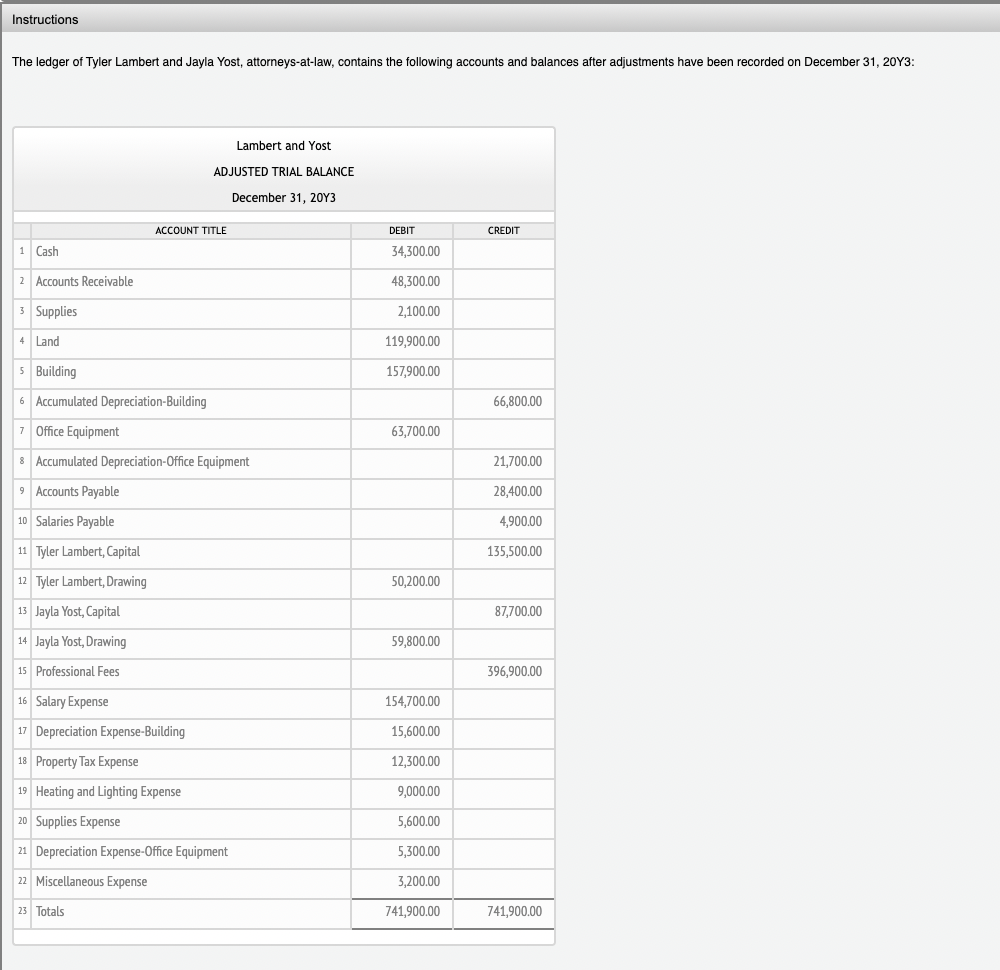

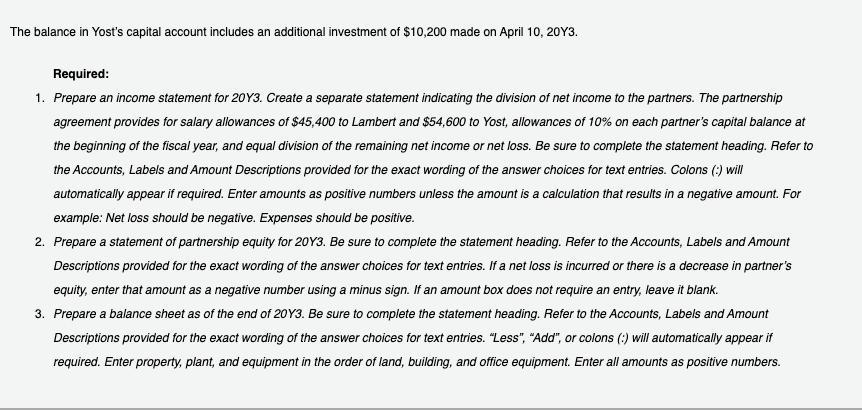

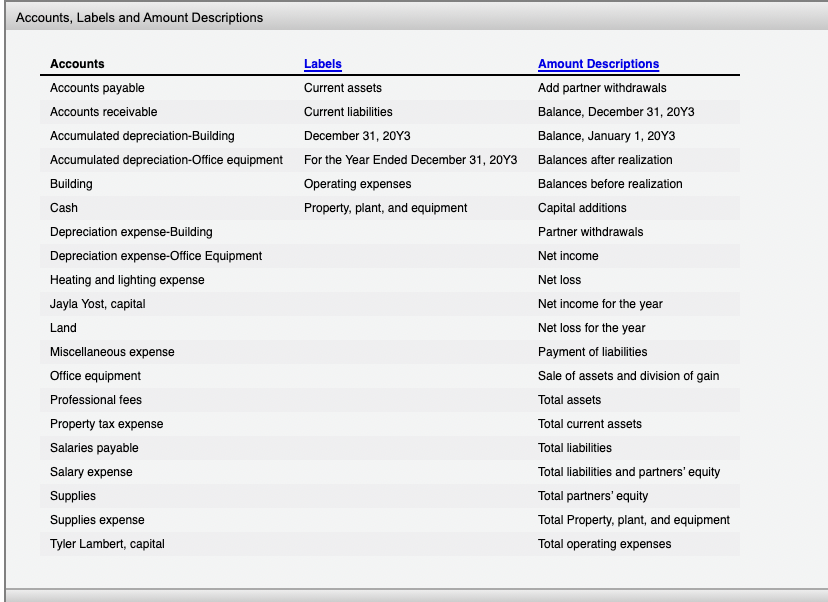

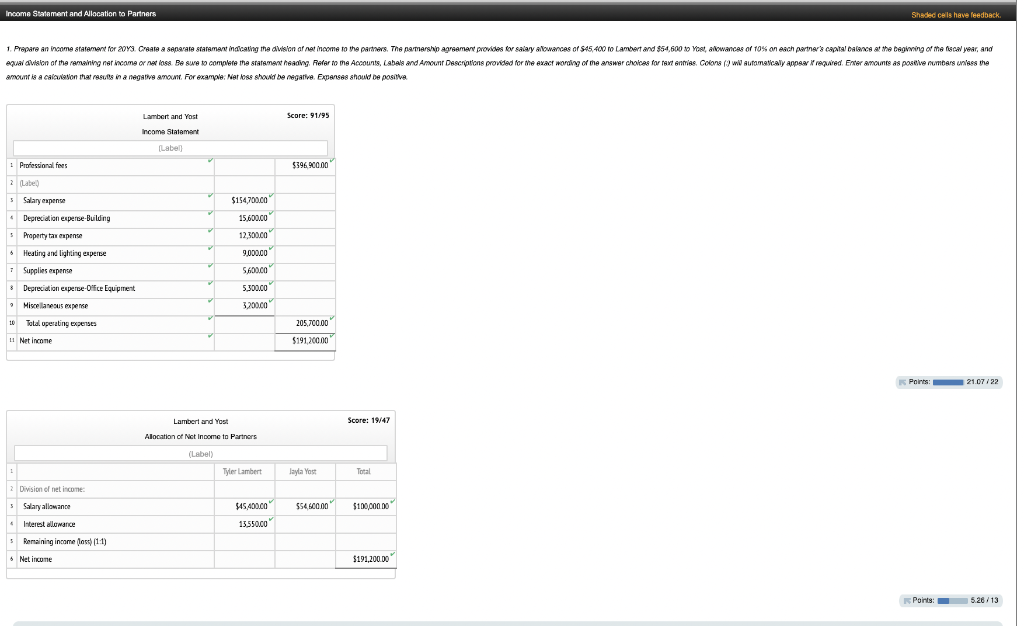

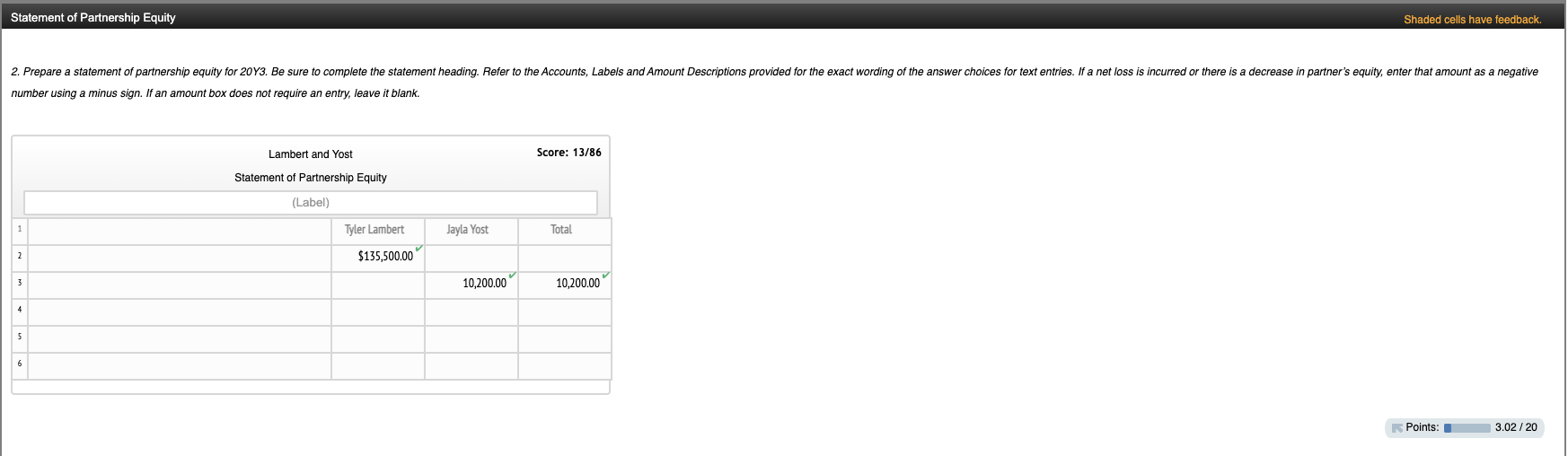

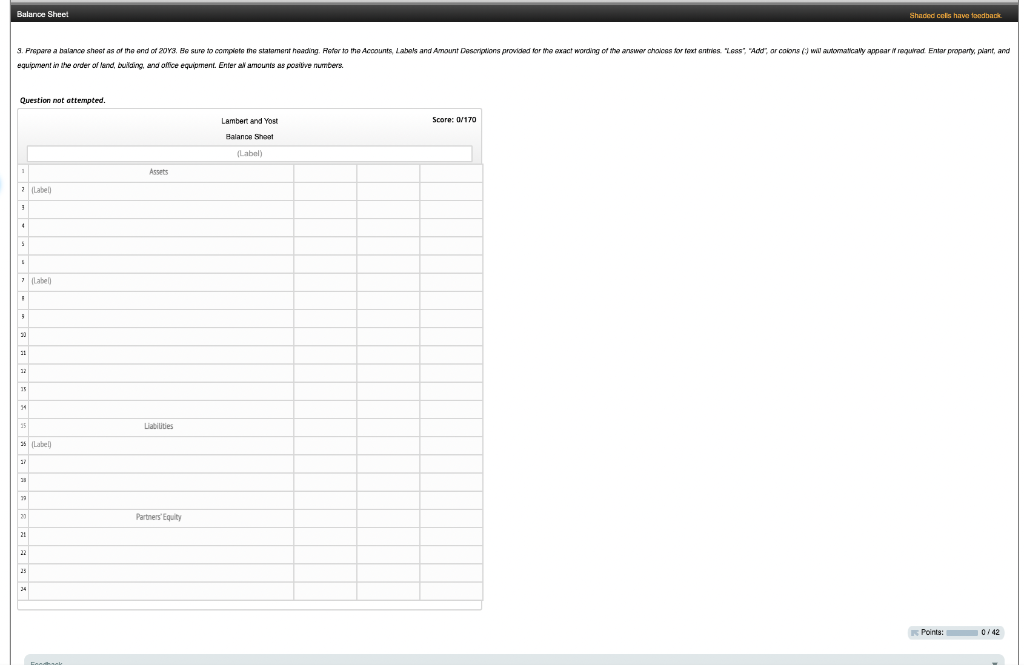

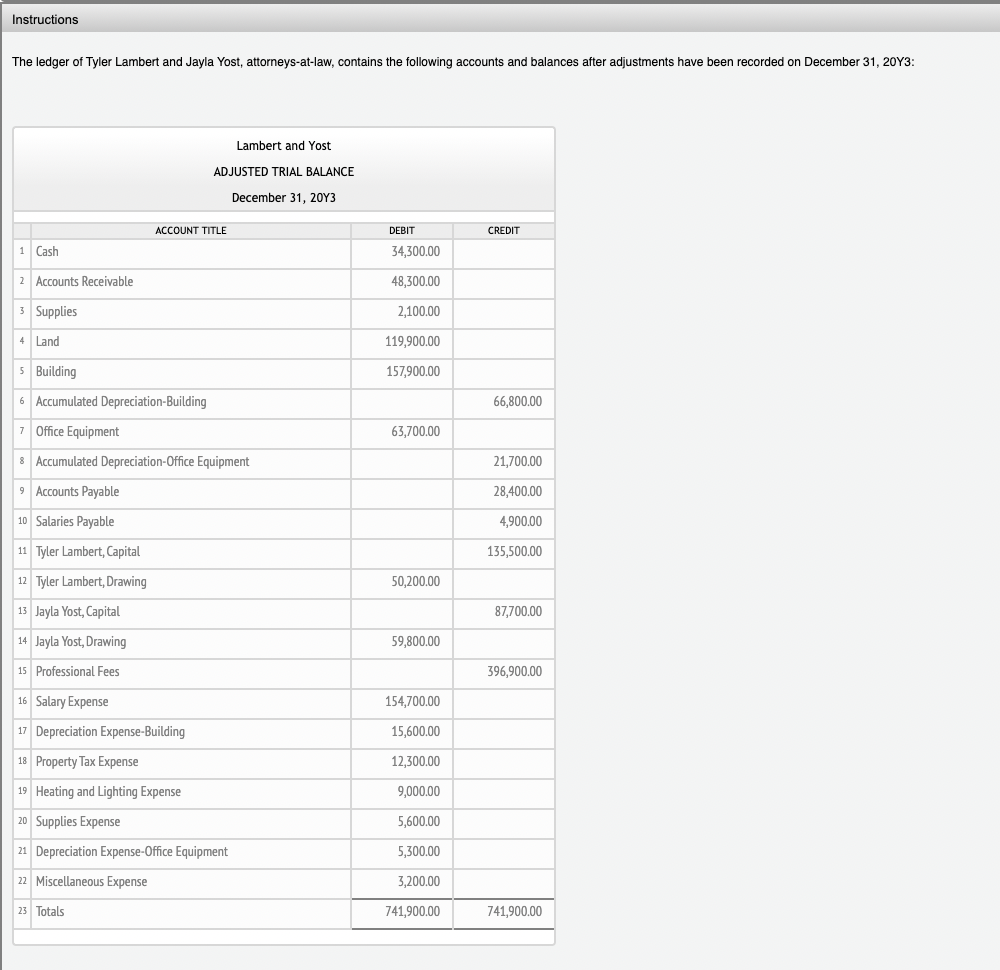

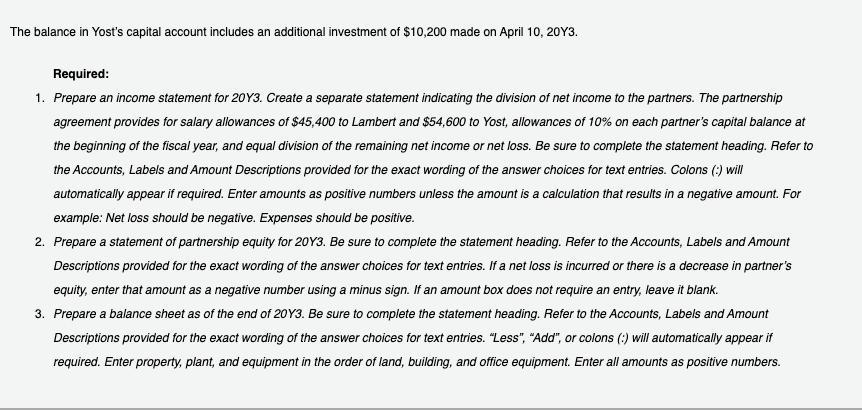

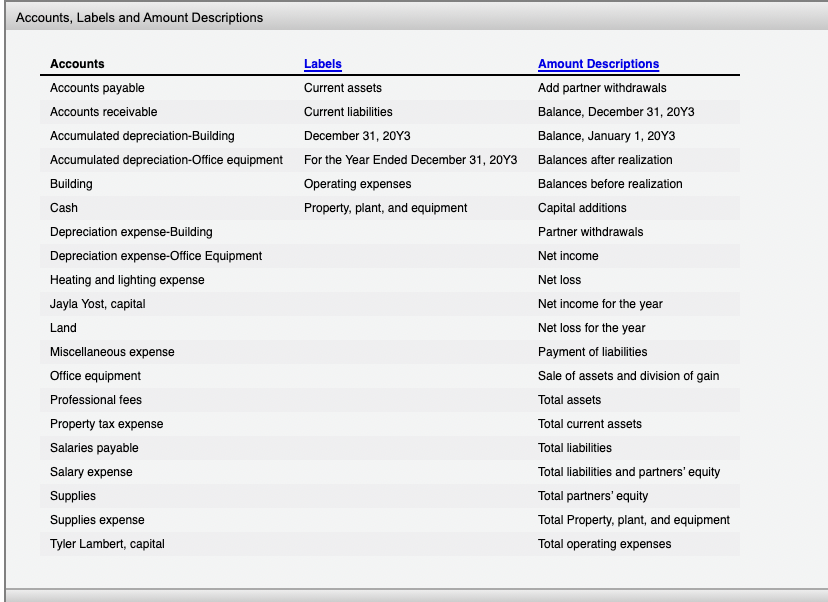

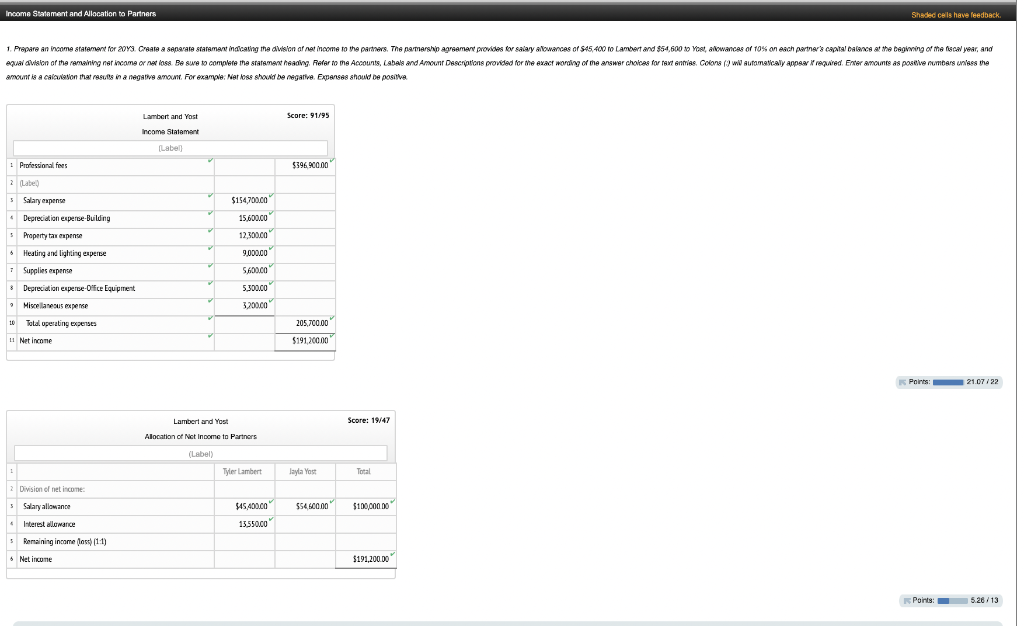

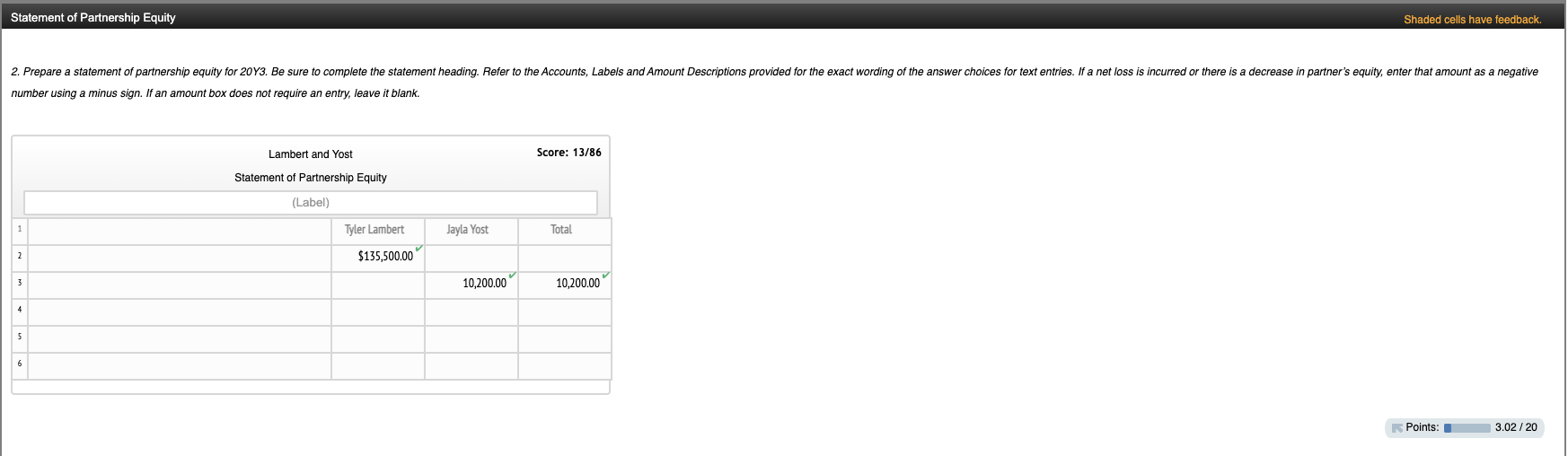

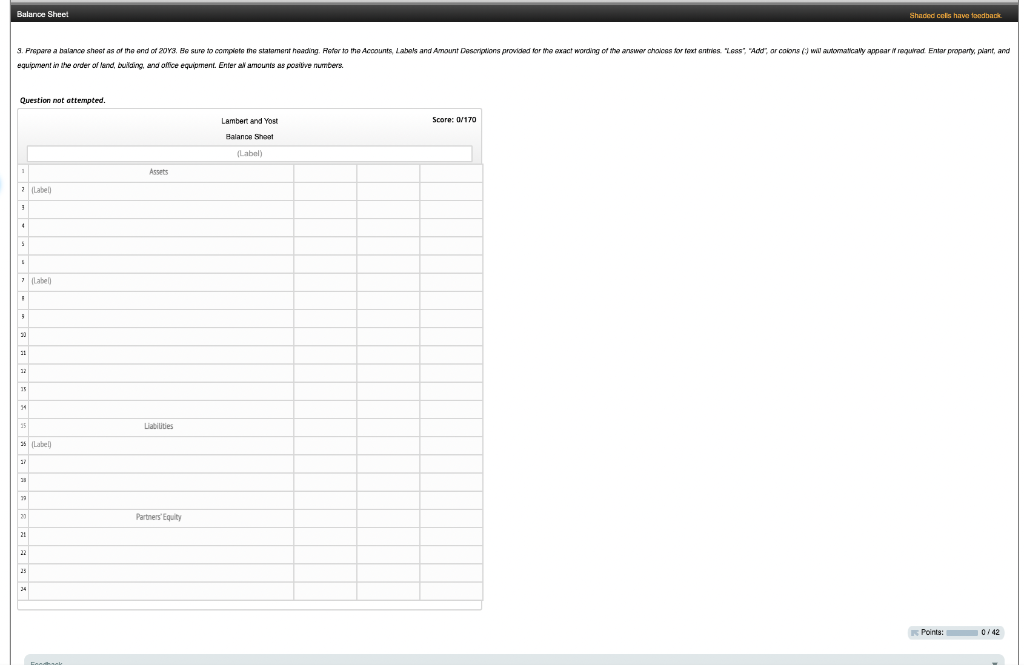

Instructions The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y3: Lambert and Yost ADJUSTED TRIAL BALANCE December 31, 20Y3 ACCOUNT TITLE DEBIT CREDIT 1 Cash 34,300.00 2 Accounts Receivable 48,300.00 3 Supplies 2,100.00 4 Land 119,900.00 157,900.00 5 Building 6 Accumulated