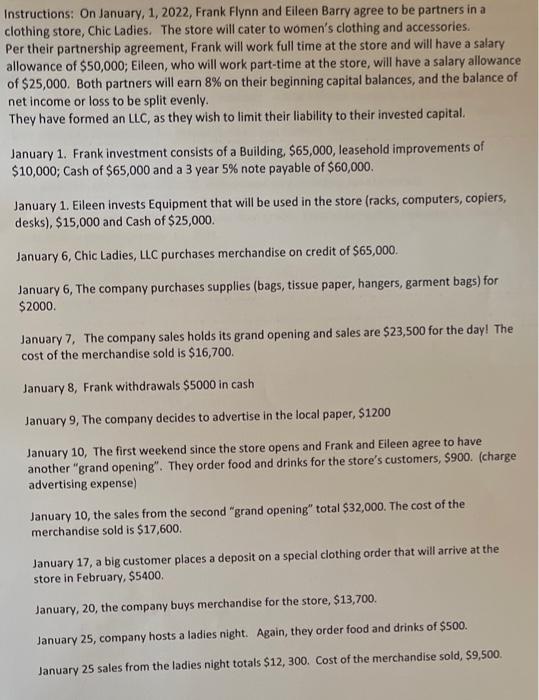

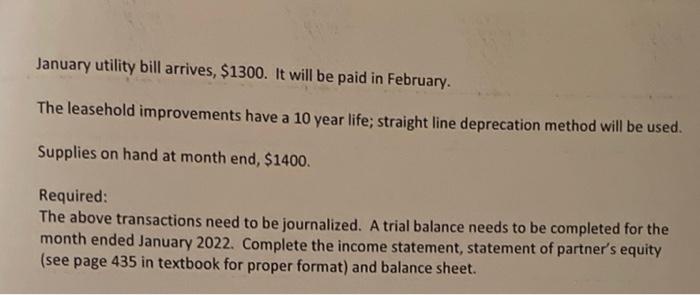

Instructions: On January 1, 2022, Frank Flynn and Eileen Barry agree to be partners in a clothing store, Chic Ladies. The store will cater to women's clothing and accessories. Per their partnership agreement, Frank will work full time at the store and will have a salary allowance of $50,000; Eileen, who will work part-time at the store, will have a salary allowance of $25,000. Both partners will earn 8% on their beginning capital balances, and the balance of net income or loss to be split evenly. They have formed an LLC, as they wish to limit their liability to their invested capital. January 1. Frank investment consists of a Building. $65,000, leasehold improvements of $10,000; Cash of $65,000 and a 3 year 5% note payable of $60,000. January 1. Eileen invests Equipment that will be used in the store (racks, computers, copiers, desks), $15,000 and Cash of $25,000 January 6, Chic Ladies, LLC purchases merchandise on credit of $65,000 January 6, The company purchases supplies (bags, tissue paper, hangers, garment bags) for $2000 January 7, The company sales holds its grand opening and sales are $23,500 for the day! The cost of the merchandise sold is $16,700. January 8, Frank withdrawals $5000 in cash January 9, The company decides to advertise in the local paper, $1200 January 10, The first weekend since the store opens and Frank and Eileen agree to have another "grand opening". They order food and drinks for the store's customers, $900. (charge advertising expense) January 10, the sales from the second "grand opening" total $32,000. The cost of the merchandise sold is $17,600. January 17, a big customer places a deposit on a special clothing order that will arrive at the store in February, $5400 January, 20, the company buys merchandise for the store, $13,700. January 25, company hosts a ladies night. Again, they order food and drinks of $500. January 25 sales from the ladies night totals $12, 300. Cost of the merchandise sold, $9,500 January utility bill arrives, $1300. It will be paid in February The leasehold improvements have a 10 year life; straight line deprecation method will be used. Supplies on hand at month end, $1400. Required: The above transactions need to be journalized. A trial balance needs to be completed for the month ended January 2022. Complete the income statement, statement of partner's equity (see page 435 in textbook for proper format) and balance sheet