| Instructions: | PREPARE YOUR ANALYSIS For | | | | |

| A | Cost Profit Volume analysis | | | | |

| | 1. Evaluate the production data and find out cost per unit MUSK. |

| | 2. Find out the sales price/unit, variable cost/unit , Contrib. Margin/unit and |

| | | monthly fixed cost | | | | |

| | 3. Find out the BEP. | | | | | |

| B | Sales forecast analysis | | | | |

| | 4. Prepare the table for the monthly 5 years sales forecast in units |

| | 5. Prepare the table for Sales budget and proposed delivery budget |

| Instructions: | PREPARE YOUR ANALYSIS For | | | | | | | | |

| A | Cost Profit Volume analysis | | | | | | | | |

| | 1. Evaluate the production data and find out cost per unit MUSK. |

| | 2. Find out the sales price/unit, variable cost/unit , Contrib. Margin/unit and |

| | | monthly fixed cost | | | | | monthly fixed cost | | | | |

| | 3. Find out the BEP. | | | | | | | | | | |

| B | Sales forecast analysis | | | | | | | | |

| | 4. Prepare the table for the monthly 5 years sales forecast in units |

| | 5. Prepare the table for Sales budget and proposed delivery budget |

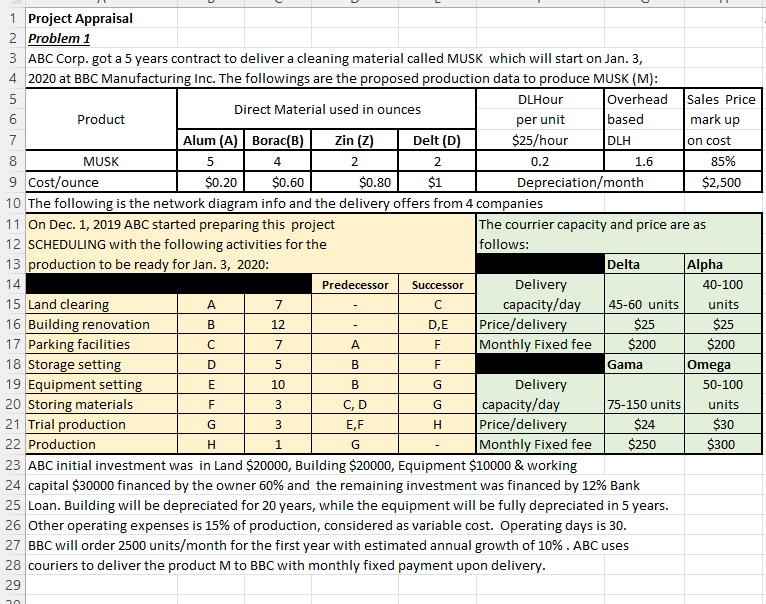

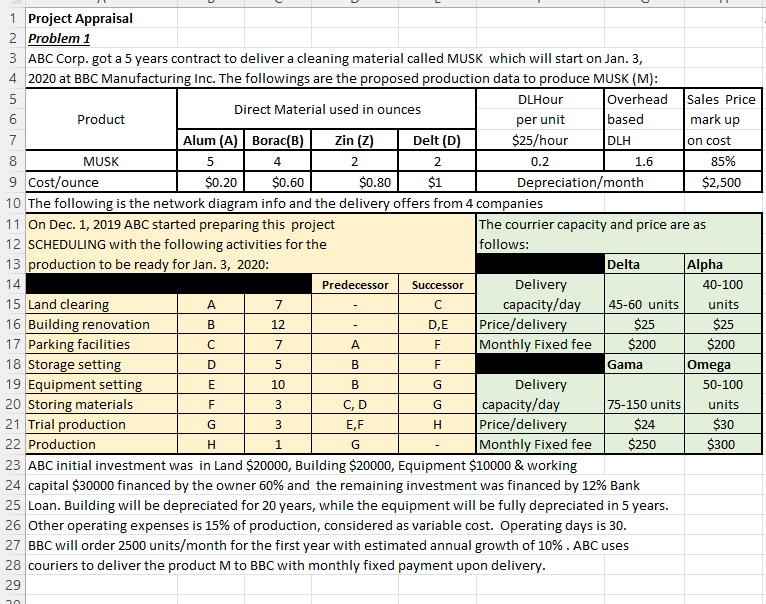

per unit mark up 1 Project Appraisal 2 Problem 1 3 ABC Corp. got a 5 years contract to deliver a cleaning material called MUSK which will start on Jan. 3, 4 2020 at BBC Manufacturing Inc. The followings are the proposed production data to produce MUSK (M): 5 DLHour Overhead Sales Price Direct Material used in ounces 6 Product based 7 Alum (A) Borac(B) Zin (2) Delt (D) $25/hour DLH on cost 8 MUSK 5 4 2 2 0.2 1.6 85% 9 Cost/ounce $0.20 $0.60 $0.80 $1 Depreciation/month $2,500 10 The following is the network diagram info and the delivery offers from 4 companies 11 On Dec. 1, 2019 ABC started preparing this project The courrier capacity and price are as 12 SCHEDULING with the following activities for the follows: 13 production to be ready for Jan. 3, 2020: Delta Alpha 14 Predecessor Successor Delivery 40-100 15 Land clearing 7 capacity/day 45-60 units units 16 Building renovation B 12 DE Price/delivery $25 $25 17 Parking facilities 7 F Monthly Fixed fee $200 $200 18 Storage setting D 5 B Gama Omega 19 Equipment setting E 10 B G Delivery 50-100 20 Storing materials F 3 CD capacity/day 75-150 units units 21 Trial production G 3 E,F H Price/delivery $24 $30 22 Production H 1 G Monthly Fixed fee $250 $300 23 ABC initial investment was in Land $20000, Building $20000, Equipment $10000 & working 24 capital $30000 financed by the owner 60% and the remaining investment was financed by 12% Bank 25 Loan. Building will be depreciated for 20 years, while the equipment will be fully depreciated in 5 years. 