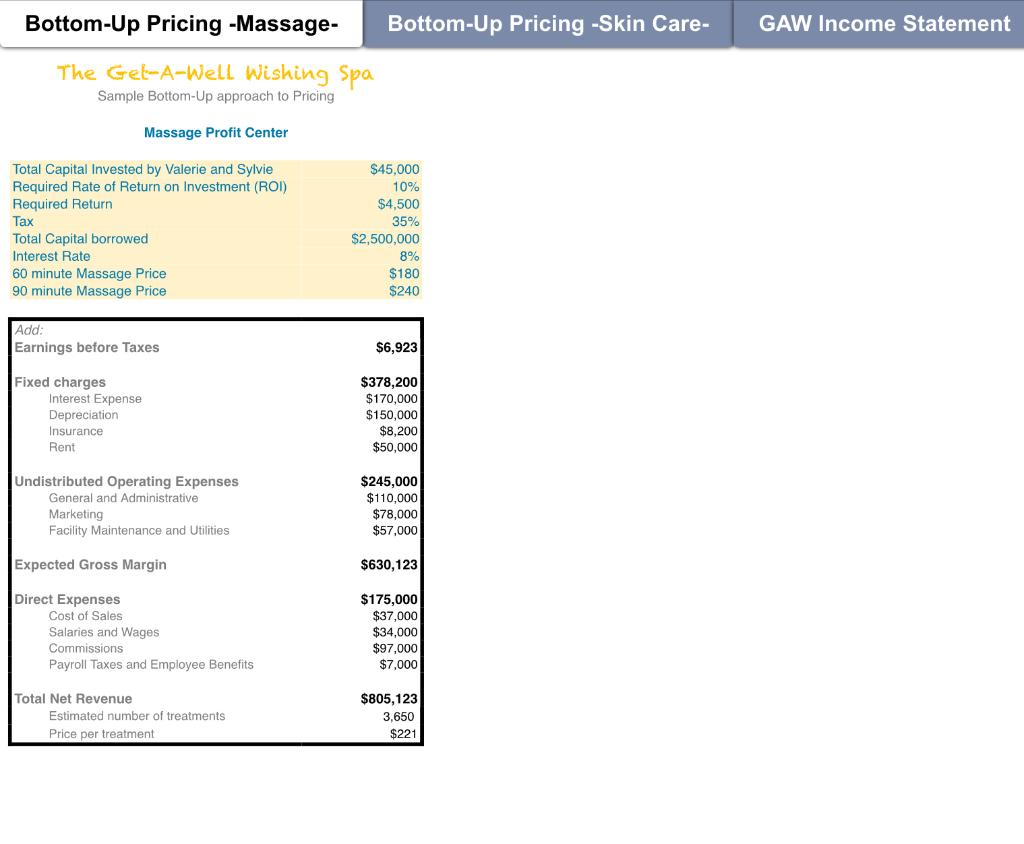

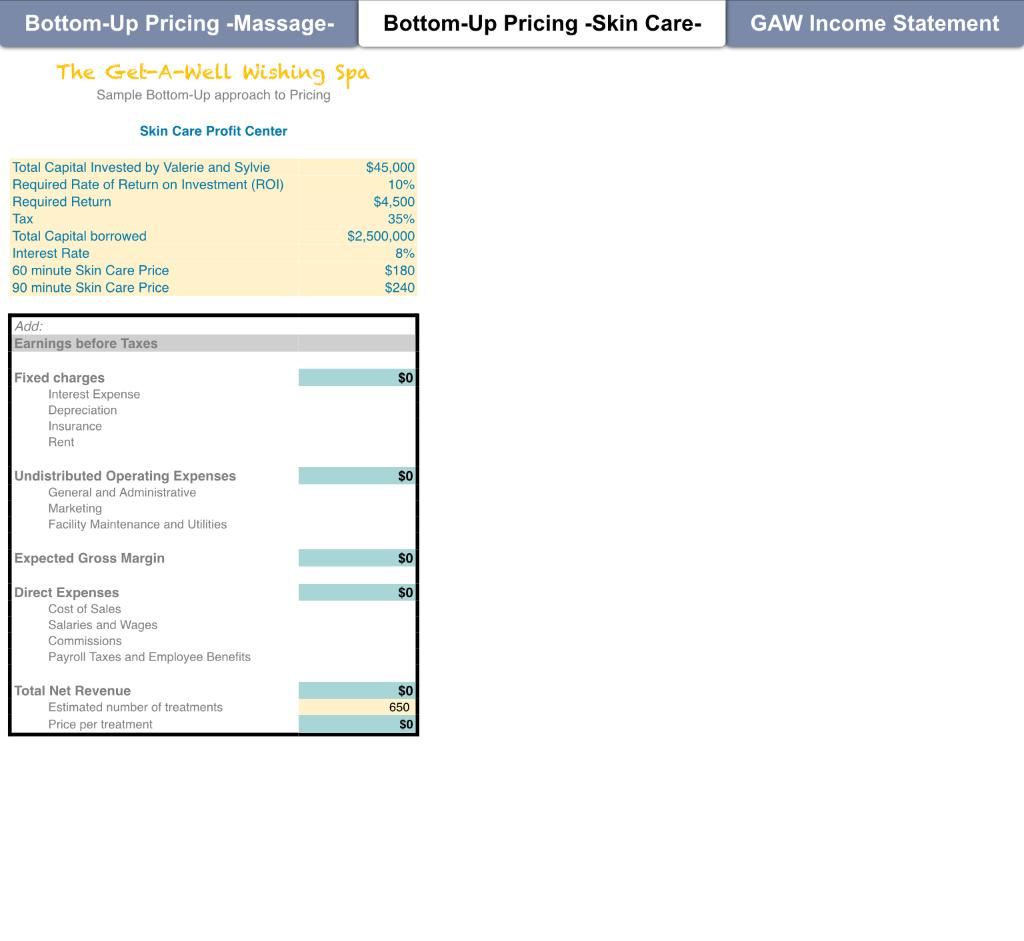

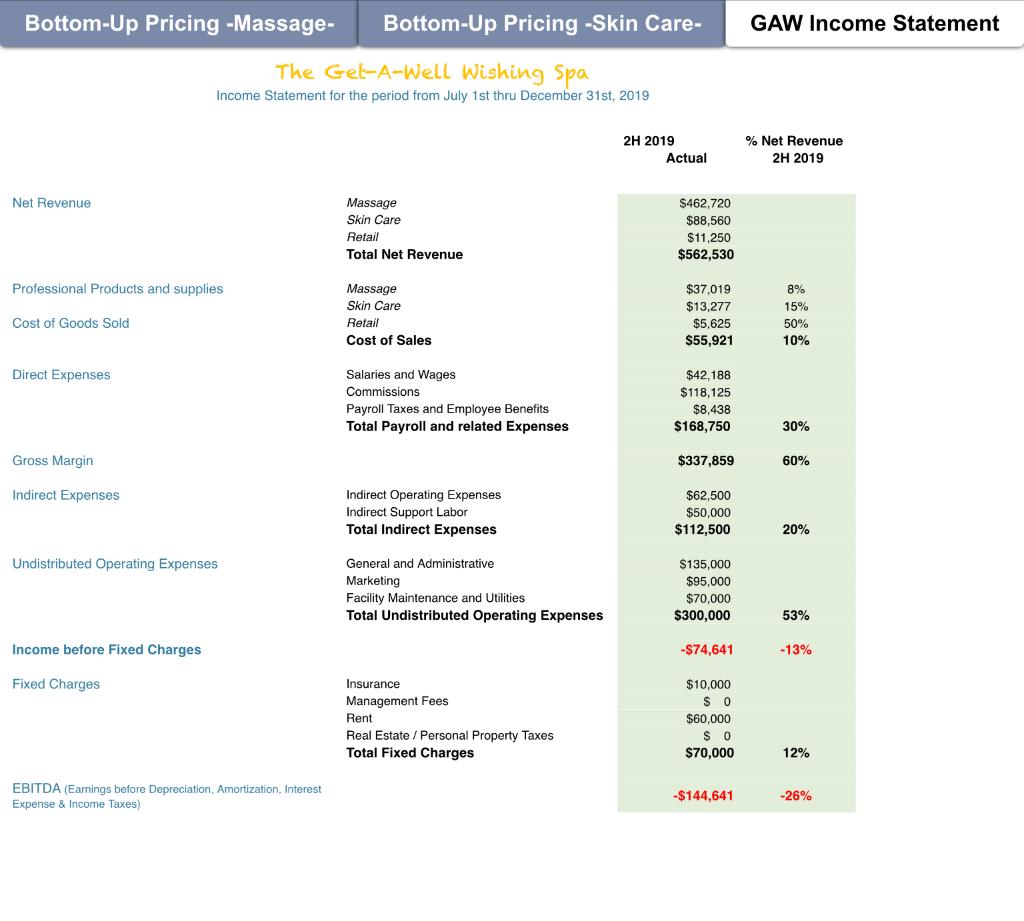

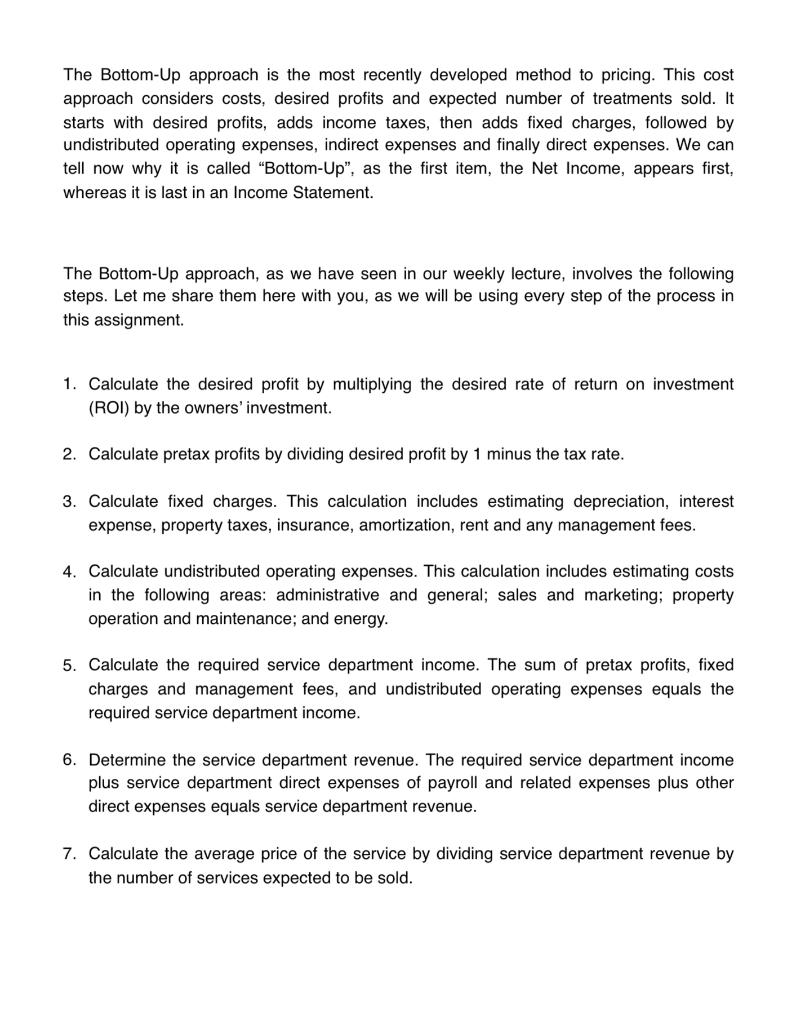

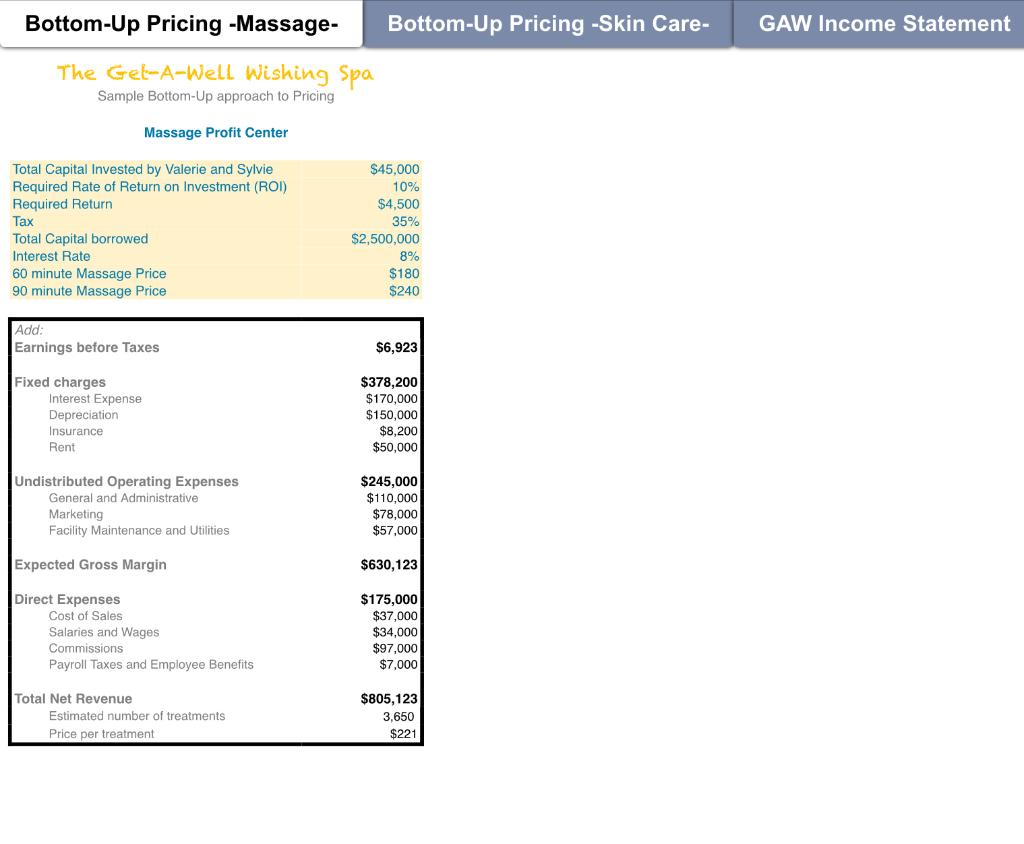

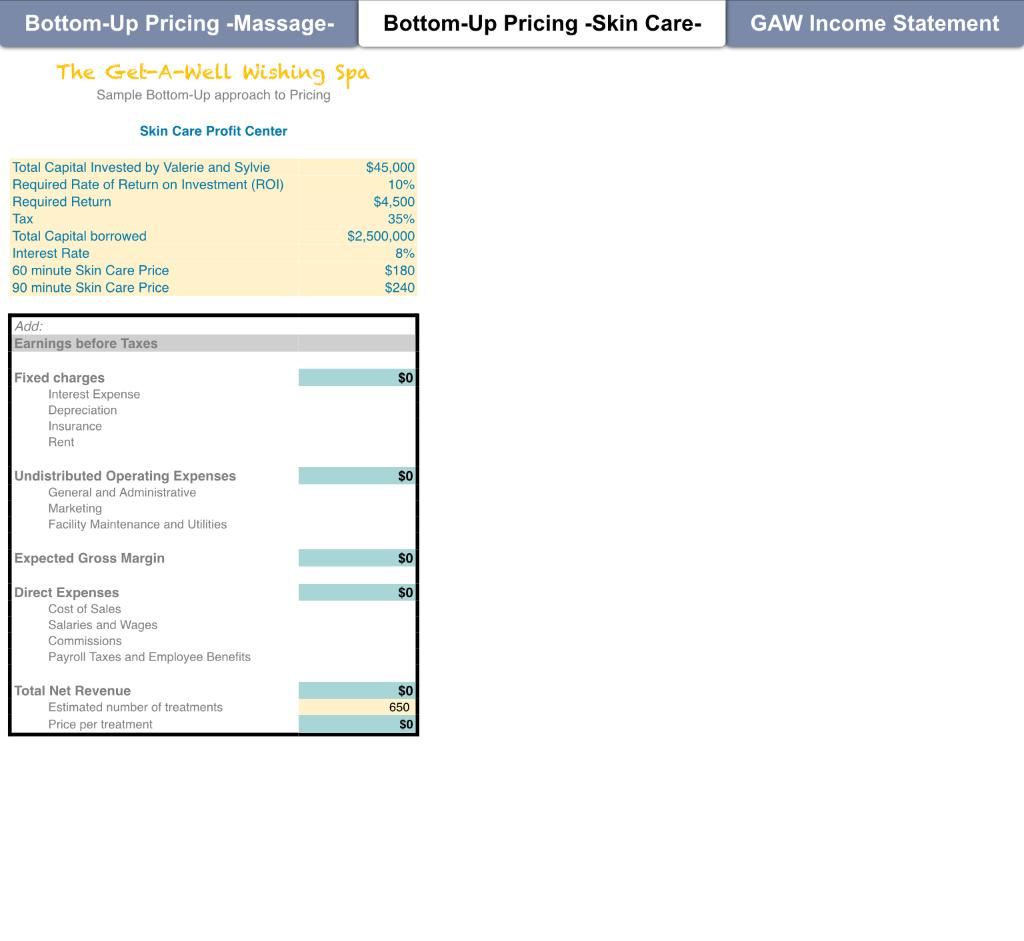

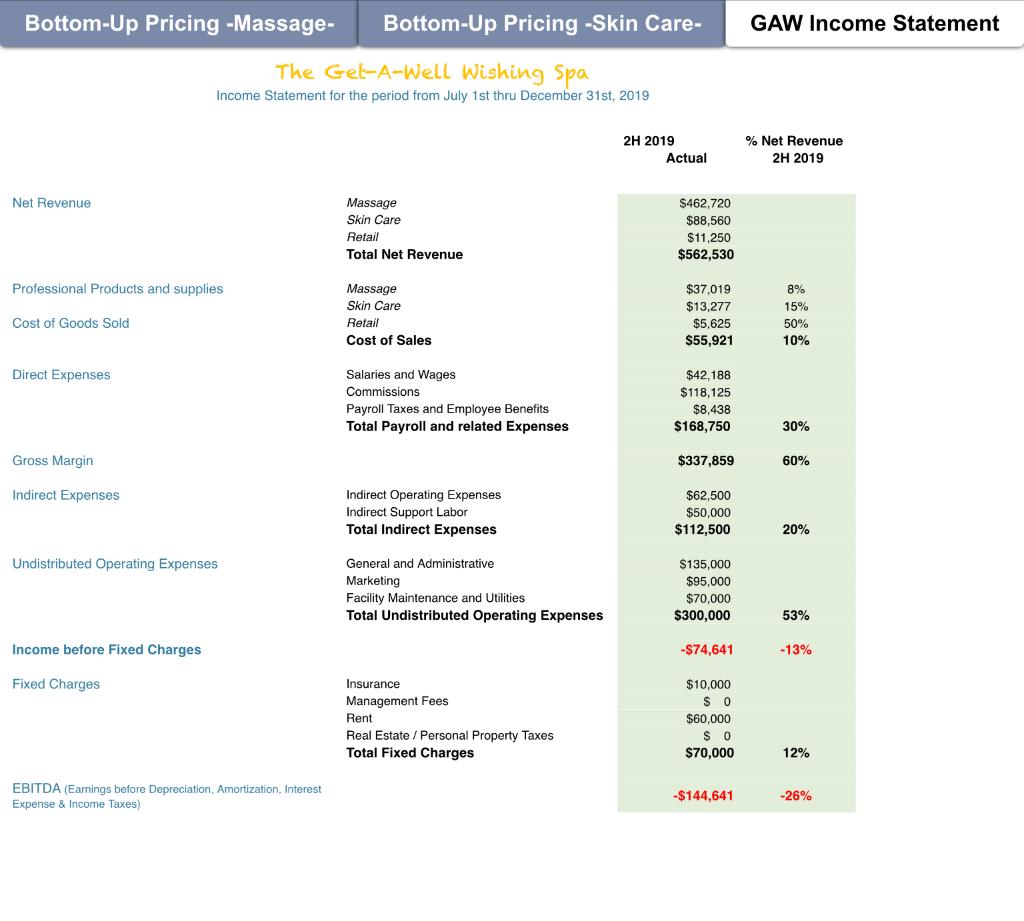

Instructions For this assignment you are required to suggest a price per treatment for the Skin Care profit center. Please refer to this PDF for directions: The Secret to Pricing In the attached spreadsheet, Get-A-Well Wishing Spa Bottom- Up Pricing , you will find three worksheets, one of them with the sample of the Massage center Bottom-Up approach, a second one with the template you will use for the Skin Care profit Center, and a third one with the Income Statement from July 1st thru December 31st, 2019, as a reference. Approximately 85% of the Get-A-Well Wishing Spa Income comes from the Massage profit center and 15% from the Skin Care profit center. Please consider this when estimating Fixed Charges, Undistributed Operating Expenses as well as Direct Expenses. The Secret to Pricing Determining the right price for spa services is hard. It might actually be one of the toughest things to do when setting up a spa as it has such a big impact on the spa's bottom line. Setting a price too low will lead to a loss of profit, while setting a price too high will lead to a loss of customers. Pricing Strategies can be used to pursue different types of objectives, such as increasing market share, expanding profit margin or driving a competitor from the marketplace. Spas will most likely change their pricing strategy over time as the market changes. Deciding on the price for a product or service goes beyond calculating its cost and adding a mark-up. Pricing a product is one of the most important aspects of the spa's marketing strategy. Spa Managers need to understand the importance on creating and implementing an effective