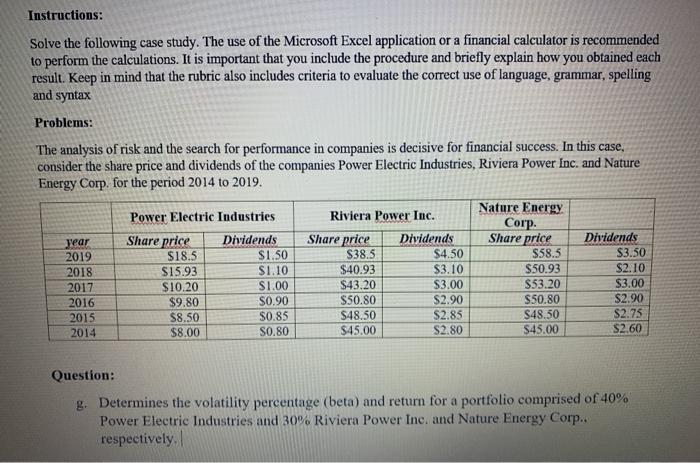

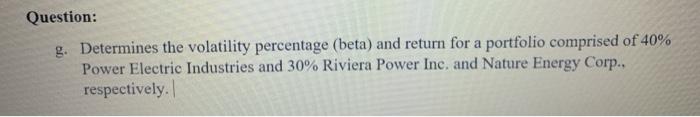

Instructions: Solve the following case study. The use of the Microsoft Excel application or a financial calculator is recommended to perform the calculations. It is important that you include the procedure and briefly explain how you obtained each result. Keep in mind that the rubric also includes criteria to evaluate the correct use of language, grammar, spelling and syntax Problems: The analysis of risk and the search for performance in companies is decisive for financial success. In this case, consider the share price and dividends of the companies Power Electric Industries, Riviera Power Inc. and Nature Energy Corp. for the period 2014 to 2019. Power Electric Industries Riviera Power Inc. Nature Energy Corp. Share price Dividends Share price Dividends Share price Dividends 2019 $18.5 S1.50 $38.5 $4.50 $58.5 $3.50 2018 $15.93 $1.10 $40.93 $3.10 $50.93 $2.10 2017 $10.20 S1.00 S43.20 $3.00 S53.20 $3.00 2016 $9.80 $0.90 S50.80 $2.90 $50.80 S2.90 2015 $8.50 $0.85 $48.50 S2.85 $48.50 $2.75 2014 $8.00 S0.80 $45.00 S2.80 $45.00 S2.60 year Question: g. Determines the volatility percentage (beta) and return for a portfolio comprised of 40% Power Electric Industries and 30% Riviera Power Inc. and Nature Energy Corp.. respectively. Question: g. Determines the volatility percentage (beta) and return for a portfolio comprised of 40% Power Electric Industries and 30% Riviera Power Inc. and Nature Energy Corp.. respectively. Instructions: Solve the following case study. The use of the Microsoft Excel application or a financial calculator is recommended to perform the calculations. It is important that you include the procedure and briefly explain how you obtained each result. Keep in mind that the rubric also includes criteria to evaluate the correct use of language, grammar, spelling and syntax Problems: The analysis of risk and the search for performance in companies is decisive for financial success. In this case, consider the share price and dividends of the companies Power Electric Industries, Riviera Power Inc. and Nature Energy Corp. for the period 2014 to 2019. Power Electric Industries Riviera Power Inc. Nature Energy Corp. Share price Dividends Share price Dividends Share price Dividends 2019 $18.5 S1.50 $38.5 $4.50 $58.5 $3.50 2018 $15.93 $1.10 $40.93 $3.10 $50.93 $2.10 2017 $10.20 S1.00 S43.20 $3.00 S53.20 $3.00 2016 $9.80 $0.90 S50.80 $2.90 $50.80 S2.90 2015 $8.50 $0.85 $48.50 S2.85 $48.50 $2.75 2014 $8.00 S0.80 $45.00 S2.80 $45.00 S2.60 year Question: g. Determines the volatility percentage (beta) and return for a portfolio comprised of 40% Power Electric Industries and 30% Riviera Power Inc. and Nature Energy Corp.. respectively. Question: g. Determines the volatility percentage (beta) and return for a portfolio comprised of 40% Power Electric Industries and 30% Riviera Power Inc. and Nature Energy Corp.. respectively