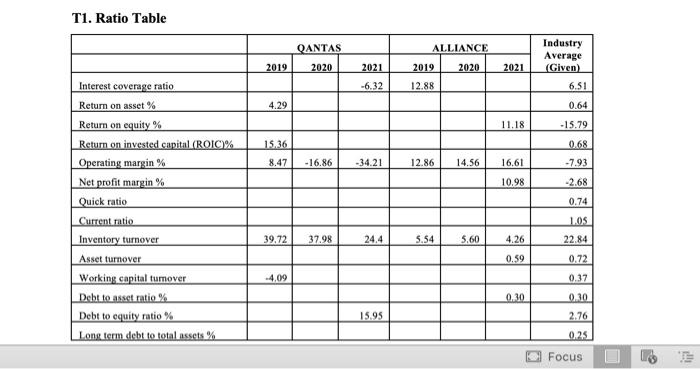

Instructions: The table below reports various financial ratios for two Australian Airlines; Qantas Airways, and Alliance Aviation Services for three years (2019, 2020, 2021). 1. From the given Annual Reports of the companies, and using the formulas provided, calculate and complete the ratio table below for the companies for the three years (2019, 2020, 2021). 2. From the ratios calculated in Q1, analyze the 'profitability' and 'efficiency' of the two companies for the relevant years (use three ratios each for profitability and efficiency). Consider industry averages when formulating your analysis. 3. If you were contemplating an investment in any of these two airline companies, identify| what other information (non-financial) would assist your investment decision and why this information (two) are important to you. Requirements: You will present in a clear and concise six to eight minute (6-8) video recording that includes an introduction, a completed ratio table, key analysis ('profitability' and 'efficiency ratios), nonfinancial factors and a conclusion. T1. Ratio Table Instructions: The table below reports various financial ratios for two Australian Airlines; Qantas Airways, and Alliance Aviation Services for three years (2019, 2020, 2021). 1. From the given Annual Reports of the companies, and using the formulas provided, calculate and complete the ratio table below for the companies for the three years (2019, 2020, 2021). 2. From the ratios calculated in Q1, analyze the 'profitability' and 'efficiency' of the two companies for the relevant years (use three ratios each for profitability and efficiency). Consider industry averages when formulating your analysis. 3. If you were contemplating an investment in any of these two airline companies, identify| what other information (non-financial) would assist your investment decision and why this information (two) are important to you. Requirements: You will present in a clear and concise six to eight minute (6-8) video recording that includes an introduction, a completed ratio table, key analysis ('profitability' and 'efficiency ratios), nonfinancial factors and a conclusion. T1. Ratio Table