Answered step by step

Verified Expert Solution

Question

1 Approved Answer

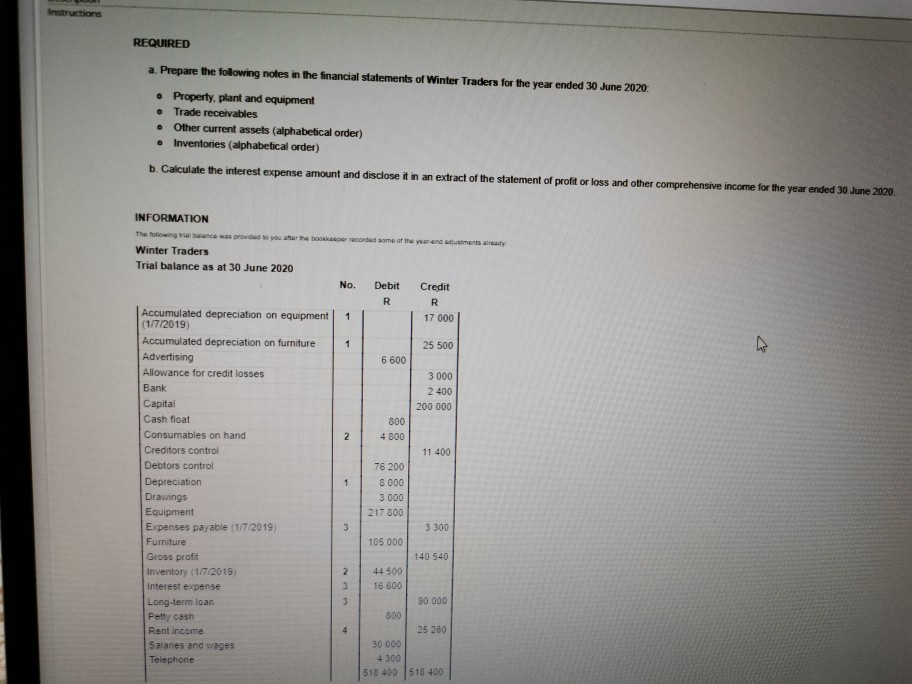

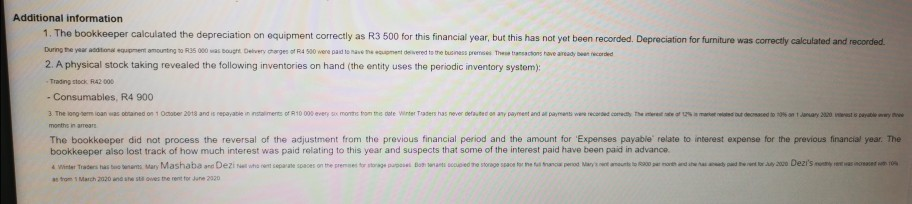

Instructions REQUIRED o a. Prepare the following notes in the financial statements of Winter Traders for the year ended 30 June 2020 Property, plant and

