Answered step by step

Verified Expert Solution

Question

1 Approved Answer

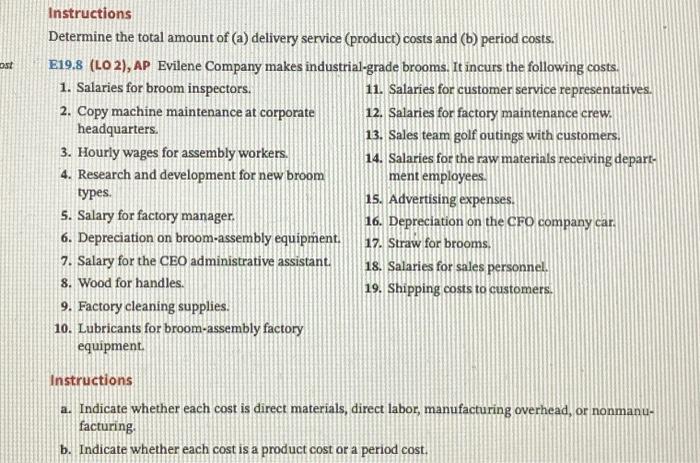

Instructions Determine the total amount of (a) delivery service (product) costs and (b) period costs. E19.8 (LO 2), AP Evilene Company makes industrial-grade brooms. It

Instructions Determine the total amount of (a) delivery service (product) costs and (b) period costs. E19.8 (LO 2), AP Evilene Company makes industrial-grade brooms. It incurs the following costs. 1. Salaries for broom inspectors. 11. Salaries for customer service representatives. 2. Copy machine maintenance at corporate headquarters. 3. Hourly wages for assembly workers. 4. Research and development for new broom types. 5. Salary for factory manager. 6. Depreciation on broom-assembly equipment. 7. Salary for the CEO administrative assistant. 8. Wood for handles. 9. Factory cleaning supplies. 10. Lubricants for broom-assembly factory equipment. 12. Salaries for factory maintenance crew. 13. Sales team golf outings with customers. 14. Salaries for the raw materials receiving depart- ment employees. 15. Advertising expenses. 16. Depreciation on the CFO company car. 17. Straw for brooms. 18. Salaries for sales personnel. 19. Shipping costs to customers. Instructions a. Indicate whether each cost is direct materials, direct labor, manufacturing overhead, or nonmanu- facturing. b. Indicate whether each cost is a product cost or a period cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started