pricing strategy to maximizing profitability. It is very common to use the cost- based pricing strategy and include a mark-up percentage. However, there are a number of important factors that must be considered when pricing, such as the following: 1. Type of spa 2. Target market 3. Type and duration of treatments 4. Extra services or facilities that can be added-on 5. Geographic location of the spa 6. Average market rate 7. Value for money In this assignment, we will learn how to use the Bottom-Up approach to Pricing. The Bottom-Up approach is the most recently developed method to pricing. This cost approach considers costs, desired profits and expected number of treatments sold. It starts with desired profits, adds income taxes, then adds fixed charges, followed by undistributed operating expenses, indirect expenses and finally direct expenses. We can tell now why it is called "Bottom-Up", as the first item, the Net Income, appears first, whereas it is last in an Income Statement. The Bottom-Up approach, as we have seen in our weekly lecture, involves the following steps. Let me share them here with you, as we will be using every step of the process in this assignment. 1. Calculate the desired profit by multiplying the desired rate of return on investment (ROI) by the owners'investment. 2. Calculate pretax profits by dividing desired profit by 1 minus the tax rate. 3. Calculate fixed charges. This calculation includes estimating depreciation, interest expense, property taxes, insurance, amortization, rent and any management fees. 4. Calculate undistributed operating expenses. This calculation includes estimating costs in the following areas: administrative and general; sales and marketing; property operation and maintenance; and energy. 5. Calculate the required service department income. The sum of pretax profits, fixed charges and management fees, and undistributed operating expenses equals the required service department income. 