Depreciation-Building 1 Office Equipment 66,800.00 63,700.00 8 Accumulated Depreciation Office Equipment 21,700.00 9 Accounts Payable 28,400.00 10 Salaries Payable 4,900.00 11 Tyler Lambert, Capital 135,500.00 12 Tyler Lambert, Drawing 50,200.00 13 Jayla Yost, Capital 87,700.00 14 Jayla Yost, Drawing 59,800.00 15 Professional Fees 396,900.00 16 Salary Expense 154,700.00 17 Depreciation Expense-Building 15,600.00 18 Property Tax Expense 12,300.00 19 Heating and Lighting Expense 9,000.00 20 Supplies Expense 5,600.00 21 Depreciation Expense-Office Equipment 5,300.00 22 Miscellaneous Expense 3,200.00 23 Totals 741,900.00 741,900.00 The balance in Yost's capital account includes an additional investment of $10,200 made on April 10, 20Y3. Required: 1. Prepare an income statement for 2073. Create a separate statement indicating the division of net income to the partners. The partnership agreement provides for salary allowances of $45,400 to Lambert and $54,600 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and equal division of the remaining net income or net loss. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Colons (c) will automatically appear if required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. 2. Prepare a statement of partnership equity for 20Y3. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. If a net loss is incurred or there is a decrease in partner's equity, enter that amount as a negative number using a minus sign. If an amount box does not require an entry, leave it blank. 3. Prepare a balance sheet as of the end of 20Y3. