Instructions for the data case can be found on pages 68 and 69 of the textbook. a. The companies to be examined are Disney and Tyson Foods. b. As the text describes, the Disney and Tyson Foods financial statements can be accessed on Morningstar.com. The book is incorrect where it instructs you to copy and paste the financial statements into Excel from Morningstar. There is actually an Export button when you open each financial statement on Morningstar that will export the financial statements to Excel. You will then need to paste the financial statements into the template from the Excel file created by the export. Specific instructions to copy and paste the financial statements into the template are contained in the first worksheet in the data case template. c. When accessing the financial statements for each company, use the financial statements as originally reported. d. Industry averages are no longer available on Reuters. It is unnecessary to answer question 4a. e. Question 4b should be answered for each company. Rather than comparing the companies ratios to industry averages, comment on the trends in each companys performance over the last four years. 3. The data case must be submitted using the Excel template found on Learn. a. Any value that can be calculated must be calculated within the submitted Excel file using formulas and/or Excel functions. Hard coding calculated values into the spreadsheet will result in a 50% deduction. b. The template includes separate worksheets for each company. Each worksheet has space to paste each companys financial statements. c. The yellow highlighted areas in the template are to answer the questions found in the textbook.

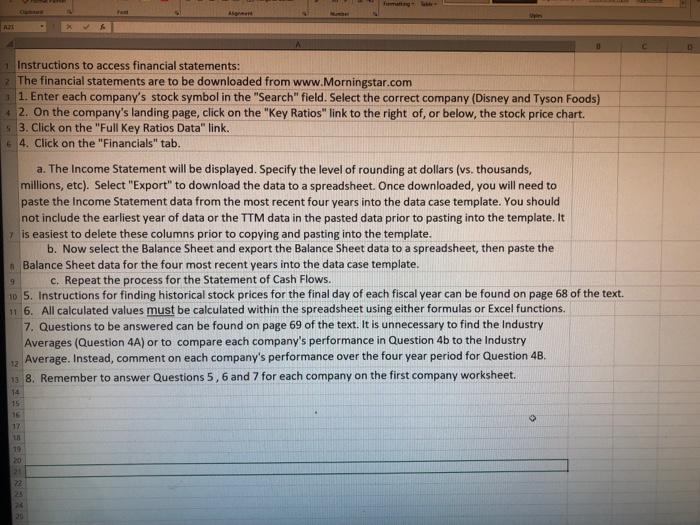

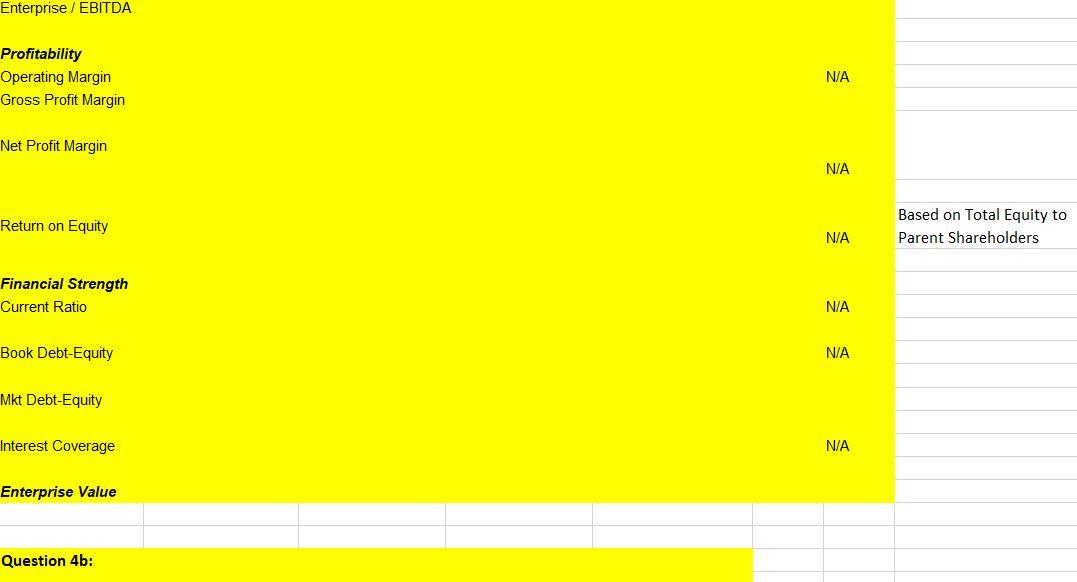

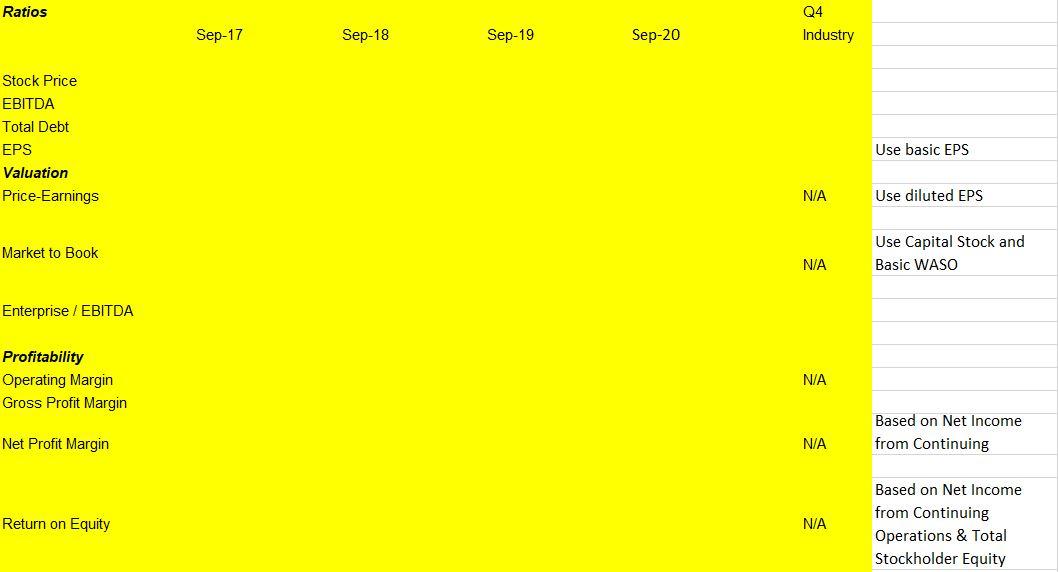

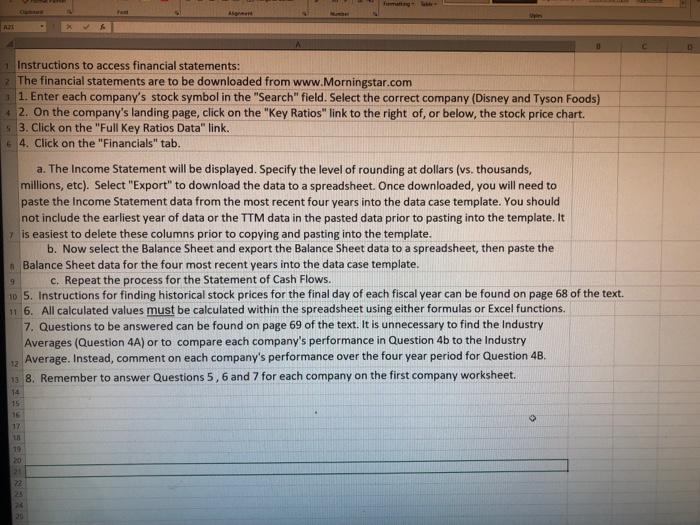

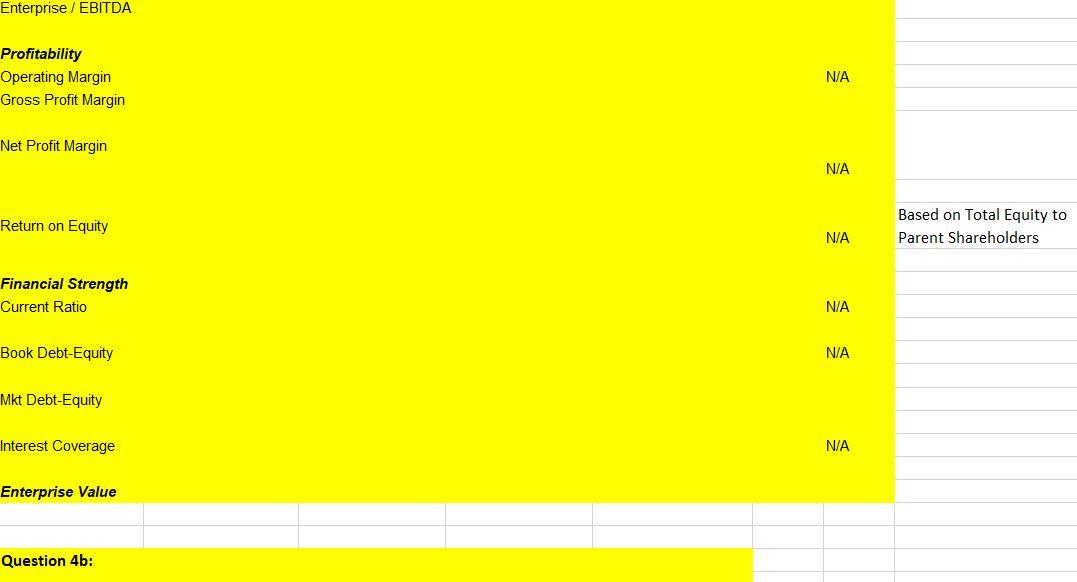

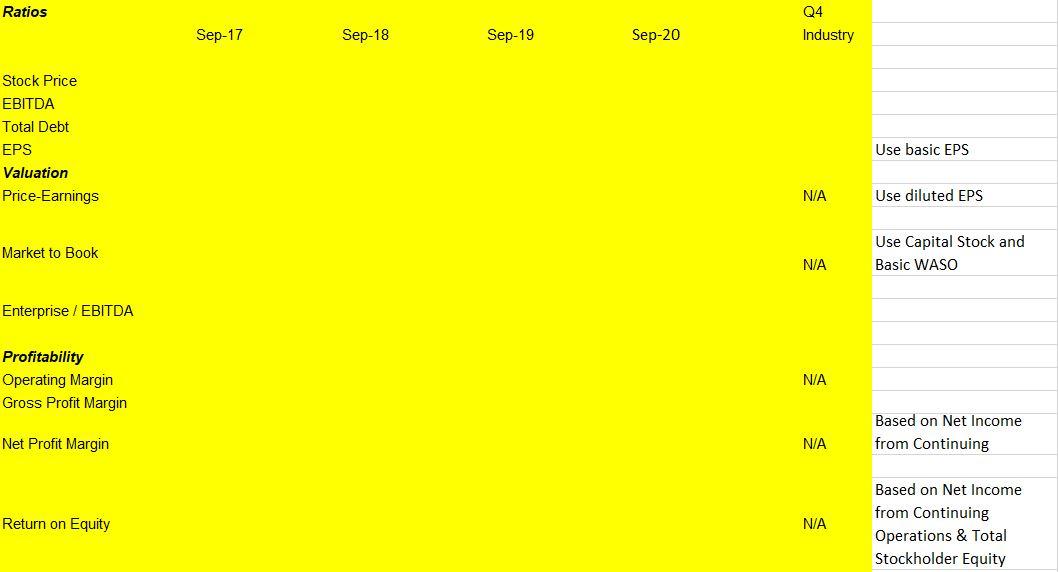