6. Determine the service department revenue. The required service department income plus service department direct expenses of payroll and related expenses plus other direct expenses equals service department revenue. 7. Calculate the average price of the service by dividing service department revenue by the number of services expected to be sold. You are now required to suggest a price per treatment for the Skin Care profit center. For the purpose of this assignment, please consider 650 Skin Care treatments are estimated to be sold in the period from July 1st, thru December 31st. In the attached spreadsheet, you will find three worksheets, one of them with the sample of the massage center Bottom-Up approach we just reviewed, a second one with the template you will use for the Skin Care profit Center, and a third one with the Income Statement from July 1st thru December 31st, 2019, as a reference. Approximately 85% of the Get-A-Well Wishing Spa Income comes from the Massage profit center and 15% from the Skin Care profit center. Please consider this when estimating Fixed Charges, Undistributed Operating Expenses as well as Direct Expenses. Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- GAW Income Statement The Get-A-Well Wishing Spa Sample Bottom-Up approach to Pricing Massage Profit Center Total Capital Invested by Valerie and Sylvie Required Rate of Return on Investment (ROI) Required Return Tax Total Capital borrowed Interest Rate 60 minute Massage Price 90 minute Massage Price $45,000 10% $4,500 35% $2,500,000 8% $180 $240 Add: Earnings before Taxes $6,923 Fixed charges Interest Expense Depreciation Insurance Rent $378,200 $170,000 $150,000 $8,200 $50,000 Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities $245,000 $110,000 $78,000 $57,000 Expected Gross Margin $630,123 Direct Expenses Cost of Sales Salaries and Wages Commissions Payroll Taxes and Employee