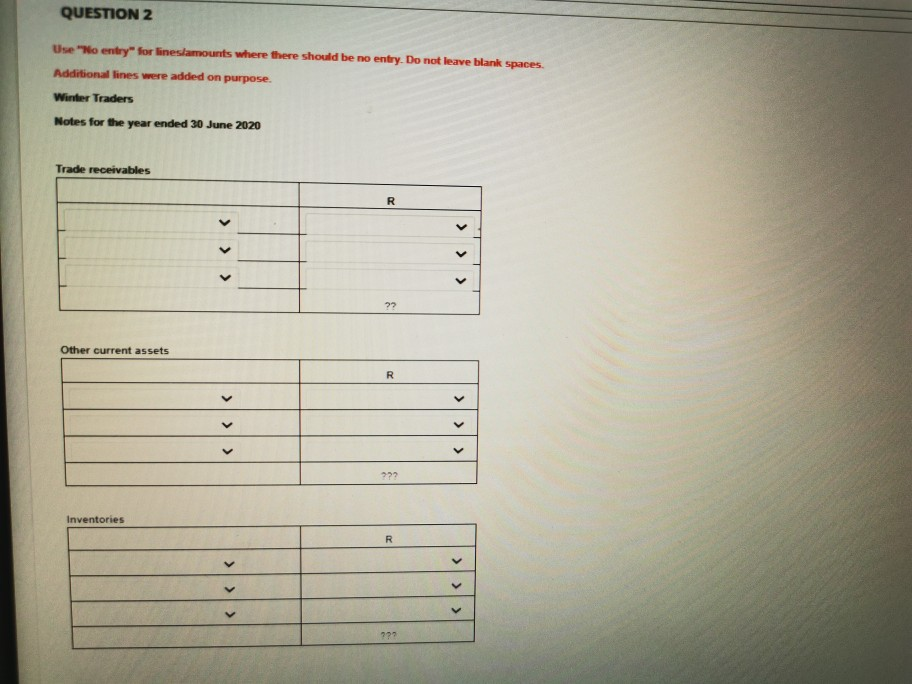

Instructions REQUIRED o a. Prepare the following notes in the financial statements of Winter Traders for the year ended 30 June 2020 Property, plant and equipment Trade receivables Other current assets (alphabetical order) Inventories (alphabetical order) b. Calculate the interest expense amount and disclose it in an extract of the statement of profit or loss and other comprehensive income for the year ended 30 June 2020 M INFORMATION The following trance was provides you after the recorded some of the year and adjustments already Winter Traders Trial balance as at 30 June 2020 No. Debit Credit R R Accumulated depreciation on equipment 1 17 000 (1/7/2019) Accumulated depreciation on furniture 1 25 500 Advertising 6 600 Allowance for credit losses 3 000 Bank 2 400 Capital 200 000 Cash float 800 Consumables on hand 2 4 800 Creditors control 11 400 Debtors control 76 200 Depreciation 1 8 000 Drawings 3000 Equipment 217 800 Expenses payable 1/7/2019) 3 3 300 Furniture 105 000 Gross profit 140 540 Inventory (1/7/2019) 2 44 500 Interest expense 16 600 Long-term loan 3 90 000 Petty cash 800 Rent income 4 25 260 Salaries and wages 30 000 Telephone 4 300 518 400 518 400 Additional information 1. The bookkeeper calculated the depreciation on equipment correctly as R3 500 for this financial year, but this has not yet been recorded. Depreciation for furniture was correctly calculated and recorded. During the year and content amounting to R35000 was bought Delivery charges of R4 500 were paid to have the ones were to the business premises. The actions have already recorded 2. A physical stock taking revealed the following inventories on hand (the entity uses the periodic inventory system): - Trading cock RA2000 - Consumables, R4 900 3. The long term loan wastaned on October 2018 and is reparatie annamets of R10 000 every six months ton me date Winter Traders has never dated on any payment and a payments were recorded the membered but dered to onary2020 tywy months in man The bookkeeper did not process the reversal of the adjustment from the previous financial period and the amount for 'Expenses payable relate to interest expense for the previous financial year. The bookkeeper also lost track of how much interest was paid relating to this year and suspects that some of the interest paid have been paid in advance. Winter Traders as to war wary Mashaba Dezitual when separate saus on the restoran Bomoarte scued the storage scale operator by 2000 Dezi's 10 strom1 March 2020 este western for June 2030 QUESTION 2 Use "No entry for linestamounts where there should be no entry. Do not leave blank spaces. Additional lines were added on purpose. Winter Traders Notes for the year ended 30 June 2020 Trade receivables R 72 Other current assets R 779 Instructions REQUIRED o a. Prepare the following notes in the financial statements of Winter Traders for the year ended 30 June 2020 Property, plant and equipment Trade receivables Other current assets (alphabetical order) Inventories (alphabetical order) b. Calculate the interest expense amount and disclose it in an extract of the statement of profit or loss and other comprehensive income for the year ended 30 June 2020 M INFORMATION The following trance was provides you after the recorded some of the year and adjustments already Winter Traders Trial balance as at 30 June 2020 No. Debit Credit R R Accumulated depreciation on equipment 1 17 000 (1/7/2019) Accumulated depreciation on furniture 1 25 500 Advertising 6 600 Allowance for credit losses 3 000 Bank 2 400 Capital 200 000 Cash float 800 Consumables on hand 2 4 800 Creditors control 11 400 Debtors control 76 200 Depreciation 1 8 000 Drawings 3000 Equipment 217 800 Expenses payable 1/7/2019) 3 3 300 Furniture 105 000 Gross profit 140 540 Inventory (1/7/2019) 2 44 500 Interest expense 16 600 Long-term loan 3 90 000 Petty cash 800 Rent income 4 25 260 Salaries and wages 30 000 Telephone 4 300 518 400 518 400 Additional information 1. The bookkeeper calculated the depreciation on equipment correctly as R3 500 for this financial year, but this has not yet been recorded. Depreciation for furniture was correctly calculated and recorded. During the year and content amounting to R35000 was bought Delivery charges of R4 500 were paid to have the ones were to the business premises. The actions have already recorded 2. A physical stock taking revealed the following inventories on hand (the entity uses the periodic inventory system): - Trading cock RA2000 - Consumables, R4 900 3. The long term loan wastaned on October 2018 and is reparatie annamets of R10 000 every six months ton me date Winter Traders has never dated on any payment and a payments were recorded the membered but dered to onary2020 tywy months in man The bookkeeper did not process the reversal of the adjustment from the previous financial period and the amount for 'Expenses payable relate to interest expense for the previous financial year. The bookkeeper also lost track of how much interest was paid relating to this year and suspects that some of the interest paid have been paid in advance. Winter Traders as to war wary Mashaba Dezitual when separate saus on the restoran Bomoarte scued the storage scale operator by 2000 Dezi's 10 strom1 March 2020 este western for June 2030 QUESTION 2 Use "No entry for linestamounts where there should be no entry. Do not leave blank spaces. Additional lines were added on purpose. Winter Traders Notes for the year ended 30 June 2020 Trade receivables R 72 Other current assets R 779

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started