1 Instructions to access financial statements: The financial statements are to be downloaded from www.Morningstar.com 1. Enter each company's stock symbol in the "Search"field. Select the correct company (Disney and Tyson Foods) * 2. On the company's landing page, click on the "Key Ratios" link to the right of, or below, the stock price chart. 3. Click on the "Full Key Ratios Data" link. 4. Click on the "Financials" tab. a. The Income Statement will be displayed. Specify the level of rounding at dollars (vs. thousands, millions, etc). Select "Export" to download the data to a spreadsheet. Once downloaded, you will need to paste the Income Statement data from the most recent four years into the data case template. You should not include the earliest year of data or the TTM data in the pasted data prior to pasting into the template. It is easiest to delete these columns prior to copying and pasting into the template. b. Now select the Balance Sheet and export the Balance Sheet data to a spreadsheet, then paste the Balance Sheet data for the four most recent years into the data case template. c. Repeat the process for the Statement of Cash Flows. 10 5. Instructions for finding historical stock prices for the final day of each fiscal year can be found on page 68 of the text. 11 6. All calculated values must be calculated within the spreadsheet using either formulas or Excel functions. 7. Questions to be answered can be found on page 69 of the text. It is unnecessary to find the Industry Averages (Question 4A) or to compare each company's performance in Question 4b to the Industry 2 Average. Instead, comment on each company's performance over the four year period for Question 4B. 13 8. Remember to answer Questions 5, 6 and 7 for each company on the first company worksheet. 