Answered step by step

Verified Expert Solution

Question

1 Approved Answer

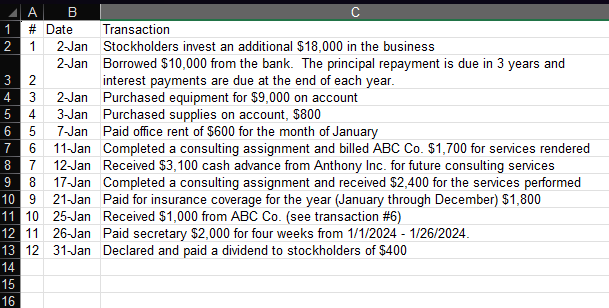

Instructions for the Cycle Project: Prepare journal entries for the January 2 0 2 4 transactions for Wallace Corporation described in the transaction worksheet. Enter

Instructions for the Cycle Project:

Prepare journal entries for the January transactions for Wallace Corporation described in the transaction

worksheet. Enter them in the general Journal I have provided. Use the accounts listed in the General Ledger.

Add new accounts if you think they are necessary. For this assignment you can ignore income taxes.

Post the journal entries to the taccounts in the General Ledger worksheet. Post the journal entries by

referencing your journal entries dont input the numbers again All your work from this step forward should

involve referencing cells rather than inputting numbers. The January balances are provided. Wallace

Corporation has a calendar fiscal year and prepares monthly financial statements.

Calculate endofmonth account balances in the General Ledger tab using Excel use an Excel formula; don't

type in the balance

Fill in the Unadjusted Trial Balance columns on your worksheet and check to see that the total of the debit

balances equals the total of the credit balances. If it does not go back and check your work in parts and

Using the information in the Supplies, Prepaid Insurance, Wages Payable, Unearned Revenue, Interest and

Equipment tabs calculate what the balances should be for each of these accounts. Show in these tabs

how you are coming up with each of these balances. Make sure that you are calculating the balances of

the above balance sheet accounts and not the related revenue or expense accounts. Highlight the

balance you calculate.

Prepare Adjusting Journal Entries and enter them in your General Journal below your January

transaction journal entries enter amounts using cell references to where you calculated them do not hard

key the numbers

Post your adjustments to your worksheet and add new accounts, as needed and calculate an Adjusted Trial

Balance. Don't post your adjustments to the General Ledger.

Verify that the balances you came up with in part above agree with the balances in your adjusted

trial balance. If they do not agree correct your adjustment in part above.

Optional Fill in the income statement and balance sheet columns on the trial balance worksheet. Note that

the income statement and balance sheet columns in the worksheet are not an income statement or a

balance sheet.

Prepare an Income Statement and Statement of Retained Earnings for the month of January and a Balance

Sheet as of January Use additional Excel worksheets for these statements. Follow my financial statement

formatting rules and refer to financial statement examples in the book.

The only numbers that should be hardkeyed in this entire document are in the Journal Entries and calculations

in the Supplies, Prepaid Insurance, Wages Payable, Unearned Revenue, Interest and Equipment tabs All other

amounts should be derived from cell references and formulas.

Submit your spreadsheet through Blackboard.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started