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. "Less", "Add", or colons (1) will automatically appear if required. Enter property, plant, and equipment in the order of land, building, and office equipment. Enter all amounts as positive numbers. Accounts, Labels and Amount Descriptions Accounts Labels Accounts payable Current assets Accounts receivable Current liabilities Accumulated depreciation-Building December 31, 20Y3 Accumulated depreciation Office equipment for the Year Ended December 31, 20Y3 Building Operating expenses Cash Property, plant, and equipment Depreciation expense-Building Depreciation expense-Office Equipment Heating and lighting expense Jayla Yost, capital Land Miscellaneous expense Office equipment Professional fees Property tax expense Salaries payable Salary expense Supplies Supplies expense Tyler Lambert, capital Amount Descriptions Add partner withdrawals Balance, December 31, 2093 Balance, January 1, 20Y3 Balances after realization Balances before realization Capital additions Partner withdrawals Net income Net loss Net income for the year Net loss for the year Payment of liabilities Sale of assets and division of gain Total assets Total current assets Total liabilities Total liabilities and partners' equity Total partners' equity Total Property, plant, and equipment Total operating expenses Income Statement and Allocation to Partners Shaded cells have feedback. 1. Prepare an income statement for 2073. Create a separate statement indicating the division of not come to the partners. The namership