Benefits $175,000 $37,000 $34.000 $97,000 $7.000 Total Net Revenue Estimated number of treatments Price per treatment $805,123 3,650 $221 Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- GAW Income Statement The Get-A-Well Wishing Spa Sample Bottom-Up approach to Pricing Skin Care Profit Center Total Capital Invested by Valerie and Sylvie Required Rate of Return on Investment (ROI) Required Return Tax Total Capital borrowed Interest Rate 60 minute Skin Care Price 90 minute Skin Care Price $45,000 10% $4,500 35% $2,500,000 8% $180 $240 Add: Earnings before Taxes $0 Fixed charges Interest Expense Depreciation Insurance Rent $0 Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities Expected Gross Margin SO $O Direct Expenses Cast of Sales Salaries and Wages Commissions Payroll Taxes and Employee Benefits Total Net Revenue Estimated number of treatments Price per treatment $0 650 SO GAW Income Statement Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- The Get-A-Well Wishing Spa Income Statement for the period from July 1st thru December 31st, 2019 2H 2019 Actual % Net Revenue 2H 2019 Net Revenue Massage Skin Care Retail Total Net Revenue $462,720 $88,560 $11.250 $562,530 Professional Products and supplies Massage Skin Care Retail Cost of Sales $37,019 $13,277 $5,625 $55,921 8% 15% 50% 10% Cost of Goods Sold Direct Expenses Salaries and Wages Commissions Payroll Taxes and Employee Benefits Total Payroll and related Expenses $42,188 $118,125 $8,438 $168,750 30% Gross Margin $337,859 60% Indirect Expenses Indirect Operating Expenses Indirect Support Labor Total Indirect Expenses $62,500 $50,000 $112,500 20% Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities Total Undistributed Operating Expenses $135,000 $95,000 $70,000 $300,000 53% Income before Fixed Charges -$74,641 -13% Fixed Charges Insurance Management Fees Rent Real Estate / Personal Property Taxes Total Fixed Charges $10,000 S 0 $60,000 $ 0 $70,000 12% EBITDA (Earnings before Depreciation, Amortization, Interest Expense & Income Taxes) -$144,641 -26% Instructions For this assignment you are required to suggest a price per treatment for the Skin Care profit center. Please refer to this PDF for directions: The Secret to Pricing In the attached spreadsheet, Get-A-Well Wishing Spa Bottom- Up Pricing , you will find three worksheets, one of them with the sample of the Massage center Bottom-Up approach, a second one with the template you will use for the Skin Care profit Center, and a third one with the Income Statement from July 1st thru December 31st, 2019, as a reference. Approximately 85% of the Get-A-Well Wishing Spa Income comes from the Massage profit center and 15% from the Skin Care profit center. Please consider this when estimating Fixed Charges, Undistributed Operating Expenses as well as Direct Expenses. The Secret to Pricing Determining the right price for spa services is hard. It might actually be one of the toughest things to do when setting up a spa as it has such a big impact on the spa's bottom line. Setting a price too low will lead to a loss of profit, while setting a price too high will lead to a loss of customers. Pricing Strategies can be used to pursue different types of objectives, such as increasing market share, expanding profit margin or driving a competitor from the marketplace. Spas will most likely change their pricing strategy over time as the market changes. Deciding on the price for a product or service goes beyond calculating its cost and adding a mark-up. Pricing a product is one of the most important aspects of the spa's marketing strategy. Spa Managers need to understand the importance on creating and implementing an effective pricing strategy to maximizing profitability. It is very common to use the cost- based pricing strategy and include a mark-up percentage. However, there are a number of