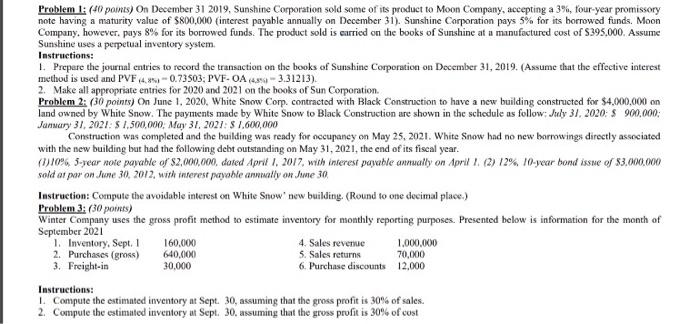

Instructions: Problem 1: (40 points) On December 31 2019, Sunshine Corporation sold some of its product to Moon Company, accepting a 3%, four-year promissory note having a maturity value of $800,000 interest payable annually on December 31). Sunshine Corporation pays 5% for its borrowed funds. Moon Company, however, pays 8% for its borrowed funds. The product sold is carried on the books of Sunshine at a manufactured cost of $395,000. Assume Sunshine uses a perpetual inventory system 1. Prepare the journal entries to record the transaction on the books of Sunshine Corporation on December 31, 2019. (Assume that the effective interest method is used and PVF4.5-0.73503; PVF-OA 384-3.31213). 2. Make all appropriate entries for 2020 and 2021 on the books of Sun Corporation. Problem 2: (30 points) on June 1, 2020, White Snow Corp. contracted with Black Construction to have a new building constructed for $4.000.000 on land owned by White Snow. The payments made by White Snow to Black Construction are shown in the schedule as follow: July 31, 2020: S 900,000: January 31, 2021. 57.500,000, May 31, 2027: $ 1.600,000 Construction was completed and the building was ready for necupancy on May 25, 2021. White Snow had no new borrowings directly associated with the new building but had the following debt outstanding on May 31, 2021, the end of its fiscal year. (7.0% 5-year note payable of $2,000,00, dated April 1, 2017 with interest payable annually on April 1. (2) 12% 10-year bond issue of $3.000.000 sold at per on June 30, 2012, with interest payable anwally on some 30 Instruction: Compute the avoidable interest on White Snow new building. (Round to one decimal place.) Problem 3: (30 points) Winter Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of September 2021 1. Inventory, Sept. 1 160.000 4. Sales revenue 1,000,000 2. Purchases (gross) 640,000 5. Sales returns 70,000 3. Freight-in 30,000 6. Purchase discounts 12.000 Instructions: 1. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of sales. 2. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of cost Instructions: Problem 1: (40 points) On December 31 2019, Sunshine Corporation sold some of its product to Moon Company, accepting a 3%, four-year promissory note having a maturity value of $800,000 interest payable annually on December 31). Sunshine Corporation pays 5% for its borrowed funds. Moon Company, however, pays 8% for its borrowed funds. The product sold is carried on the books of Sunshine at a manufactured cost of $395,000. Assume Sunshine uses a perpetual inventory system 1. Prepare the journal entries to record the transaction on the books of Sunshine Corporation on December 31, 2019. (Assume that the effective interest method is used and PVF4.5-0.73503; PVF-OA 384-3.31213). 2. Make all appropriate entries for 2020 and 2021 on the books of Sun Corporation. Problem 2: (30 points) on June 1, 2020, White Snow Corp. contracted with Black Construction to have a new building constructed for $4.000.000 on land owned by White Snow. The payments made by White Snow to Black Construction are shown in the schedule as follow: July 31, 2020: S 900,000: January 31, 2021. 57.500,000, May 31, 2027: $ 1.600,000 Construction was completed and the building was ready for necupancy on May 25, 2021. White Snow had no new borrowings directly associated with the new building but had the following debt outstanding on May 31, 2021, the end of its fiscal year. (7.0% 5-year note payable of $2,000,00, dated April 1, 2017 with interest payable annually on April 1. (2) 12% 10-year bond issue of $3.000.000 sold at per on June 30, 2012, with interest payable anwally on some 30 Instruction: Compute the avoidable interest on White Snow new building. (Round to one decimal place.) Problem 3: (30 points) Winter Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of September 2021 1. Inventory, Sept. 1 160.000 4. Sales revenue 1,000,000 2. Purchases (gross) 640,000 5. Sales returns 70,000 3. Freight-in 30,000 6. Purchase discounts 12.000 Instructions: 1. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of sales. 2. Compute the estimated inventory at Sept. 30, assuming that the gross profit is 30% of cost