Question

Instructions The following balance sheets and income statement were taken from the records of Rosie- Lee Company: Rosie-Lee Company Comparative Balance Sheets At June 30,

Instructions

The following balance sheets and income statement were taken from the records of Rosie- Lee Company:

| Rosie-Lee Company |

| Comparative Balance Sheets |

| At June 30, 20X1 and 20X2 |

| 1 |

| 20X1 | 20X2 |

| 2 | Assets |

|

|

| 3 | Cash | $270,000.00 | $333,000.00 |

| 4 | Accounts receivable | 126,000.00 | 144,000.00 |

| 5 | Investments |

| 54,000.00 |

| 6 | Plant and equipment | 180,000.00 | 189,000.00 |

| 7 | Accumulated depreciation | (54,000.00) | (57,600.00) |

| 8 | Land | 36,000.00 | 54,000.00 |

| 9 | Total assets | $558,000.00 | $716,400.00 |

| 10 | Liabilities and equity |

|

|

| 11 | Accounts payable | $72,000.00 | $90,000.00 |

| 12 | Mortgage payable | 108,000.00 |

|

| 13 | Bonds payable |

| 90,000.00 |

| 14 | Preferred stock | 36,000.00 |

|

| 15 | Common stock | 180,000.00 | 288,000.00 |

| 16 | Retained earnings | 162,000.00 | 248,400.00 |

| 17 | Total liabilities and equity | $558,000.00 | $716,400.00 |

| Rosie-Lee Company |

| Income Statement |

| For the Year Ended June 30, 20X2 |

| 1 | Sales | $920,000.00 |

| 2 | Cost of goods sold | (620,000.00) |

| 3 | Gross margin | $300,000.00 |

| 4 | Operating expenses | (177,600.00) |

| 5 | Net income | $122,400.00 |

Additional transactions were as follows:

| A. | Sold equipment costing $21,600, with accumulated depreciation of $16,200, for $3,600. |

| B. | Issued bonds for $90,000 on December 31. |

| C. | Paid cash dividends of $36,000. |

| D. | Retired a mortgage at a price of $108,000 on December 31. |

Required:

Prepare a statement of cash flows using a worksheet similar to the one shown in Example 14.8 (p. 804). Use the indirect method to prepare the statement.

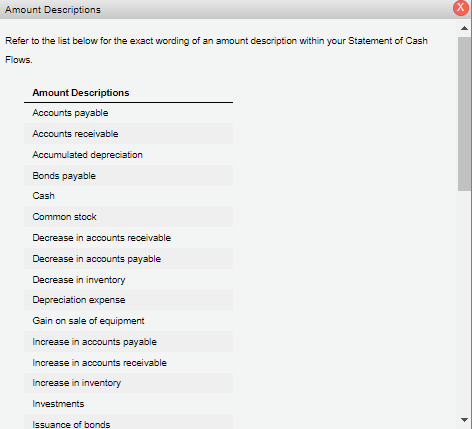

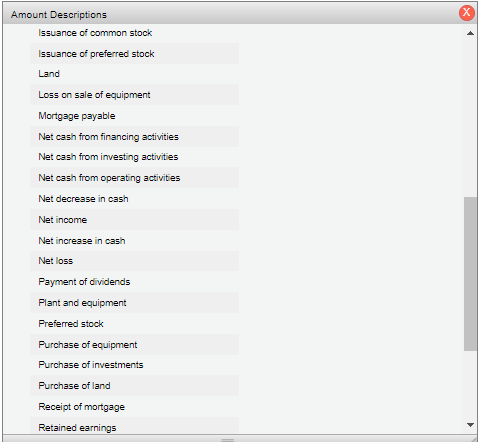

continued of Amount Descriptions Retirement of common, stockRetirement of mortgageRetirement of preferred stockSale of equipmentSale of landTotal assetsTotal liabilities and equity

Question Number 1.

| 1 |

| Beginning | Transaction | Transaction | Ending |

| 2 |

| Balance | Debit | Credit | Balance |

| 3 | Assets: |

|

|

|

|

| 4 |

|

|

|

|

|

| 5 |

|

|

|

|

|

| 6 |

|

|

|

|

|

| 7 |

|

|

|

|

|

| 8 |

|

|

|

|

|

| 9 |

|

|

|

|

|

| 10 |

|

|

|

|

|

| 11 | Liabilities and equity: |

|

|

|

|

| 12 |

|

|

|

|

|

| 13 |

|

|

|

|

|

| 14 |

|

|

|

|

|

| 15 |

|

|

|

|

|

| 16 |

|

|

|

|

|

| 17 |

|

|

|

|

|

| 18 |

|

|

|

|

|

| 19 | Cash flows from operating activities: |

|

|

|

|

| 20 |

|

|

|

|

|

| 21 |

|

|

|

|

|

| 22 |

|

|

|

|

|

| 23 |

|

|

|

|

|

| 24 |

|

|

|

|

|

| 25 | Cash flows from investing activities: |

|

|

|

|

| 26 |

|

|

|

|

|

| 27 |

|

|

|

|

|

| 28 |

|

|

|

|

|

| 29 |

|

|

|

|

|

| 30 | Cash flows from financing activities: |

|

|

|

|

| 31 |

|

|

|

|

|

| 32 |

|

|

|

|

|

| 33 |

|

|

|

|

|

| 34 |

|

|

|

|

|

| 35 |

|

|

|

|

|

| 36 |

|

|

|

|

|

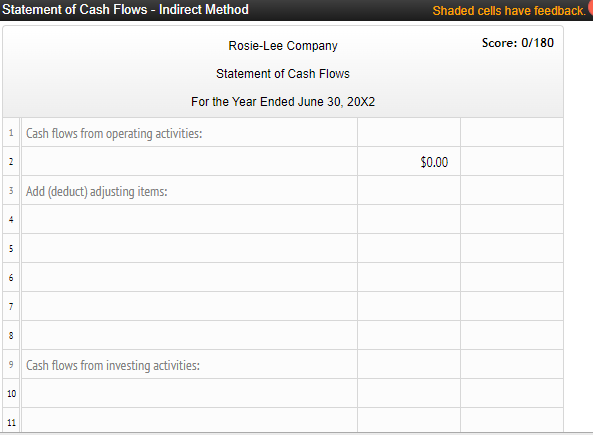

Question Number 2.

Prepare a statement of cash flows using a worksheet shown above.(Note: Begin by entering the applicable income statement amounts. Use a minus sign to indicate a negative amount. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.)

Question not attempted.

Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows. Amount Descriptions Issuance of common stock Issuance of preferred stock Land Loss on sale of equipment Mortgage payable Net cash from financing activities Net cash from investing activities Net cash from operating activities Net decrease in cash Net income Net increase in cash Net loss Payment of dividends Plant and equipment Preferred stock Purchase of equipment Purchase of investments Purchase of land Receipt of mortgage Retained earnings Statement of Cash Flows - Indirect Method Shaded cells have feedback. Rosie-Lee Company Score: 0/180 Statement of Cash Flows For the Year Ended June 30, 20X2 Cash flows from operating activities: 2 $0.00 3 Add (deduct) adjusting items: 4 5 6 7 8 9 Cash flows from investing activities: 10 11 12 13 14 Cash flows from financing activities: 16 17 18 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started