Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding

| Instructions: | For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding of intermediate work. |

|---|

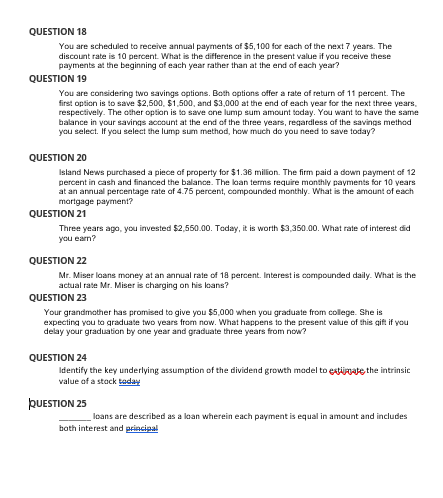

QUESTION 18 You are scheduled to receive annual payments of $5,100 for each of the next 7 years. The discount rate is 10 percent. What is the difference in the present value if vou receive these payments at the beginning of each year rather than at the end of each year? QUESTION 19 You are considering two savings options. Both options offer a rate of return of 11 percent. The first option is to save $2,500,$1,500, and $3,000 at the end of each year for the next three years, respectively. The other option is to save one lump sum amount today. You want to have the same balance in your savings acoount at the end of the three vears, reqardless of the savings method you select. If you select the lump sum method, how much do you need to save today? QUESTION 20 Island News purchased a piece of property for $1.36 milion. The firm paid a down payment of 12 percent in cash and financed the balance. The loan terms require monthly payments for 10 years at an annual percentage rate of 4.75 percent, compounded monthly. What is the amount of each mortgage payment? QUESTION 21 Three years ago, you invested $2,560.00. Today, it is worth $3,350.00. What rate of interest did you earn? QUESTION 22 Mr. Miser loans money at an annual rate of 18 percent. Interest is compounded daily. What is the actual rase Mr. Miser is charging on his loans? QUESTION 23 Your grandmother has promised to give you \$5,000 when you graduate from college. She is expecting you to qraduase two years from now. What happens to the present value of this gie if you delay your graduation by one year and graduate three years from now? QUESTION 24 Identify the key underlying assumption of the dividend growth madel to eatijebate the intrinsic value of a stack taday RUESTION 25 loans are described as a loan wherein each payment is equal in amount and includes both interest and priaciagal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started