Answered step by step

Verified Expert Solution

Question

1 Approved Answer

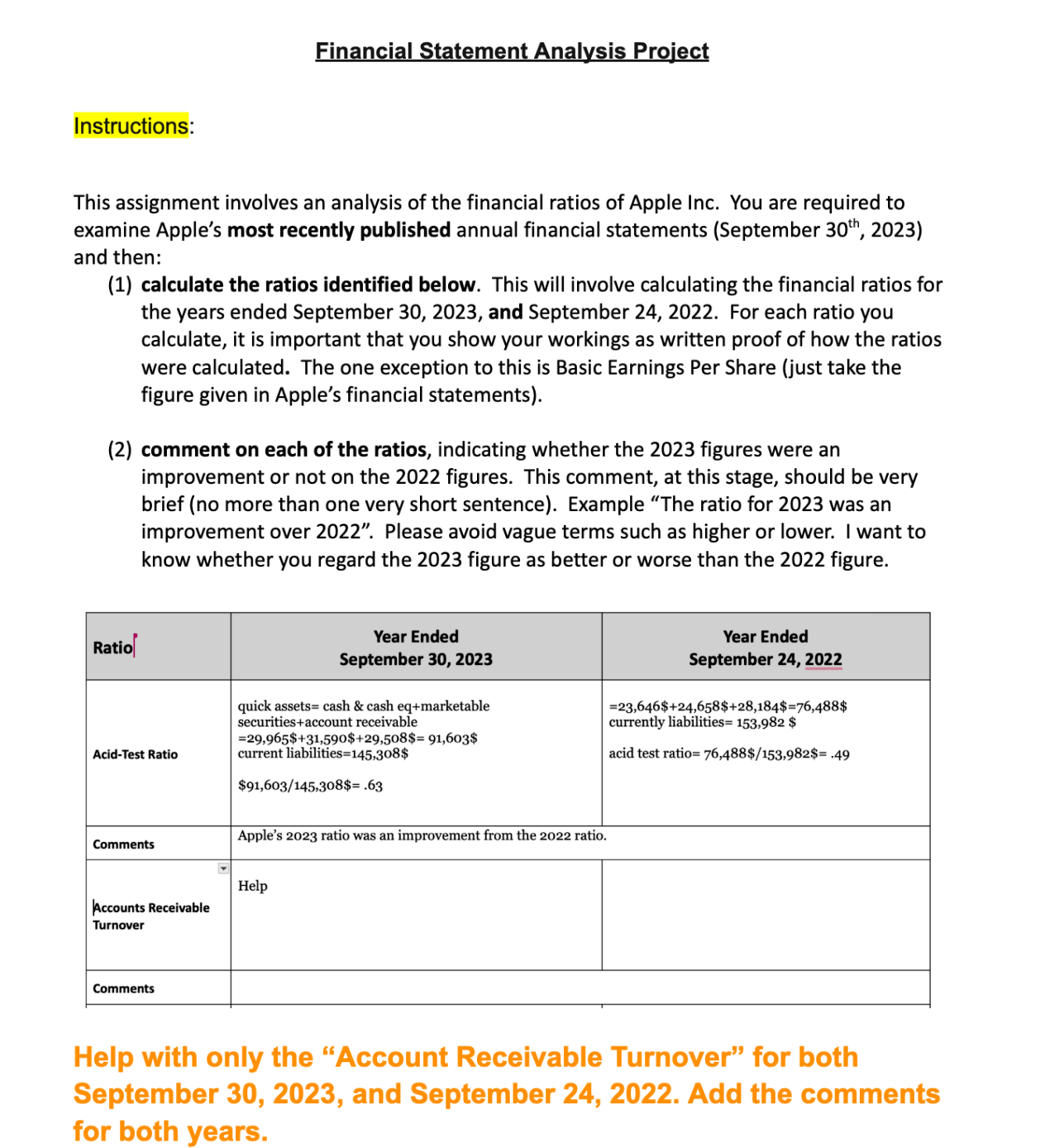

Instructions: Financial Statement Analysis Project This assignment involves an analysis of the financial ratios of Apple Inc. You are required to examine Apple's most

Instructions: Financial Statement Analysis Project This assignment involves an analysis of the financial ratios of Apple Inc. You are required to examine Apple's most recently published annual financial statements (September 30th, 2023) and then: (1) calculate the ratios identified below. This will involve calculating the financial ratios for the years ended September 30, 2023, and September 24, 2022. For each ratio you calculate, it is important that you show your workings as written proof of how the ratios were calculated. The one exception to this is Basic Earnings Per Share (just take the figure given in Apple's financial statements). (2) comment on each of the ratios, indicating whether the 2023 figures were an improvement or not on the 2022 figures. This comment, at this stage, should be very brief (no more than one very short sentence). Example "The ratio for 2023 was an improvement over 2022". Please avoid vague terms such as higher or lower. I want to know whether you regard the 2023 figure as better or worse than the 2022 figure. Ratio Year Ended September 30, 2023 quick assets cash & cash eq+marketable securities+account receivable =29,965$+31,590$+29,508$= 91,603$ Acid-Test Ratio current liabilities=145,308$ Comments $91,603/145,308$= .63 Apple's 2023 ratio was an improvement from the 2022 ratio. Help Accounts Receivable Turnover Comments Year Ended September 24, 2022 =23,646$+24,658$+28,184$=76,488$ currently liabilities= 153,982 $ acid test ratio= 76,488$/153,982$= .49 Help with only the "Account Receivable Turnover" for both September 30, 2023, and September 24, 2022. Add the comments for both years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started