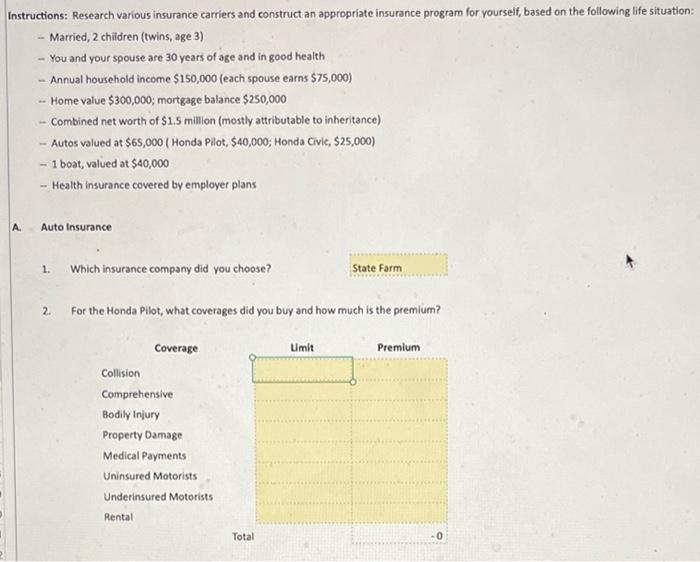

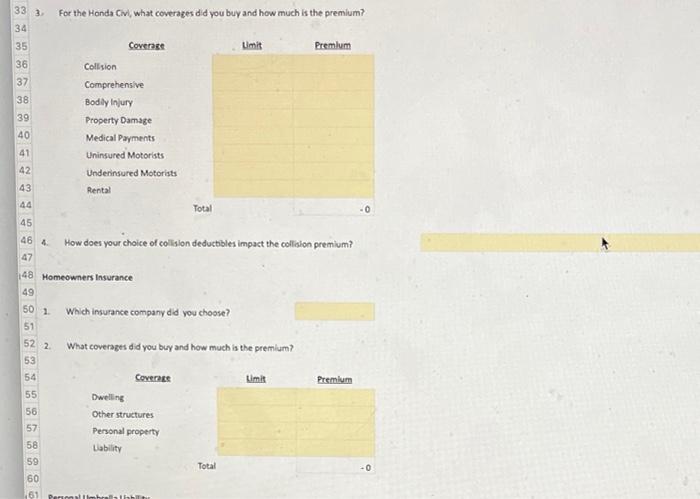

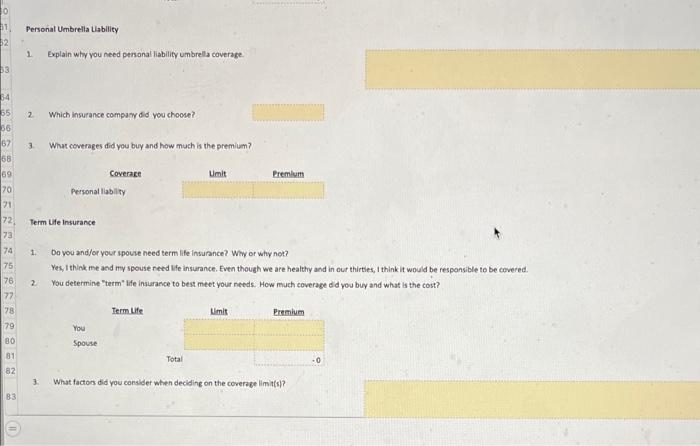

Instructions: Research various insurance carriers and construct an appropriate insurance program for yourself, based on the following life situation: - Married, 2 children (twins, age 3) - You and your spouse are 30 years of age and in good health - Annual household income $150,000 (each spouse earns $75,000 ) - Home value $300,000; mortgage balance $250,000 - Combined net worth of $1.5 million (mostly attributable to inheritance) - Autos valued at $65,000 (Honda Pillot, \$40,000; Honda Civic, \$25,000) - 1 boat, valued at $40,000 - Health insurance covered by employet plans A. Auto insurance 1. Which insurance company did you choose? 2. For the Honda Pilot, what coverages did you buy and how much is the premium? 3. For the Honda Civi, what coverages did you buy and how much is the premium? 4. How does your choice of colision deductibles impact the colidion premium? Homeowners Insurance 1. Which ingurance company dd you choose? 2. What coverages dd you buy and how much is the premlum? 1. Explain why you need personal liability umbrella coverage. 2. Which insurance compary did you choose? 3. What coverages did you buy and how much is the premium? Term tife Insurance 1. Do you andfor your ipowie need term life insuance? Wiy or why not? Yes, I think me and my spouse reed life insurance. Even though we are healthy and in our thirties, I think it would be responsible to be covered. 2. You determine "term" Ife insurance to best meet your needs. How much coverage did you buy and what is the cost? 3. What facton did you consider when deciding on the coverage limit(s)? Instructions: Research various insurance carriers and construct an appropriate insurance program for yourself, based on the following life situation: - Married, 2 children (twins, age 3) - You and your spouse are 30 years of age and in good health - Annual household income $150,000 (each spouse earns $75,000 ) - Home value $300,000; mortgage balance $250,000 - Combined net worth of $1.5 million (mostly attributable to inheritance) - Autos valued at $65,000 (Honda Pillot, \$40,000; Honda Civic, \$25,000) - 1 boat, valued at $40,000 - Health insurance covered by employet plans A. Auto insurance 1. Which insurance company did you choose? 2. For the Honda Pilot, what coverages did you buy and how much is the premium? 3. For the Honda Civi, what coverages did you buy and how much is the premium? 4. How does your choice of colision deductibles impact the colidion premium? Homeowners Insurance 1. Which ingurance company dd you choose? 2. What coverages dd you buy and how much is the premlum? 1. Explain why you need personal liability umbrella coverage. 2. Which insurance compary did you choose? 3. What coverages did you buy and how much is the premium? Term tife Insurance 1. Do you andfor your ipowie need term life insuance? Wiy or why not? Yes, I think me and my spouse reed life insurance. Even though we are healthy and in our thirties, I think it would be responsible to be covered. 2. You determine "term" Ife insurance to best meet your needs. How much coverage did you buy and what is the cost? 3. What facton did you consider when deciding on the coverage limit(s)