Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Please submit all work via Excel spreadsheets. Clearly articulate all assumptions and calculations. Identify each key cell used in your calculations. Overview for Problems

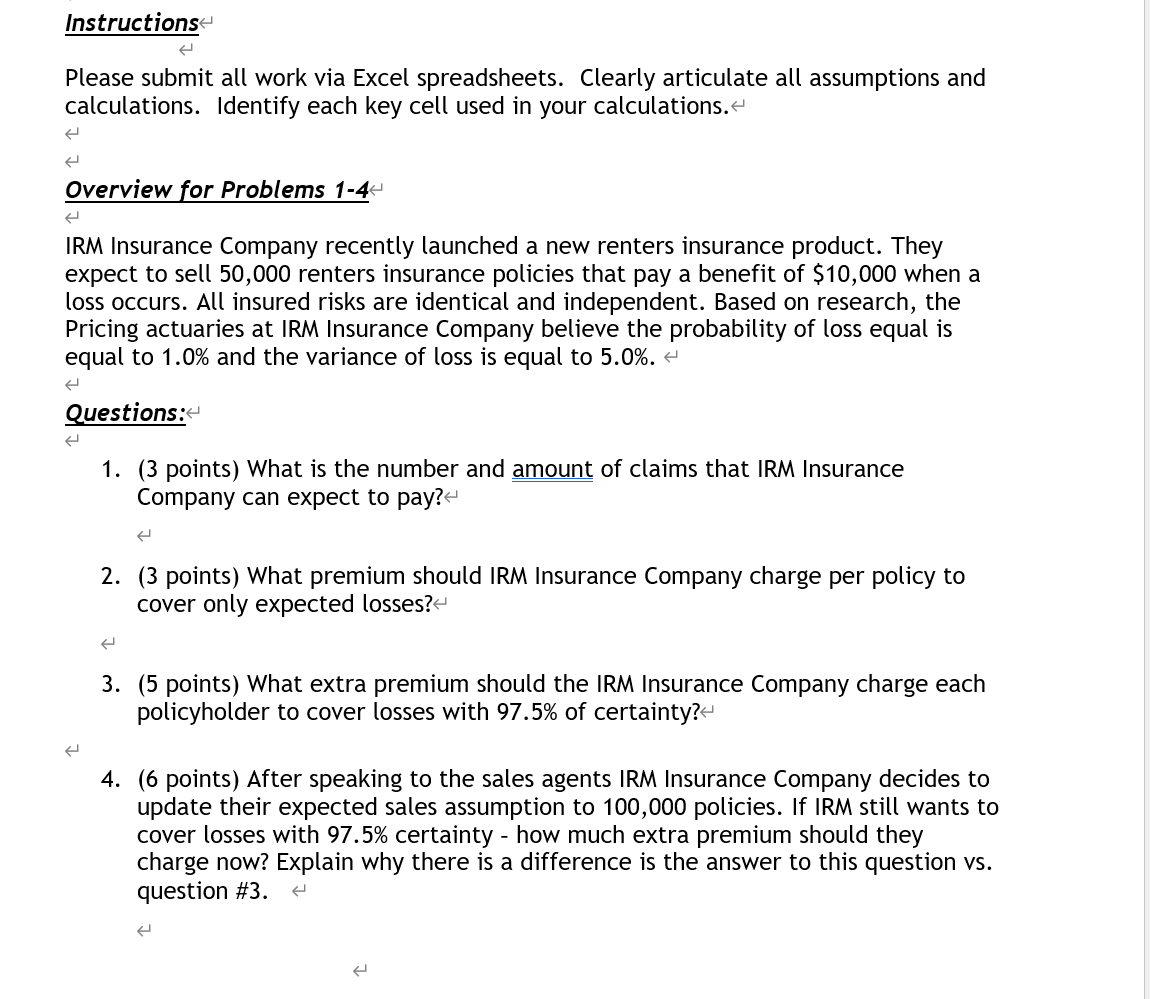

Instructions

Please submit all work via Excel spreadsheets. Clearly articulate all assumptions and

calculations. Identify each key cell used in your calculations.

Overview for Problems

IRM Insurance Company recently launched a new renters insurance product. They

expect to sell renters insurance policies that pay a benefit of $ when a

loss occurs. All insured risks are identical and independent. Based on research, the

Pricing actuaries at IRM Insurance Company believe the probability of loss equal is

equal to and the variance of loss is equal to

Questions:

points What is the number and amount of claims that IRM Insurance

Company can expect to pay?

points What premium should IRM Insurance Company charge per policy to

cover only expected losses?

points What extra premium should the IRM Insurance Company charge each

policyholder to cover losses with of certainty?

points After speaking to the sales agents IRM Insurance Company decides to

update their expected sales assumption to policies. If IRM still wants to

cover losses with certainty how much extra premium should they

charge now? Explain why there is a difference is the answer to this question vs

question #

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started