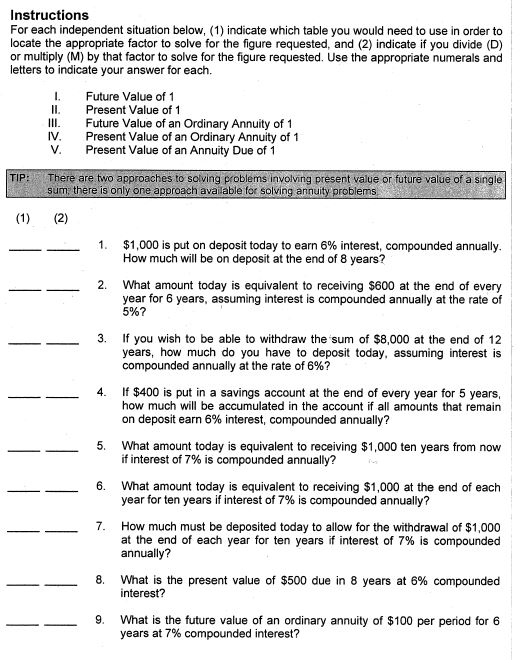

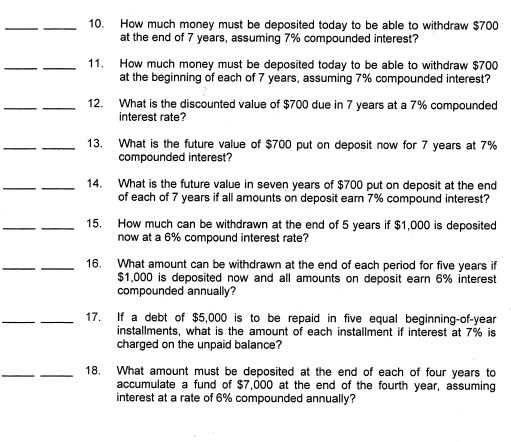

Instructions For each independent situation below, (1) indicate which table you would need to use in order to locate the appropriate factor to solve for the figure requested, and (2) indicate if you divide (D) or multiply (M) by that factor to solve for the figure requested. Use the appropriate numerals and letters to indicate your answer for each. 1. Future Value of 1 II. Present Value of 1 Future Value of an Ordinary Annuity of 1 Present Value of an Ordinary Annuity of 1 V Present Value of an Annuity Due of 1 IV. TIP: There are two approaches to solving problems involving present value or future value of a single sum there is only one approach available for solving annuity problems (1) (2) 1. 2. 4. $1,000 is put on deposit today to earn 6% interest, compounded annually. How much will be on deposit at the end of 8 years? What amount today is equivalent to receiving $600 at the end of every year for 6 years, assuming interest is compounded annually at the rate of 5%? 3. If you wish to be able to withdraw the sum of $8,000 at the end of 12 years, how much do you have to deposit today, assuming interest is compounded annually at the rate of 6%? If $400 is put in a savings account at the end of every year for 5 years, how much will be accumulated in the account if all amounts that remain on deposit earn 6% interest, compounded annually? 5. What amount today is equivalent to receiving $1,000 ten years from now if interest of 7% is compounded annually? 6. What amount today is equivalent to receiving $1,000 at the end of each year for ten years if interest of 7% is compounded annually? 7. How much must be deposited today to allow for the withdrawal of $1,000 at the end of each year for ten years if interest of 7% is compounded annually? 8. What is the present value of $500 due in 8 years at 6% compounded interest? What is the future value of an ordinary annuity of $100 per period for 6 years at 7% compounded interest? 9. 13 10. How much money must be deposited today to be able to withdraw $700 at the end of 7 years, assuming 7% compounded interest? 11. How much money must be deposited today to be able to withdraw $700 at the beginning of each of 7 years, assuming 7% compounded interest? 12. What is the discounted value of $700 due in 7 years at a 7% compounded interest rate? What is the future value of $700 put on deposit now for 7 years at 7% compounded interest? 14. What is the future value in seven years of $700 put on deposit at the end of each of 7 years if all amounts on deposit earn 7% compound interest? 15. How much can be withdrawn at the end of 5 years if $1,000 is deposited now at a 6% compound interest rate? 16. What amount can be withdrawn at the end of each period for five years if $1,000 is deposited now and all amounts on deposit earn 6% interest compounded annually? 17. If a debt of $5,000 is to be repaid in five equal beginning-of-year installments, what is the amount of each installment if interest at 7% is charged on the unpaid balance? 18. What amount must be deposited at the end of each of four years to accumulate a fund of $7,000 at the end of the fourth year, assuming interest at a rate of 6% compounded annually