts receivable turnover

- Number of days sales in receivables

- Inventory turnover

- Number of days sales in inventory

- Ratio of fixed assets to long-term liabilities

- Ratio of liabilities to stockholders equity

- Times interest earned

- Asset turnover

- Return on total assets

- Return on stockholders equity

- Return on common stockholders equity

- Earnings per share on common stock

- Price-earnings ratio

- Dividends per share

- Dividend yield

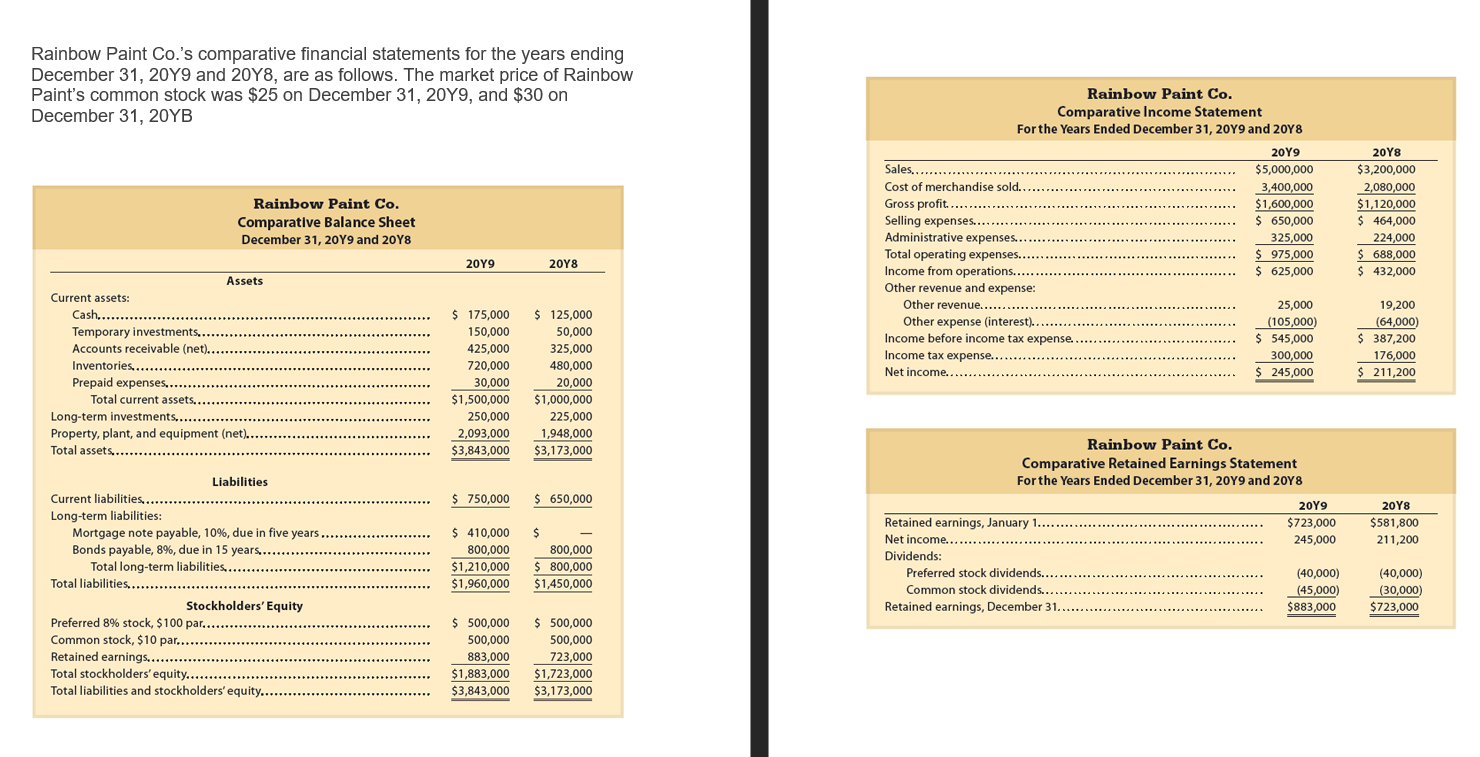

Rainbow Paint Co.'s comparative financial statements for the years ending December 31, 2049 and 2048, are as follows. The market price of Rainbow Paint's common stock was $25 on December 31, 2019, and $30 on December 31, 20YB Rainbow Paint Co. Comparative Balance Sheet December 31, 2049 and 20Y8 Rainbow Paint Co. Comparative Income Statement For the Years Ended December 31, 2019 and 2048 2099 Sales......... $5,000,000 Cost of merchandise sold. 3,400,000 Gross profit....... $1,600,000 Selling expenses......... $ 650,000 Administrative expenses.. 325,000 Total operating expenses. $ 975,000 Income from operations...... $ 625,000 Other revenue and expense: Other revenue........... 25,000 Other expense interest)....... (105,000) Income before income tax expense.. $ 545,000 Income tax expense......... 300,000 Net income...... $ 245,000 20Y8 $3,200,000 2,080,000 $1,120,000 $ 464,000 224,000 $ 688,000 $ 432,000 20Y9 2018 Assets Current assets: Cash......... Temporary investments....... Accounts receivable (net).......... Inventories..... Prepaid expenses... Total current assets.... Long-term investments......... Property, plant, and equipment (net).. Total assets.... 19,200 (64,000) $ 387,200 176,000 $ 211,200 $ 175,000 150,000 425,000 720,000 30,000 $1,500,000 250,000 2,093,000 $3,843,000 $ $ 125,000 50,000 325,000 480,000 20,000 $1,000,000 225,000 1,948,000 $3,173,000 Rainbow Paint Co. Comparative Retained Earnings Statement For the Years Ended December 31, 2019 and 2048 $ 750,000 $ 650,000 20Y9 $ 723,000 245,000 20Y8 $581,800 211,200 Liabilities Current liabilities..... Long-term liabilities: Mortgage note payable, 10%, due in five years Bonds payable, 8%, due in 15 years....... Total long-term liabilities................... Total liabilities........ Stockholders' Equity Preferred 8% stock, $100 par........ Common stock, $10 par............ Retained earnings..... Total stockholders' equity....... Total liabilities and stockholders' equity... $ 410,000 800,000 $1,210,000 $1,960,000 $ 800,000 $ 800,000 $1,450,000 Retained earnings, January 1...... Net income.. Dividends: Preferred stock dividends.... Common stock dividends... Retained earnings, December 31....... (40,000) (45,000) $883,000 (40,000) (30,000) $723,000 $ 500,000 $500,000 500,000 500,000 883,000 723,000 $1,883,000 $1,723,000 $3,843,000 $3,173,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started