Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Identify each statement as true or false. If false, indicate how to correct the statement. of ELE E12-2 K. Decker, S. Rosen, and

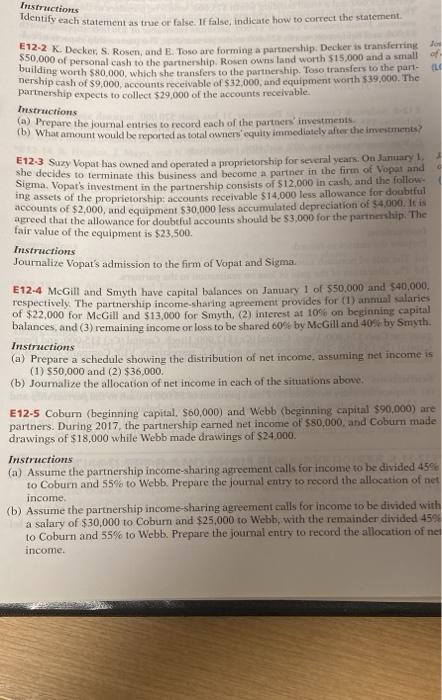

Instructions Identify each statement as true or false. If false, indicate how to correct the statement. of ELE E12-2 K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring Jos $50,000 of personal cash to the partnership. Rosen owns land worth $15,000 and a small building worth $80,000, which she transfers to the partnership. Toso transfers to the part- nership cash of $9,000, accounts receivable of $32,000, and equipment worth $39,000. The partnership expects to collect $29,000 of the accounts receivable. Instructions (a) Prepare the journal entries to record each of the partners' investments. (b) What amount would be reported as total owners' equity immediately after the investments? E12-3 Suzy Vopat has owned and operated a proprietorship for several years. On January 1, she decides to terminate this business and become a partner in the firm of Vopat and Sigma. Vopat's investment in the partnership consists of $12,000 in cash, and the follow ing assets of the proprietorship: accounts receivable $14,000 less allowance for doubtful accounts of $2,000, and equipment $30,000 less accumulated depreciation of $4,000. It is agreed that the allowance for doubtful accounts should be $3,000 for the partnership. The fair value of the equipment is $23,500. Instructions Journalize Vopat's admission to the firm of Vopat and Sigma. E12-4 McGill and Smyth have capital balances on January 1 of $50,000 and $40,000.. respectively. The partnership income-sharing agreement provides for (1) annual salaries of $22,000 for McGill and $13,000 for Smyth, (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shared 60% by McGill and 40% by Smyth. Instructions (a) Prepare a schedule showing the distribution of net income, assuming net income is (1) $50,000 and (2) $36,000. (b) Journalize the allocation of net income in each of the situations above. E12-5 Coburn (beginning capital. $60,000) and Webb (beginning capital $90,000) are partners. During 2017, the partnership earned net income of $80,000, and Coburn made drawings of $18,000 while Webb made drawings of $24,000. Instructions (a) Assume the partnership income-sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income. (b) Assume the partnership income-sharing agreement calls for income to be divided with a salary of $30,000 to Coburn and $25,000 to Webb, with the remainder divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started