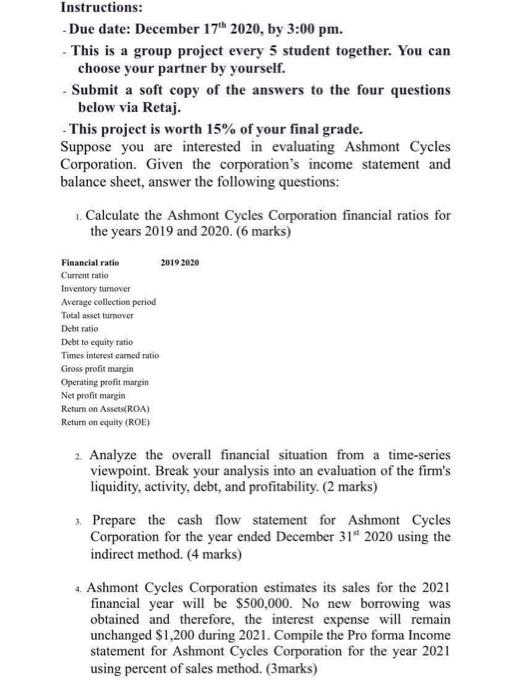

Instructions: Due date: December 17 2020, by 3:00 pm. This is a group project every 5 student together. You can choose your partner by yourself. Submit a soft copy of the answers to the four questions below via Retaj. This project is worth 15% of your final grade. Suppose you are interested in evaluating Ashmont Cycles Corporation. Given the corporation's income statement and balance sheet, answer the following questions: Calculate the Ashmont Cycles Corporation financial ratios for the years 2019 and 2020. (6 marks) Financial ratio 2019 2020 Current ratio Inventory tumover Average collection period Total asset turnover Debt ratio Debt to equity ratio Times interest camed ratio Gross profit margin Operating profit margin Net profit margin Return on Assets(ROA) Retum on cquity (ROE) 2. Analyze the overall financial situation from a time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability. (2 marks) 3. Prepare the cash flow statement for Ashmont Cycles Corporation for the year ended December 31* 2020 using the indirect method. (4 marks) 4. Ashmont Cycles Corporation estimates its sales for the 2021 financial year will be $500,000. No new borrowing was obtained and therefore, the interest expense will remain unchanged $1,200 during 2021. Compile the Pro forma Income statement for Ashmont Cycles Corporation for the year 2021 using percent of sales method. (3marks) Instructions: Due date: December 17 2020, by 3:00 pm. This is a group project every 5 student together. You can choose your partner by yourself. Submit a soft copy of the answers to the four questions below via Retaj. This project is worth 15% of your final grade. Suppose you are interested in evaluating Ashmont Cycles Corporation. Given the corporation's income statement and balance sheet, answer the following questions: Calculate the Ashmont Cycles Corporation financial ratios for the years 2019 and 2020. (6 marks) Financial ratio 2019 2020 Current ratio Inventory tumover Average collection period Total asset turnover Debt ratio Debt to equity ratio Times interest camed ratio Gross profit margin Operating profit margin Net profit margin Return on Assets(ROA) Retum on cquity (ROE) 2. Analyze the overall financial situation from a time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability. (2 marks) 3. Prepare the cash flow statement for Ashmont Cycles Corporation for the year ended December 31* 2020 using the indirect method. (4 marks) 4. Ashmont Cycles Corporation estimates its sales for the 2021 financial year will be $500,000. No new borrowing was obtained and therefore, the interest expense will remain unchanged $1,200 during 2021. Compile the Pro forma Income statement for Ashmont Cycles Corporation for the year 2021 using percent of sales method. (3marks)