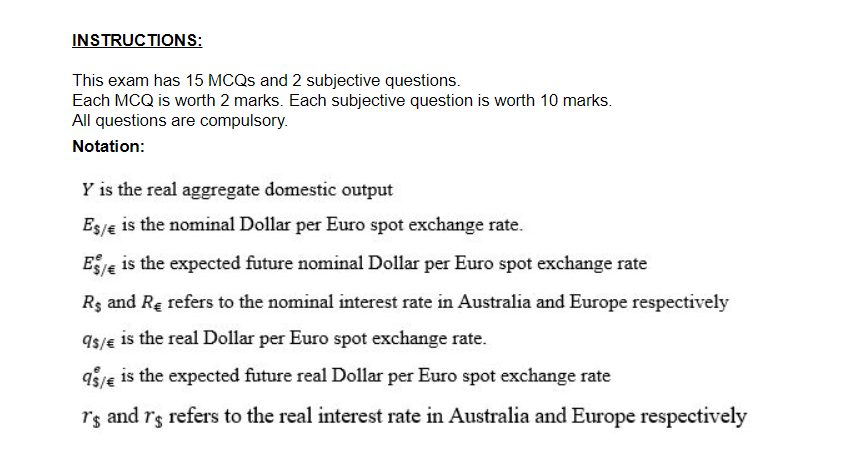

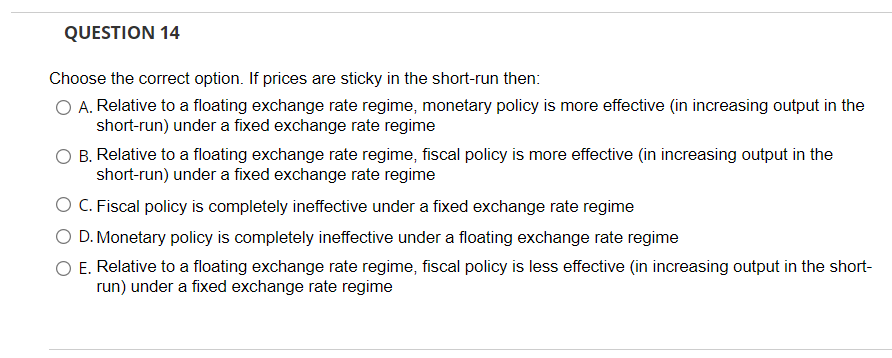

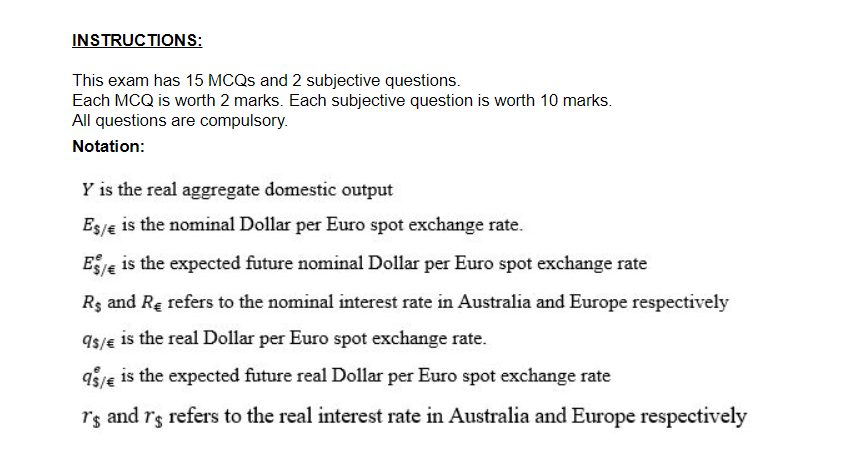

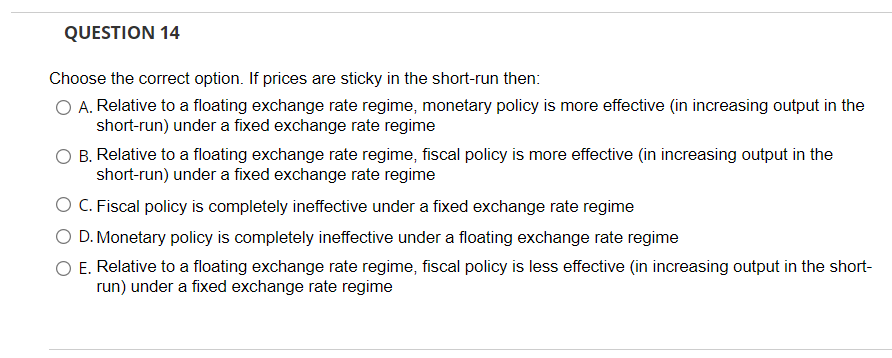

INSTRUCTIONS: This exam has 15 MCQs and 2 subjective questions. Each MCQ is worth 2 marks. Each subjective question is worth 10 marks. All questions are compulsory. Notation: Y is the real aggregate domestic output Es/ is the nominal Dollar per Euro spot exchange rate. Es is the expected future nominal Dollar per Euro spot exchange rate Rs and Re refers to the nominal interest rate in Australia and Europe respectively 95/ is the real Dollar per Euro spot exchange rate. 95/ is the expected future real Dollar per Euro spot exchange rate r's and r's refers to the real interest rate in Australia and Europe respectively QUESTION 14 Choose the correct option. If prices are sticky in the short-run then: A. Relative to a floating exchange rate regime, monetary policy is more effective (in increasing output in the short-run) under a fixed exchange rate regime B. Relative to a floating exchange rate regime, fiscal policy is more effective (in increasing output in the short-run) under a fixed exchange rate regime C. Fiscal policy is completely ineffective under a fixed exchange rate regime D. Monetary policy is completely ineffective under a floating exchange rate regime E. Relative to a floating exchange rate regime, fiscal policy is less effective (in increasing output in the short- run) under a fixed exchange rate regime INSTRUCTIONS: This exam has 15 MCQs and 2 subjective questions. Each MCQ is worth 2 marks. Each subjective question is worth 10 marks. All questions are compulsory. Notation: Y is the real aggregate domestic output Es/ is the nominal Dollar per Euro spot exchange rate. Es is the expected future nominal Dollar per Euro spot exchange rate Rs and Re refers to the nominal interest rate in Australia and Europe respectively 95/ is the real Dollar per Euro spot exchange rate. 95/ is the expected future real Dollar per Euro spot exchange rate r's and r's refers to the real interest rate in Australia and Europe respectively QUESTION 14 Choose the correct option. If prices are sticky in the short-run then: A. Relative to a floating exchange rate regime, monetary policy is more effective (in increasing output in the short-run) under a fixed exchange rate regime B. Relative to a floating exchange rate regime, fiscal policy is more effective (in increasing output in the short-run) under a fixed exchange rate regime C. Fiscal policy is completely ineffective under a fixed exchange rate regime D. Monetary policy is completely ineffective under a floating exchange rate regime E. Relative to a floating exchange rate regime, fiscal policy is less effective (in increasing output in the short- run) under a fixed exchange rate regime