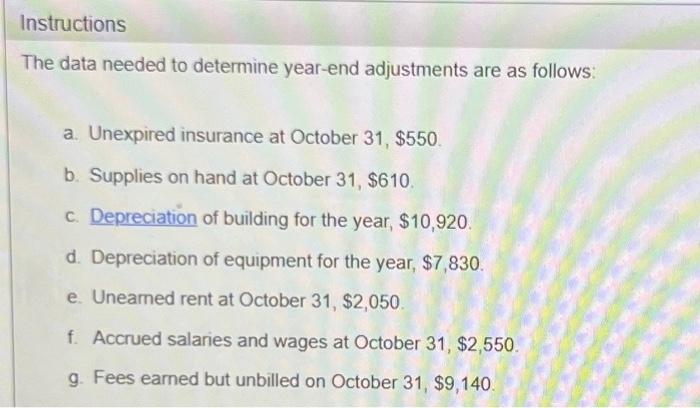

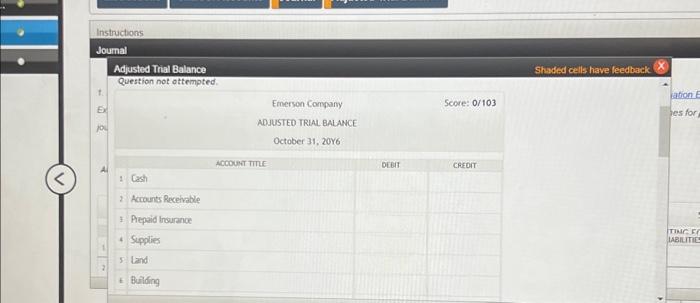

Instructions The data needed to determine year-end adjustments are as follows: a. Unexpired insurance at October 31, $550. b. Supplies on hand at October 31, $610. c. Depreciation of building for the year, $10,920. d. Depreciation of equipment for the year, $7,830. e. Unearned rent at October 31, $2,050. f. Accrued salaries and wages at October 31, $2,550. g. Fees earned but unbilled on October 31, $9,140.