important factors that must be considered when pricing, such as the following: 1. Type of spa 2. Target market 3. Type and duration of treatments 4. Extra services or facilities that can be added-on 5. Geographic location of the spa 6. Average market rate 7. Value for money In this assignment, we will learn how to use the Bottom-Up approach to Pricing. The Bottom-Up approach is the most recently developed method to pricing. This cost approach considers costs, desired profits and expected number of treatments sold. It starts with desired profits, adds income taxes, then adds fixed charges, followed by undistributed operating expenses, indirect expenses and finally direct expenses. We can tell now why it is called "Bottom-Up", as the first item, the Net Income, appears first, whereas it is last in an Income Statement. The Bottom-Up approach, as we have seen in our weekly lecture, involves the following steps. Let me share them here with you, as we will be using every step of the process in this assignment. 1. Calculate the desired profit by multiplying the desired rate of return on investment (ROI) by the owners'investment. 2. Calculate pretax profits by dividing desired profit by 1 minus the tax rate. 3. Calculate fixed charges. This calculation includes estimating depreciation, interest expense, property taxes, insurance, amortization, rent and any management fees. 4. Calculate undistributed operating expenses. This calculation includes estimating costs in the following areas: administrative and general; sales and marketing; property operation and maintenance; and energy. 5. Calculate the required service department income. The sum of pretax profits, fixed charges and management fees, and undistributed operating expenses equals the required service department income. 6. Determine the service department revenue. The required service department income plus service department direct expenses of payroll and related expenses plus other direct expenses equals service department revenue. 