agreement provides for salary allowances of $45.400 to Lambert and $54,600 to Yost, allowances of 10% on each partner's capital balance at the beginning of the fiscal year, and Aqual vision of the remaining ner came or ser loss. Be sure to complete the statement heading Reler to me Accounts, Labals and Amount Descriptions provided for the exact wording of me answer choices for extenmes. Cons() will automatically appear it required. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Nat loss should be negative Expanses should be positive Score: 91/95 Lambert and Yast Income Statement Label 1 Professional fees $39690000 $154,700.00 15,600.00 12,300.00 2 Label 5 Salary expense Depreciation experbe Building 5 Property tax expense 6 Heating and lighting experte + Supplies mpense 3 Depreciation expense-Office Equipment Miscellaneous expense 9,000.00 5.600.00 5.300.00 3.200.00 to Total operating expenses 205,700.00 1 Net Income $191,200.00 K Paints: 21.07/22 Score: 19/42 Lamberland Yost Alocation of Net Income to Partners (Label) 1 Tyler Lambert Jayla Yos Total Division of net income 5 Salary allowance $45.400.00 554600.00 $100,000 DO 15.550.00 Interest allowance 5 Remaining income (111) Net income $191,200 DO Points: 5.28/13 Statement of Partnership Equity Shaded cells have feedback. 2. Prepare a statement of partnership equity for 20Y3. Be sure to complete the statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. If a net loss is incurred or there is a decrease in partner's equity, enter that amount as a negative number using a minus sign. If an amount box does not require an entry, leave it blank. Lambert and Yost Score: 13/86 Statement of Partnership Equity (Label) 1 Jayla Yost Total Tyler Lambert $135,500.00 2 3 10,200.00 10,200.00 4 5 Points: 0 3.02 / 20 Balance Sheet Shades colis have foedback 3. Prepare a balance sheer as or the end of 2013. Be sure to complete me statement heading. Refer to the Accounts, Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. "Less","Add", ar colors() will automatically appear if required Entar property, plant, and equipment in the order of land, building, and allice equipment. Enter al amounts positive numbers. Question not attempted Score: 0/170 Lambert and Yost Balance Shoot (Label) Assets ? Label 4 5 Label 11 12 Liabilities 35 Label 35 19 20 Partners' Equity 21 22 Points: 0/42