Answered step by step

Verified Expert Solution

Question

1 Approved Answer

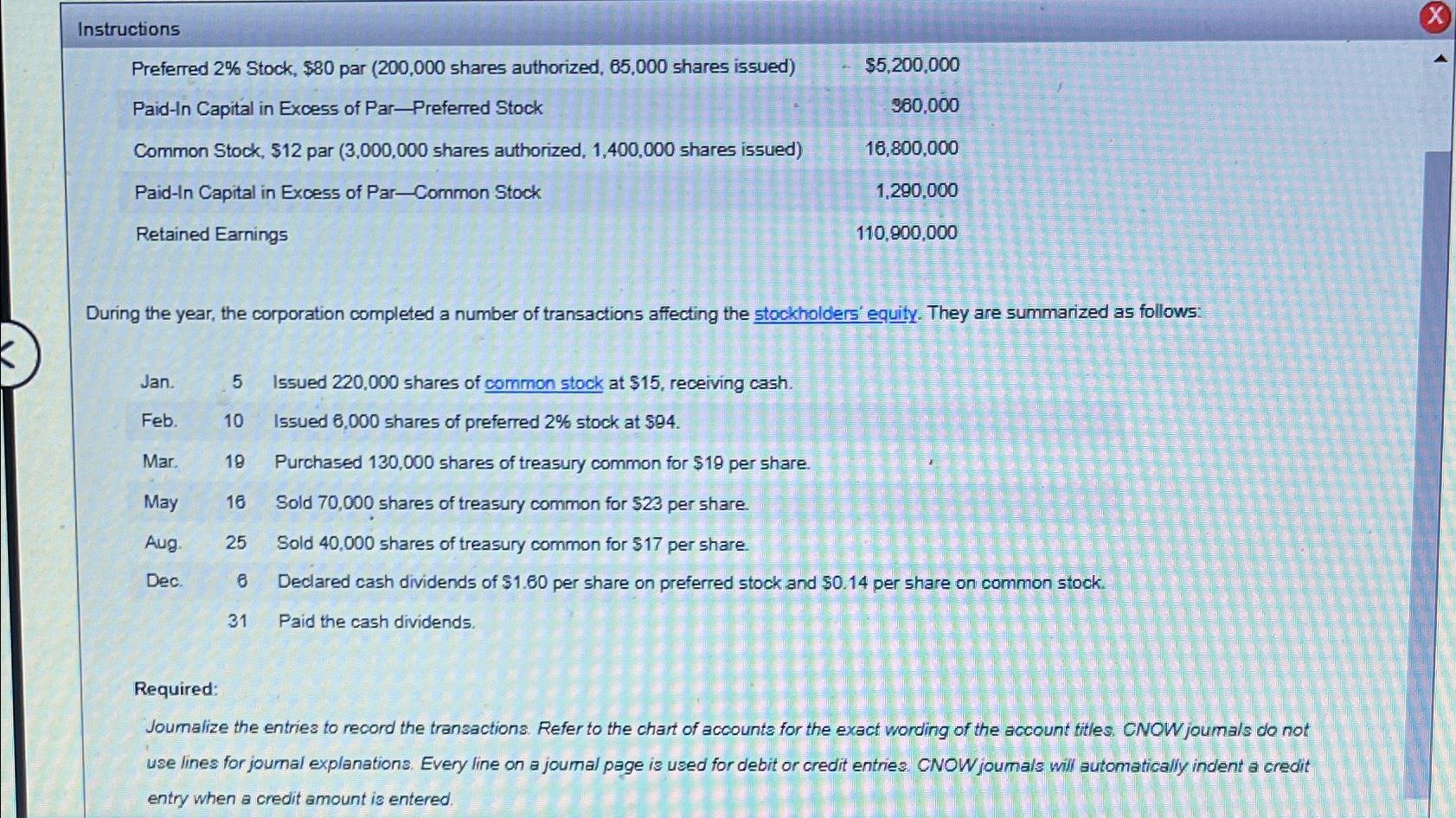

Instructions Preferred 2% Stock, $80 par (200,000 shares authorized, 65,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock $5,200,000 360,000 Common Stock, $12

Instructions Preferred 2% Stock, $80 par (200,000 shares authorized, 65,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock $5,200,000 360,000 Common Stock, $12 par (3,000,000 shares authorized, 1,400,000 shares issued) 16,800,000 Paid-In Capital in Excess of Par-Common Stock 1,290,000 Retained Earnings 110,900,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: Jan. 5 Issued 220,000 shares of common stock at $15, receiving cash. Feb. 10 Issued 6,000 shares of preferred 2% stock at $94. Mar. 19 Purchased 130,000 shares of treasury common for $19 per share. May 16 Sold 70,000 shares of treasury common for $23 per share. Aug. Dec. 25 Sold 40,000 shares of treasury common for $17 per share. 6 31 Declared cash dividends of $1.60 per share on preferred stock and $0.14 per share on common stock. Paid the cash dividends. Required: Joumalize the entries to record the transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW joumals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW joumals will automatically indent a credit entry when a credit amount is entered. X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Jan 5 Cash common stock issuance 3300000 Common Stock 2640000 PaidIn Capital in Exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started