7. Calculate the average price of the service by dividing service department revenue by the number of services expected to be sold. You are now required to suggest a price per treatment for the Skin Care profit center. For the purpose of this assignment, please consider 650 Skin Care treatments are estimated to be sold in the period from July 1st, thru December 31st. In the attached spreadsheet, you will find three worksheets, one of them with the sample of the massage center Bottom-Up approach we just reviewed, a second one with the template you will use for the Skin Care profit Center, and a third one with the Income Statement from July 1st thru December 31st, 2019, as a reference. Approximately 85% of the Get-A-Well Wishing Spa Income comes from the Massage profit center and 15% from the Skin Care profit center. Please consider this when estimating Fixed Charges, Undistributed Operating Expenses as well as Direct Expenses. Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- GAW Income Statement The Get-A-Well Wishing Spa Sample Bottom-Up approach to Pricing Massage Profit Center Total Capital Invested by Valerie and Sylvie Required Rate of Return on Investment (ROI) Required Return Tax Total Capital borrowed Interest Rate 60 minute Massage Price 90 minute Massage Price $45,000 10% $4,500 35% $2,500,000 8% $180 $240 Add: Earnings before Taxes $6,923 Fixed charges Interest Expense Depreciation Insurance Rent $378,200 $170,000 $150,000 $8,200 $50,000 Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities $245,000 $110,000 $78,000 $57,000 Expected Gross Margin $630,123 Direct Expenses Cost of Sales Salaries and Wages Commissions Payroll Taxes and Employee Benefits $175,000 $37,000 $34.000 $97,000 $7.000 Total Net Revenue Estimated number of treatments Price per treatment $805,123 3,650 $221 Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- GAW