Question

INSTRUCTIONS: SOLVE ALL problems on separate pages and submit them before the deadline. Show your work, as discussed in class, providing a timeline where you

INSTRUCTIONS: SOLVE ALL problems on separate pages and submit them before the deadline. Show your work, as discussed in class, providing a timeline where you believe it is needed to clarify your answer. Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show trailing zeros (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. Please contact me at (787) 504-0077 if you have any questions. Your work must be completed individually in your own handwriting. Plagiarism will not be tolerated.

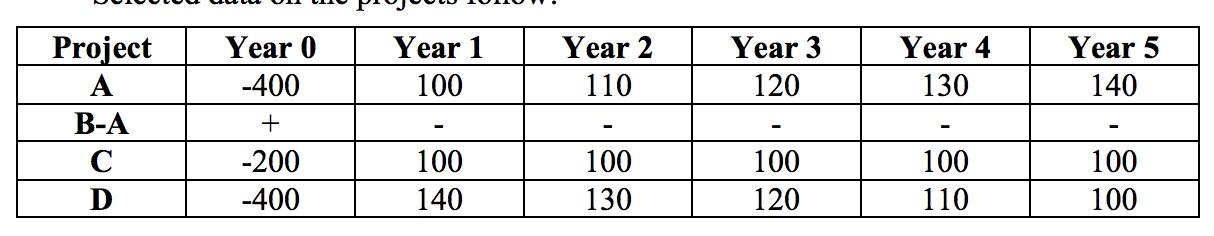

5) Hard choice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow:

a) Consider only projects A and B by examining the incremental project cash flows BA. They are mutually exclusive opportunities. If the IRRB-A = 12% and the discount rate is 15% then what is your decision? (2 marks)

b) Ignoring the information in question (a), assume instead that projects A and C are independent, Hardchoice is subject to capital rationing (i.e., it may not be able to afford both projects), and the relevant discount rate is 10%.

i) What is the IRR of Project A? Project C? (2 marks)

ii) How would you rank Project A compared to Project C? (1 mark)

c) Consider the following statements and circle the Roman numeral corresponding to the one that is true. (2 marks)

I The NPV of project D will be much more sensitive to changes in the discount rate than will the NPV of project A.

II If projects C and D are mutually exclusive, incremental analysis indicates that one should reject project C and accept project D.

III It is possible for projects A and D to have the same NPV.

IV All of the above are true.

V None of the above is true.

Year 1 100 Year 2 110 Year 3 120 Year 4 130 Year 5 140 Project A B-A D Year 0 -400 + -200 -400 100 100 100 130 100 110 100 100 140 120Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started