14 15 15 17 19 22 23 Ratios Q4 Dec-17 Dec-18 Dec-19 Dec-20 Dec-20 Industry Stock Price EBITDA Total Debt EPS Valuation Price-Earnings N/A Use diluted earnings Market to Book N/A Use Basic Shares (WASO) Enterprise / EBITDA Enterprise / EBITDA Profitability Operating Margin Gross Profit Margin N/A Net Profit Margin Return on Equity Based on Total Equity to Parent Shareholders Financial Strength Current Ratio N/A Book Debt-Equity Mkt Debt-Equity Interest Coverage N/A Enterprise Value Question 4b: Ratios Q4 Industry Sep-17 Sep-18 Sep-19 Sep-20 Stock Price EBITDA Total Debt EPS Valuation Price-Earnings Use basic EPS N/A Use diluted EPS Market to Book Use Capital Stock and Basic WASO N/A Enterprise / EBITDA Profitability Operating Margin Gross Profit Margin N/A Based on Net Income from Continuing Net Profit Margin N/A Return on Equity N/A Based on Net Income from Continuing Operations & Total Stockholder Equity Financial Strength Current Ratio N/A Book Debt-Equity N/A Mkt Debt-Equity Interest Coverage N/A Enterprise Value Question 4b: Question 5: Question 6: Question 7: 1 Instructions to access financial statements: The financial statements are to be downloaded from www.Morningstar.com 1. Enter each company's stock symbol in the "Search"field. Select the correct company (Disney and Tyson Foods) * 2. On the company's landing page, click on the "Key Ratios" link to the right of, or below, the stock price chart. 3. Click on the "Full Key Ratios Data" link. 4. Click on the "Financials" tab. a. The Income Statement will be displayed. Specify the level of rounding at dollars (vs. thousands, millions, etc). Select "Export" to download the data to a spreadsheet. Once downloaded, you will need to paste the Income Statement data from the most recent four years into the data case template. You should not include the earliest year of data or the TTM data in the pasted data prior to pasting into the template. It is easiest to delete these columns prior to copying and pasting into the template. b. Now select the Balance Sheet and export the Balance Sheet data to a spreadsheet, then paste the Balance Sheet data for the four most recent years into the data case template. c. Repeat the process for the Statement of Cash Flows. 