Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Please answer the following questions and submit your responses in a single PDF file by Sunday ( June 9 ) at 1 1 :

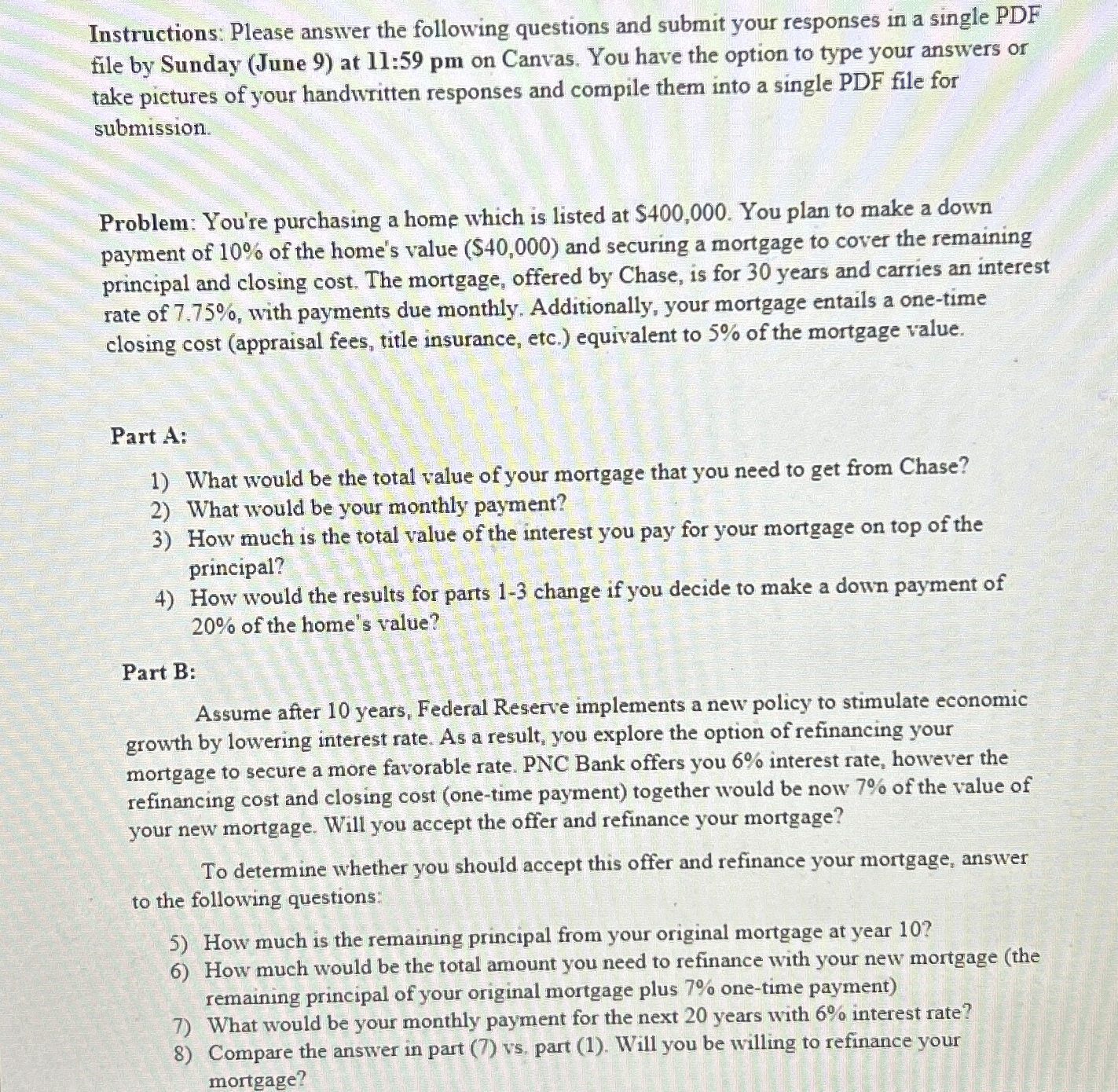

Instructions: Please answer the following questions and submit your responses in a single PDF file by Sunday June at : pm on Canvas. You have the option to type your answers or take pictures of your handwritten responses and compile them into a single PDF file for submission.

Problem: You're purchasing a home which is listed at $ You plan to make a down payment of of the home's value $ and securing a mortgage to cover the remaining principal and closing cost. The mortgage, offered by Chase, is for years and carries an interest rate of with payments due monthly. Additionally, your mortgage entails a onetime closing cost appraisal fees, title insurance, etc. equivalent to of the mortgage value.

Part A:

What would be the total value of your mortgage that you need to get from Chase?

What would be your monthly payment?

How much is the total value of the interest you pay for your mortgage on top of the principal?

How would the results for parts change if you decide to make a down payment of of the home's value?

Part B:

Assume after years, Federal Reserve implements a new policy to stimulate economic growth by lowering interest rate. As a result, you explore the option of refinancing your mortgage to secure a more favorable rate. PNC Bank offers you interest rate, however the refinancing cost and closing cost onetime payment together would be now of the value of your new mortgage. Will you accept the offer and refinance your mortgage?

To determine whether you should accept this offer and refinance your mortgage, answer to the following questions:

How much is the remaining principal from your original mortgage at year

How much would be the total amount you need to refinance with your new mortgage the remaining principal of your original mortgage plus onetime payment

What would be your monthly payment for the next years with interest rate?

Compare the answer in part vs part Will you be willing to refinance your mortgage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started