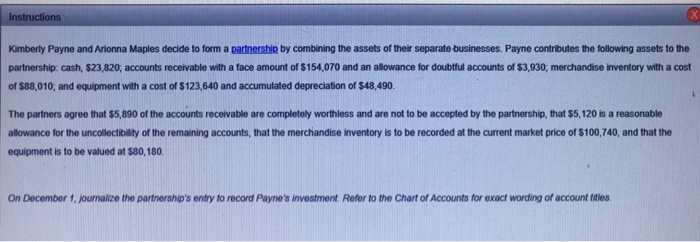

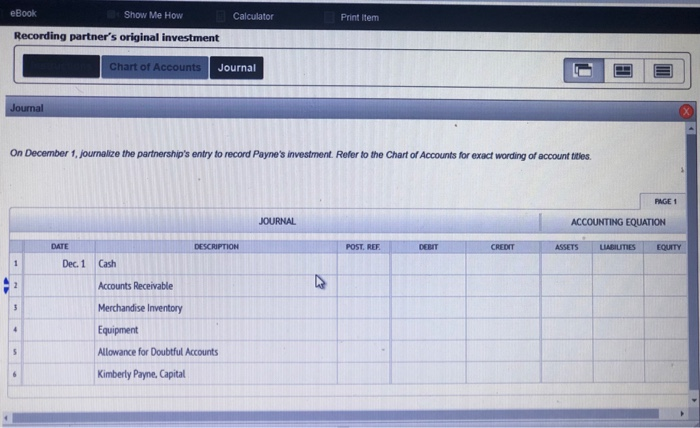

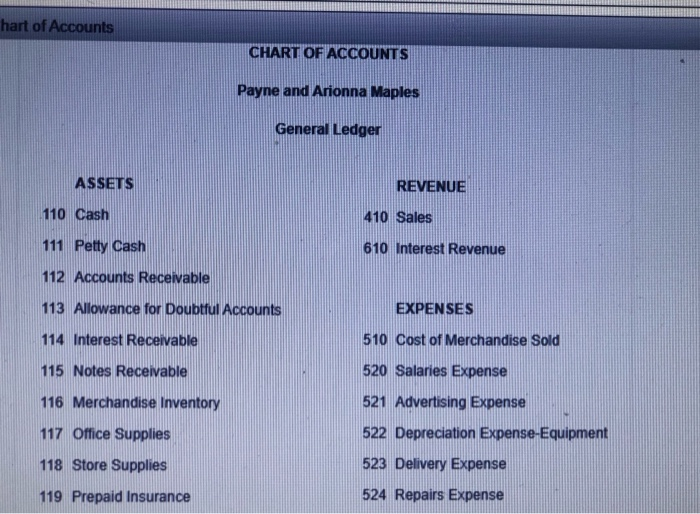

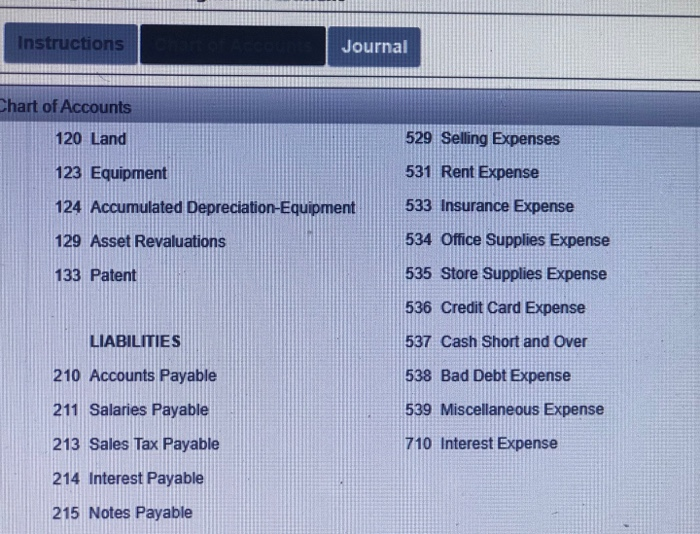

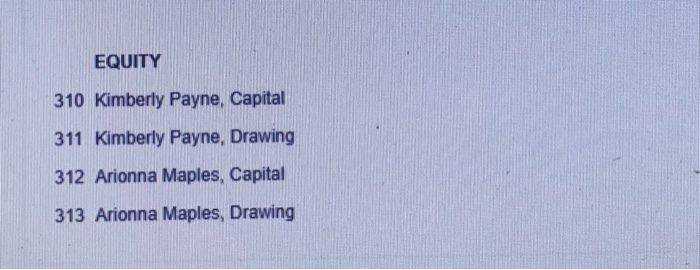

Instructions Kimberly Payne and Arionna Maples decide to form a partnership by combining the assets of their separate businesses. Payne contributes the following assets to the partnership: cash, $23,820, accounts receivable with a face amount of $154,070 and an allowance for doubtful accounts of $3,930, merchandise inventory with a cost of $88,010, and equipment with a cost of $123,640 and accumulated depreciation of 548,490. The partners agree that $5,890 of the accounts receivable are completely worthless and are not to be accepted by the partnership, that S5, 120 is a reasonable allowance for the uncollectibility of the remaining accounts, that the merchandise inventory is to be recorded at the current market price of $100,740, and that the equipment is to be valued at $80,180. On December 1, journalize the partnership's entry to record Payne's Investment. Refer to the Chart of Accounts for exact wording of account titles eBook Show Me How Calculator Print Item Recording partner's original investment Chart of Accounts Journal Journal On December 1, journalize the partnership's entry to record Payne's investment. Refer to the Chart of Accounts for exact wording of account titles. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LABILITIES EQUITY 1 Dec. 1 Cash 2 Accounts Receivable 3 Merchandise Inventory Equipment 4 5 Allowance for Doubtful Accounts Kimberly Payne, Capital hart of Accounts CHART OF ACCOUNTS Payne and Arionna Maples General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 112 Accounts Receivable 113 Allowance for Doubtful Accounts EXPENSES 114 Interest Receivable 510 Cost of Merchandise Sold 115 Notes Receivable 520 Salaries Expense 116 Merchandise Inventory 117 Office Supplies 521 Advertising Expense 522 Depreciation Expense-Equipment 523 Delivery Expense 118 Store Supplies 119 Prepaid Insurance 524 Repairs Expense Instructions Journal Chart of Accounts 120 Land 529 Selling Expenses 531 Rent Expense 123 Equipment 533 Insurance Expense 124 Accumulated Depreciation-Equipment 129 Asset Revaluations 534 Office Supplies Expense 133 Patent 535 Store Supplies Expense 536 Credit Card Expense LIABILITIES 537 Cash Short and Over 210 Accounts Payable 538 Bad Debt Expense 211 Salaries Payable 539 Miscellaneous Expense 213 Sales Tax Payable 710 Interest Expense 214 Interest Payable 215 Notes Payable EQUITY 310 Kimberly Payne, Capital 311 Kimberly Payne, Drawing 312 Arionna Maples, Capital 313 Arionna Maples, Drawing