10 5. Instructions for finding historical stock prices for the final day of each fiscal year can be found on page 68 of the text. 11 6. All calculated values must be calculated within the spreadsheet using either formulas or Excel functions. 7. Questions to be answered can be found on page 69 of the text. It is unnecessary to find the Industry Averages (Question 4A) or to compare each company's performance in Question 4b to the Industry 2 Average. Instead, comment on each company's performance over the four year period for Question 4B. 13 8. Remember to answer Questions 5, 6 and 7 for each company on the first company worksheet. 14 15 15 17 19 22 23 Ratios Q4 Dec-17 Dec-18 Dec-19 Dec-20 Dec-20 Industry Stock Price EBITDA Total Debt EPS Valuation Price-Earnings N/A Use diluted earnings Market to Book N/A Use Basic Shares (WASO) Enterprise / EBITDA Enterprise / EBITDA Profitability Operating Margin Gross Profit Margin N/A Net Profit Margin Return on Equity Based on Total Equity to Parent Shareholders Financial Strength Current Ratio N/A Book Debt-Equity Mkt Debt-Equity Interest Coverage N/A Enterprise Value Question 4b: Ratios Q4 Industry Sep-17 Sep-18 Sep-19 Sep-20 Stock Price EBITDA Total Debt EPS Valuation Price-Earnings Use basic EPS N/A Use diluted EPS Market to Book Use Capital Stock and Basic WASO N/A Enterprise / EBITDA Profitability Operating Margin Gross Profit Margin N/A Based on Net Income from Continuing Net Profit Margin N/A Return on Equity N/A Based on Net Income from Continuing Operations & Total Stockholder Equity Financial Strength Current Ratio N/A Book Debt-Equity N/A Mkt Debt-Equity Interest Coverage N/A Enterprise Value Question 4b: Question 5: Question 6: Question 7