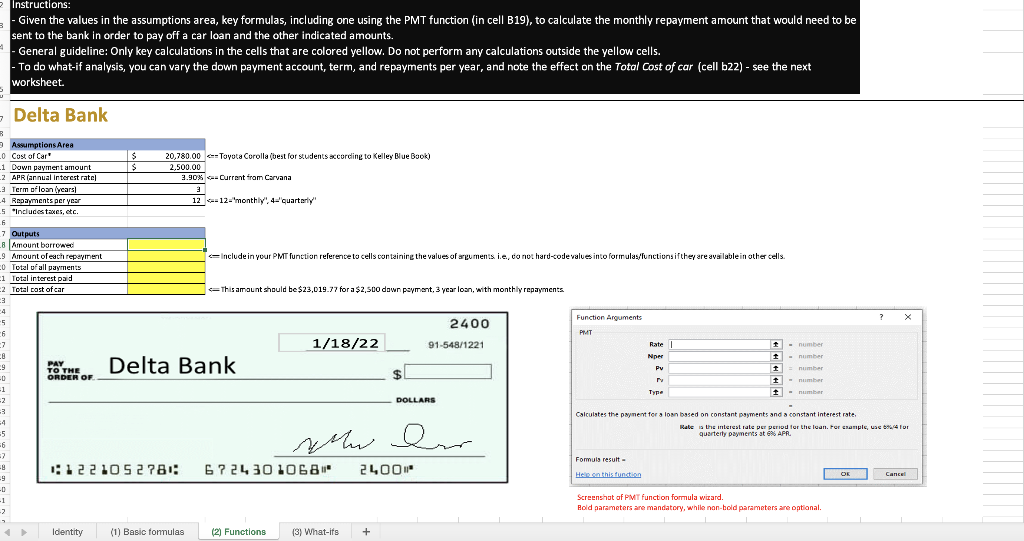

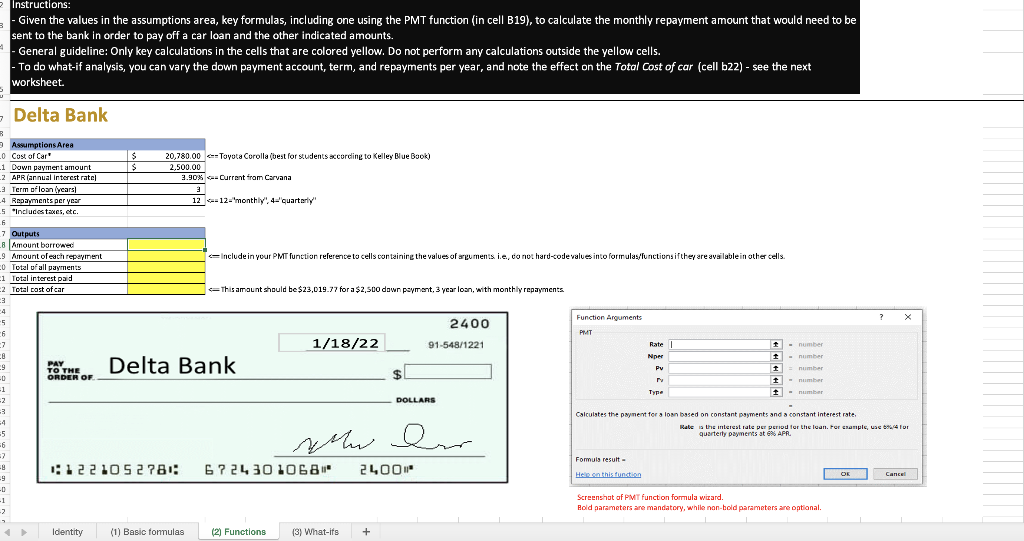

Instructions: Given the values in the assumptions area, key formulas, including one using the PMT function (in cell B19), to calculate the monthly repayment amount that would need to be sent to the bank in order to pay off a car loan and the other indicated amounts. General guideline: Only key calculations in the cells that are colored yellow. Do not perform any calculations outside the yellow cells. To do what-if analysis, you can vary the down payment account, term, and repayments per year, and note the effect on the Total cost of car (cell b22) - see the next worksheet - - Delta Bank $ S $ 20,780.00 Toyota Corolla (best for students according to Kelley Blue Book) 2.500.00 3.90% -- Current from Carvana % 3 3 12 - 12 monthly., 4quarterly Assumptions Area 0 Cost of Cars 1 Down payment amount 2 APR (annual interest rate 3 Term of loan (years) -4 Repayments per year 5 Includes taxes, etc. 6 7 Outputs 8 Amount borrowed 9 Amount of each repayment CO Total of all payments -1 Total interest paid -2 Total cost of car 3 include in your PMT function reference to cells containing the values of arguments ie, co not hard-code values into formulas functions ifthey are available in other cells. This amount should be $23,019.77 for a $2,500 down payment, 3 ycar loan, with monthly repayments Function Arguments ? 2400 -5 6 -7 PMT 1/18/22 91-548/1221 Rate 1 NON PAY TO THE ORDER OF Delta Bank Pv t 1 - - number t - number = number 1 - number - number Type DOLLARS -9 0 -1 -2 -3 -4 -5 -6 7 - -9 -D 1 -2 Calculates the payment for a loan based on constant payments and a constant interest rate Rate is the interest rate per period for the loan. For sample, was 68.4 for quarterly payments at ex APR er mw e 1:12 2 10 5 2781: 6724 30 1068" 2400 Fomuls result Hele on this function Cancel Screenshot of PMT function formula wizard. Bold parameters are mandatory, while non-bold parameters are optional. Identity (1) Basic formulas (2) Functions (3) What its + Instructions: Given the values in the assumptions area, key formulas, including one using the PMT function (in cell B19), to calculate the monthly repayment amount that would need to be sent to the bank in order to pay off a car loan and the other indicated amounts. General guideline: Only key calculations in the cells that are colored yellow. Do not perform any calculations outside the yellow cells. To do what-if analysis, you can vary the down payment account, term, and repayments per year, and note the effect on the Total cost of car (cell b22) - see the next worksheet - - Delta Bank $ S $ 20,780.00 Toyota Corolla (best for students according to Kelley Blue Book) 2.500.00 3.90% -- Current from Carvana % 3 3 12 - 12 monthly., 4quarterly Assumptions Area 0 Cost of Cars 1 Down payment amount 2 APR (annual interest rate 3 Term of loan (years) -4 Repayments per year 5 Includes taxes, etc. 6 7 Outputs 8 Amount borrowed 9 Amount of each repayment CO Total of all payments -1 Total interest paid -2 Total cost of car 3 include in your PMT function reference to cells containing the values of arguments ie, co not hard-code values into formulas functions ifthey are available in other cells. This amount should be $23,019.77 for a $2,500 down payment, 3 ycar loan, with monthly repayments Function Arguments ? 2400 -5 6 -7 PMT 1/18/22 91-548/1221 Rate 1 NON PAY TO THE ORDER OF Delta Bank Pv t 1 - - number t - number = number 1 - number - number Type DOLLARS -9 0 -1 -2 -3 -4 -5 -6 7 - -9 -D 1 -2 Calculates the payment for a loan based on constant payments and a constant interest rate Rate is the interest rate per period for the loan. For sample, was 68.4 for quarterly payments at ex APR er mw e 1:12 2 10 5 2781: 6724 30 1068" 2400 Fomuls result Hele on this function Cancel Screenshot of PMT function formula wizard. Bold parameters are mandatory, while non-bold parameters are optional. Identity (1) Basic formulas (2) Functions (3) What its +