Income Statement The Get-A-Well Wishing Spa Sample Bottom-Up approach to Pricing Skin Care Profit Center Total Capital Invested by Valerie and Sylvie Required Rate of Return on Investment (ROI) Required Return Tax Total Capital borrowed Interest Rate 60 minute Skin Care Price 90 minute Skin Care Price $45,000 10% $4,500 35% $2,500,000 8% $180 $240 Add: Earnings before Taxes $0 Fixed charges Interest Expense Depreciation Insurance Rent $0 Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities Expected Gross Margin SO $O Direct Expenses Cast of Sales Salaries and Wages Commissions Payroll Taxes and Employee Benefits Total Net Revenue Estimated number of treatments Price per treatment $0 650 SO GAW Income Statement Bottom-Up Pricing -Massage- Bottom-Up Pricing -Skin Care- The Get-A-Well Wishing Spa Income Statement for the period from July 1st thru December 31st, 2019 2H 2019 Actual % Net Revenue 2H 2019 Net Revenue Massage Skin Care Retail Total Net Revenue $462,720 $88,560 $11.250 $562,530 Professional Products and supplies Massage Skin Care Retail Cost of Sales $37,019 $13,277 $5,625 $55,921 8% 15% 50% 10% Cost of Goods Sold Direct Expenses Salaries and Wages Commissions Payroll Taxes and Employee Benefits Total Payroll and related Expenses $42,188 $118,125 $8,438 $168,750 30% Gross Margin $337,859 60% Indirect Expenses Indirect Operating Expenses Indirect Support Labor Total Indirect Expenses $62,500 $50,000 $112,500 20% Undistributed Operating Expenses General and Administrative Marketing Facility Maintenance and Utilities Total Undistributed Operating Expenses $135,000 $95,000 $70,000 $300,000 53% Income before Fixed Charges -$74,641 -13% Fixed Charges Insurance Management Fees Rent Real Estate / Personal Property Taxes Total Fixed Charges $10,000 S 0 $60,000 $ 0 $70,000 12% EBITDA (Earnings before Depreciation, Amortization, Interest Expense & Income Taxes) -$144,641 -26%