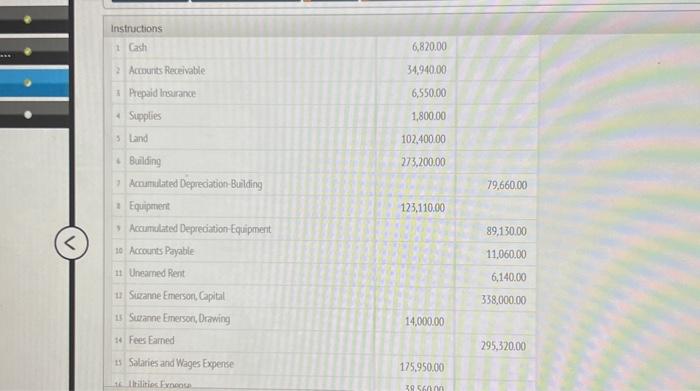

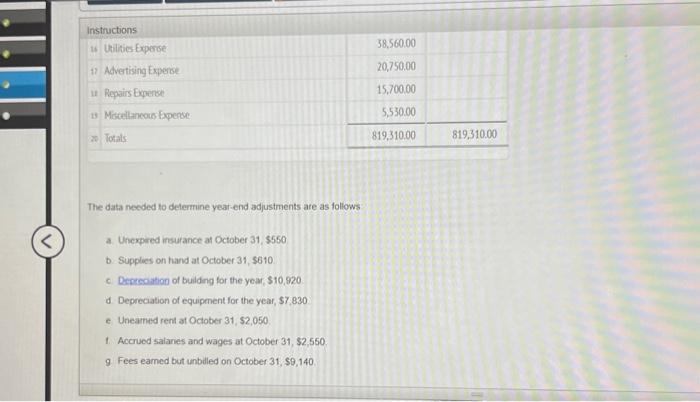

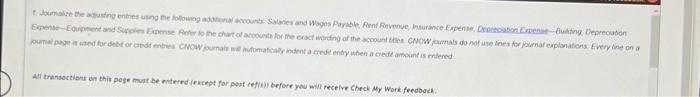

The data needed to determine year-end adjustments ate as follows: a. Uncxpered insurance at October 31,$550 b. Supples on hand at October 31,$610 c. Dererecoation of building for the year, $10,920 d. Depreciation of equipenent for the year, $7,830 e Uneamed rent at October 31, \$2,050. 1. Accrued salanes and wages at October 31,$2,550. 9 Fees eamed but unbdled on October 31,$9,140 Instructions Joumal Adjusted Trial Balance Question not ottempted. t. Ex Emerson Company Score: 0/103 ADJUSTEO TRLAL BALANCE October 31,20Y6 100 Deteit CREOT 1. Cash 2 Accounts Receivable I. Prepaid insurance + Supplies 5. Land \& Bulding \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Instructions } \\ \hline 1 & Cash & 6,820.00 & \\ \hline 2 & Acrounts Receivable & 34,940.00 & \\ \hline 3 & Prepsid trourance & 6,550,00 & \\ \hline 4 & Supplies & 1,800.00 & \\ \hline 3 & Land & 102,400,00 & \\ \hline 4 & Building & 273,200.00 & \\ \hline 7 & Acmumilated Depredation-Building & & 79,660,00 \\ \hline 1 & Equiprivert & 123,110.00 & \\ \hline , & Accumulated Deprediation Equipment & & 89,130,00 \\ \hline 10 & Accounts Payable & & 11,060.00 \\ \hline 11 & Uneamed Rent & & 6,140.00 \\ \hlineu & Siranne Emerson, Capital & & 338,000.00 \\ \hline 15 & Swanne Enesson, Drawing & 14,000.00 & \\ \hline 14 & Fees Earned & & 295,320,00 \\ \hline is & Salaries and Wages Experse & 175,950.00 & \\ \hline \end{tabular} The data needed to determine year-end adjustments are as follows: a. Unexpired insurance at October 31,$550. b. Supplies on hand at October 31, $610. c. Depreciation of building for the year, $10,920. d. Depreciation of equipment for the year, $7,830. e. Unearned rent at October 31, \$2,050. f. Accrued salaries and wages at October 31,$2,550. g. Fees earned but unbilled on October 31,$9,140. The data needed to determine year-end adjustments ate as follows: a. Uncxpered insurance at October 31,$550 b. Supples on hand at October 31,$610 c. Dererecoation of building for the year, $10,920 d. Depreciation of equipenent for the year, $7,830 e Uneamed rent at October 31, \$2,050. 1. Accrued salanes and wages at October 31,$2,550. 9 Fees eamed but unbdled on October 31,$9,140 Instructions Joumal Adjusted Trial Balance Question not ottempted. t. Ex Emerson Company Score: 0/103 ADJUSTEO TRLAL BALANCE October 31,20Y6 100 Deteit CREOT 1. Cash 2 Accounts Receivable I. Prepaid insurance + Supplies 5. Land \& Bulding \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Instructions } \\ \hline 1 & Cash & 6,820.00 & \\ \hline 2 & Acrounts Receivable & 34,940.00 & \\ \hline 3 & Prepsid trourance & 6,550,00 & \\ \hline 4 & Supplies & 1,800.00 & \\ \hline 3 & Land & 102,400,00 & \\ \hline 4 & Building & 273,200.00 & \\ \hline 7 & Acmumilated Depredation-Building & & 79,660,00 \\ \hline 1 & Equiprivert & 123,110.00 & \\ \hline , & Accumulated Deprediation Equipment & & 89,130,00 \\ \hline 10 & Accounts Payable & & 11,060.00 \\ \hline 11 & Uneamed Rent & & 6,140.00 \\ \hlineu & Siranne Emerson, Capital & & 338,000.00 \\ \hline 15 & Swanne Enesson, Drawing & 14,000.00 & \\ \hline 14 & Fees Earned & & 295,320,00 \\ \hline is & Salaries and Wages Experse & 175,950.00 & \\ \hline \end{tabular} The data needed to determine year-end adjustments are as follows: a. Unexpired insurance at October 31,$550. b. Supplies on hand at October 31, $610. c. Depreciation of building for the year, $10,920. d. Depreciation of equipment for the year, $7,830. e. Unearned rent at October 31, \$2,050. f. Accrued salaries and wages at October 31,$2,550. g. Fees earned but unbilled on October 31,$9,140