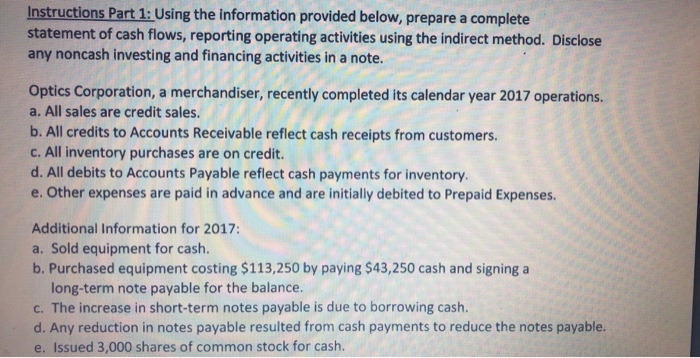

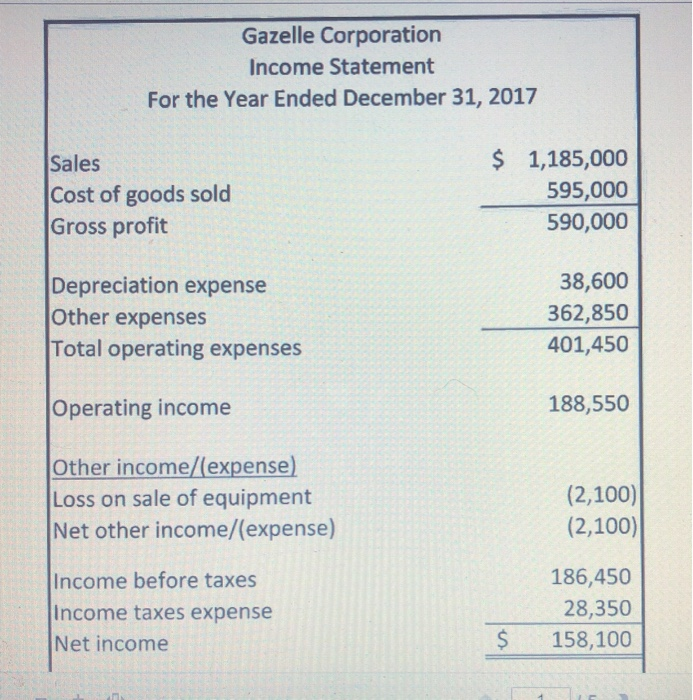

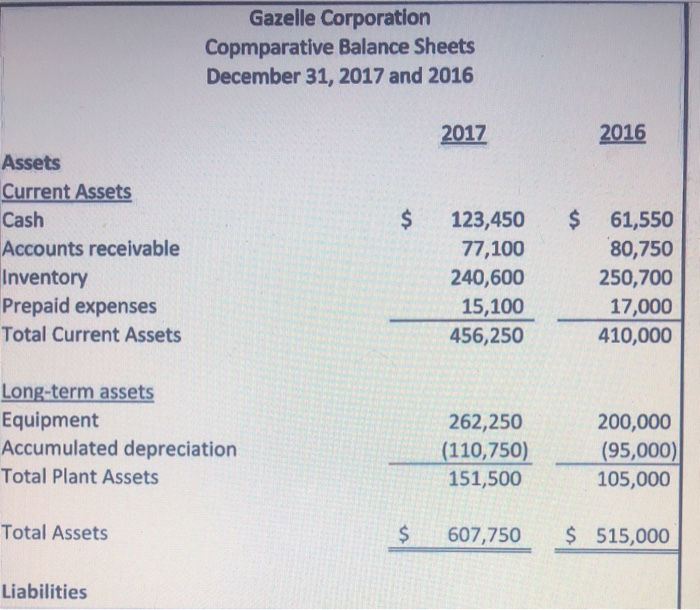

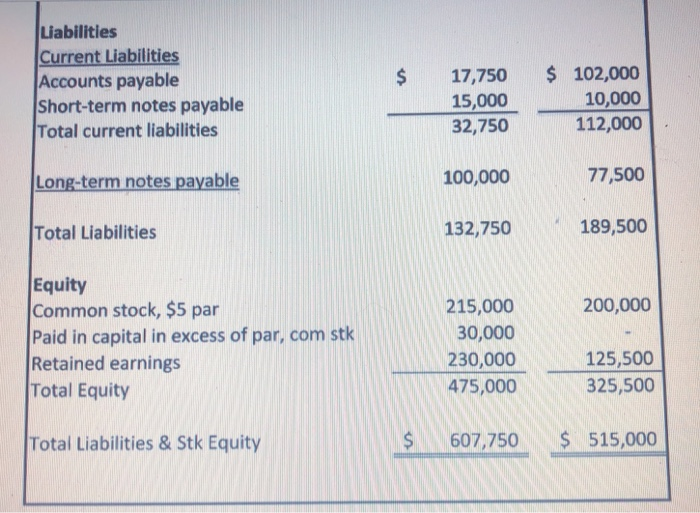

Instructions Part 1: Using the information provided below, prepare a complete statement of cash flows, reporting operating activities using the indirect method. Disclose any noncash investing and financing activities in a note. Optics Corporation, a merchandiser, recently completed its calendar year 2017 operations. a. All sales are credit sales. b. All credits to Accounts Receivable reflect cash receipts from customers. c. All inventory purchases are on credit. d. All debits to Accounts Payable reflect cash payments for inventory e. Other expenses are paid in advance and are initially debited to Prepaid Expenses. Additional Information for 2017: a. Sold equipment for cash. b. Purchased equipment costing $113,250 by paying $43,250 cash and signing a long-term note payable for the balance. C. The increase in short-term notes payable is due to borrowing cash. d. Any reduction in notes payable resulted from cash payments to reduce the notes payable. e. Issued 3,000 shares of common stock for cash. Gazelle Corporation Income Statement For the Year Ended December 31, 2017 $ Sales Cost of goods sold Gross profit 1,185,000 595,000 590,000 Depreciation expense Other expenses Total operating expenses 38,600 362,850 401,450 Operating income 188,550 Other income/(expense) Loss on sale of equipment Net other income/(expense) (2,100) (2,100) Income before taxes Income taxes expense Net income 186,450 28,350 158,100 $ Gazelle Corporation Copmparative Balance Sheets December 31, 2017 and 2016 2017 2016 Assets Current Assets Cash Accounts receivable Inventory Prepaid expenses Total Current Assets 123,450 77,100 240,600 15,100 456,250 $ 61,550 80,750 250,700 17,000 410,000 Long-term assets Equipment Accumulated depreciation Total Plant Assets 262,250 (110,750) 151,500 200,000 (95,000) 105,000 Total Assets 607,750 $ 515,000 Liabilities Liabilities Current Liabilities Accounts payable Short-term notes payable Total current liabilities 17,750 15,000 32,750 $ 102,000 10,000 112,000 100,000 77,500 Total Liabilities 132,750 189,500 200,000 Equity Common stock, $5 par Paid in capital in excess of par, com stk Retained earnings Total Equity 215,000 30,000 230,000 475,000 125,500 325,500 Total Liabilities & Stk Equity 607,750 $ 515,000