Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The capital accounts of Jamie Dexter and Max Gee have balances of $148,600 and $84,200, respectively. Darcey Lind and Loren Rothman are to be

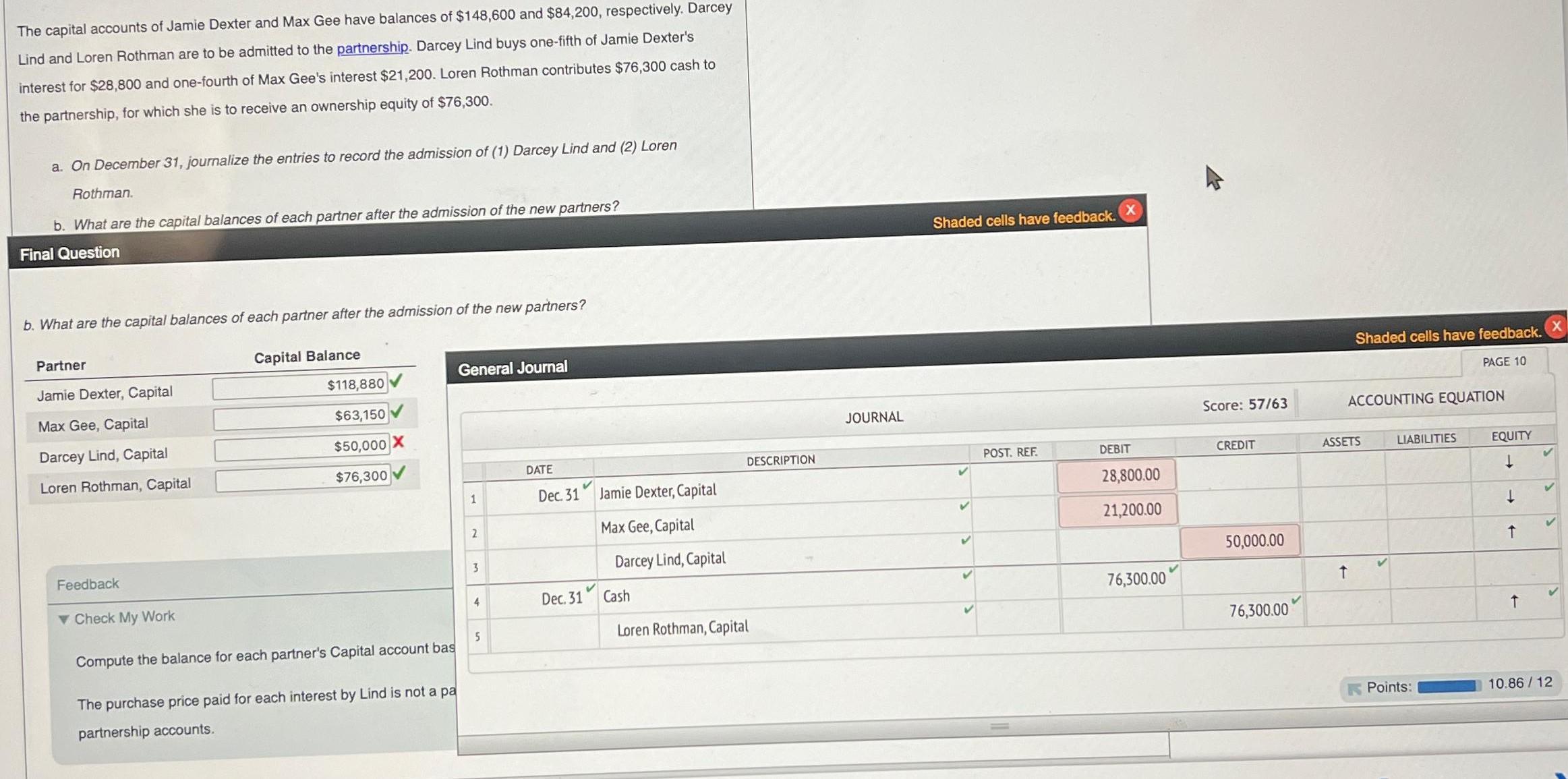

The capital accounts of Jamie Dexter and Max Gee have balances of $148,600 and $84,200, respectively. Darcey Lind and Loren Rothman are to be admitted to the partnership. Darcey Lind buys one-fifth of Jamie Dexter's interest for $28,800 and one-fourth of Max Gee's interest $21,200. Loren Rothman contributes $76,300 cash to the partnership, for which she is to receive an ownership equity of $76,300. a. On December 31, journalize the entries to record the admission of (1) Darcey Lind and (2) Loren Rothman. b. What are the capital balances of each partner after the admission of the new partners? Final Question b. What are the capital balances of each partner after the admission of the new partners? Partner Jamie Dexter, Capital Capital Balance $118,880 General Journal Max Gee, Capital Darcey Lind, Capital $63,150 $50,000 X Loren Rothman, Capital $76,300 Feedback Check My Work Compute the balance for each partner's Capital account bas The purchase price paid for each interest by Lind is not a pa partnership accounts. Shaded cells have feedback. Shaded cells have feedback. PAGE 10 X Score: 57/63 ACCOUNTING EQUATION ASSETS LIABILITIES EQUITY JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 Dec. 31 Jamie Dexter, Capital 28,800.00 2 Max Gee, Capital 21,200.00 3 Darcey Lind, Capital 4 Dec. 31 Cash 50,000.00 76,300.00 5 Loren Rothman, Capital 76,300.00 Points: 10.86/12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started