Answered step by step

Verified Expert Solution

Question

1 Approved Answer

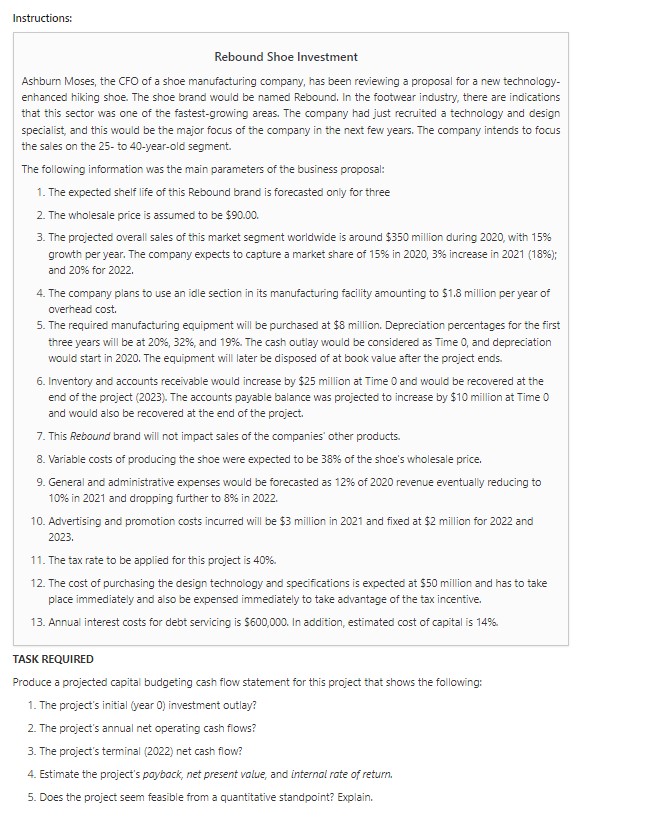

Instructions: Rebound Shoe Investment Ashburn Moses, the CFO of a shoe manufacturing company, has been reviewing a proposal for a new technology - enhanced hiking

Instructions:

Rebound Shoe Investment

Ashburn Moses, the CFO of a shoe manufacturing company, has been reviewing a proposal for a new technology

enhanced hiking shoe. The shoe brand would be named Rebound. In the footwear industry, there are indications

that this sector was one of the fastestgrowing areas. The company had just recruited a technology and design

specialist, and this would be the major focus of the company in the next few years. The company intends to focus

the sales on the to yearold segment.

The following information was the main parameters of the business proposal:

The expected shelf life of this Rebound brand is forecasted only for three

The wholesale price is assumed to be $

The projected overall sales of this market segment worldwide is around $ million during with

growth per year. The company expects to capture a market share of in increase in ;

and for

The company plans to use an idle section in its manufacturing facility amounting to $ million per year of

overhead cost.

The required manufacturing equipment will be purchased at $ million. Depreciation percentages for the first

three years will be at and The cash outlay would be considered as Time and depreciation

would start in The equipment will later be disposed of at book value after the project ends.

Inventory and accounts receivable would increase by $ million at Time and would be recovered at the

end of the project The accounts payable balance was projected to increase by $ million at Time

and would also be recovered at the end of the project.

This Rebound brand will not impact sales of the companies' other products.

Variable costs of producing the shoe were expected to be of the shoe's wholesale price.

General and administrative expenses would be forecasted as of revenue eventually reducing to

in and dropping further to in

Advertising and promotion costs incurred will be $ million in and fixed at $ million for and

The tax rate to be applied for this project is

The cost of purchasing the design technology and specifications is expected at $ million and has to take

place immediately and also be expensed immediately to take advantage of the tax incentive.

Annual interest costs for debt servicing is $ In addition, estimated cost of capital is

TASK REQUIRED

Produce a projected capital budgeting cash flow statement for this project that shows the following:

The project's initial year investment outlay?

The project's annual net operating cash flows?

The project's terminal net cash flow?

Estimate the project's paybock, net present value, and internal rate of return,

Does the project seem feasible from a quantitative standpoint? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started