26 Other operating expenses is 15% of production, considered as variable cost. Operating days is 30. 27 BBC will order 2500 units/month for the first year with estimated annual growth of 10%. ABC uses 28 couriers to deliver the product M to BBC with monthly fixed payment upon delivery. 29 C F G per unit mark up 1 Project Appraisal 2 Problem 1 3 ABC Corp. got a 5 years contract to deliver a cleaning material called MUSK which will start on Jan. 3, 4 2020 at BBC Manufacturing Inc. The followings are the proposed production data to produce MUSK (M): 5 DLHour Overhead Sales Price Direct Material used in ounces 6 Product based 7 Alum (A) Borac(B) Zin (2) Delt (D) $25/hour DLH on cost 8 MUSK 5 4 2 2 0.2 1.6 85% 9 Cost/ounce $0.20 $0.60 $0.80 $1 Depreciation/month $2,500 10 The following is the network diagram info and the delivery offers from 4 companies 11 On Dec. 1, 2019 ABC started preparing this project The courrier capacity and price are as 12 SCHEDULING with the following activities for the follows: 13 production to be ready for Jan. 3, 2020: Delta Alpha 14 Predecessor Successor Delivery 40-100 15 Land clearing 7 capacity/day 45-60 units units 16 Building renovation B 12 DE Price/delivery $25 $25 17 Parking facilities 7 F Monthly Fixed fee $200 $200 18 Storage setting D 5 B Gama Omega 19 Equipment setting E 10 B G Delivery 50-100 20 Storing materials F 3 CD capacity/day 75-150 units units 21 Trial production G 3 E,F H Price/delivery $24 $30 22 Production H 1 G Monthly Fixed fee $250 $300 23 ABC initial investment was in Land $20000, Building $20000, Equipment $10000 & working 24 capital $30000 financed by the owner 60% and the remaining investment was financed by 12% Bank 25 Loan. Building will be depreciated for 20 years, while the equipment will be fully depreciated in 5 years. 26 Other operating expenses is 15% of production, considered as variable cost. Operating days is 30. 27 BBC will order 2500 units/month for the first year with estimated annual growth of 10%. ABC uses 28 couriers to deliver the product M to BBC with monthly fixed payment upon delivery. 29 C F G