Instructions Use the provided Excel template to submit your responses to each of the study problems from the textbook below: 313, p. 73. Reviewing financial statements 315, p. 74. Analyzing the cash flow statement 425, p. 118. Calculating financial ratios Each question has a corresponding worksheet (look for the tab along the bottom of the workbook). The cells can be adjusted, added, or removed as necessary.

Instructions Use the provided Excel template to submit your responses to each of the study problems from the textbook below: 313, p. 73. Reviewing financial statements 315, p. 74. Analyzing the cash flow statement 425, p. 118. Calculating financial ratios Each question has a corresponding worksheet (look for the tab along the bottom of the workbook). The cells can be adjusted, added, or removed as necessary.

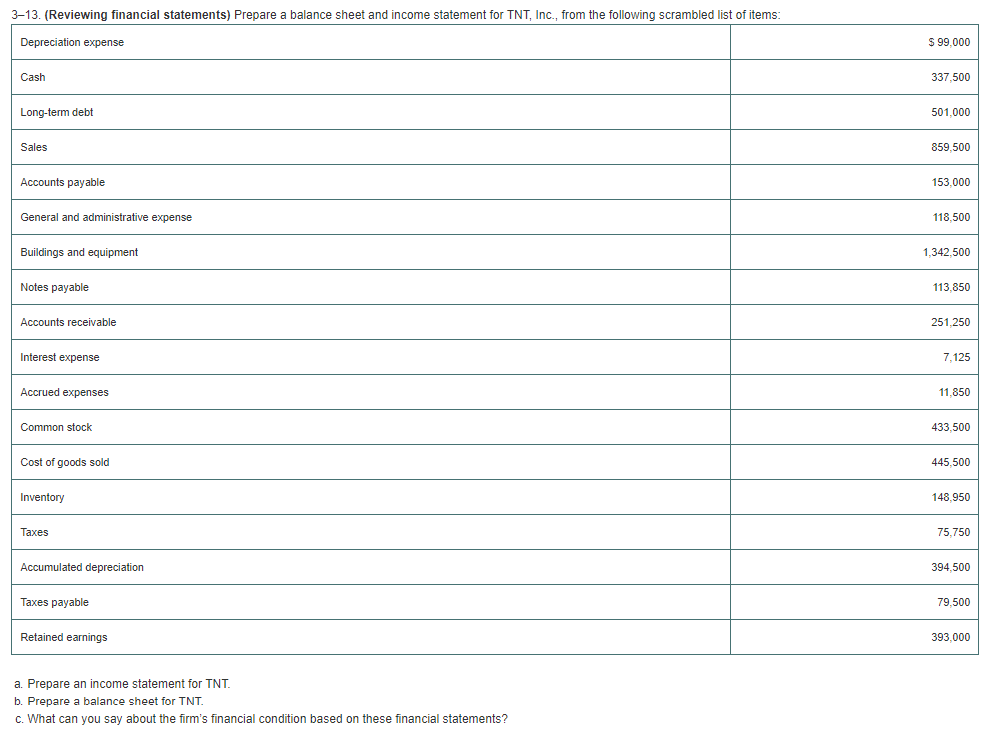

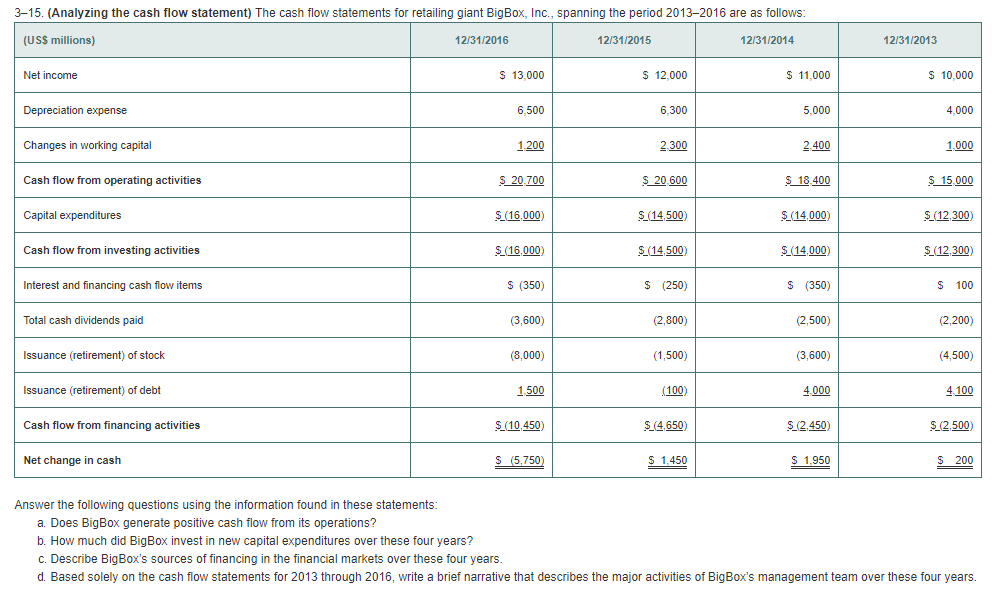

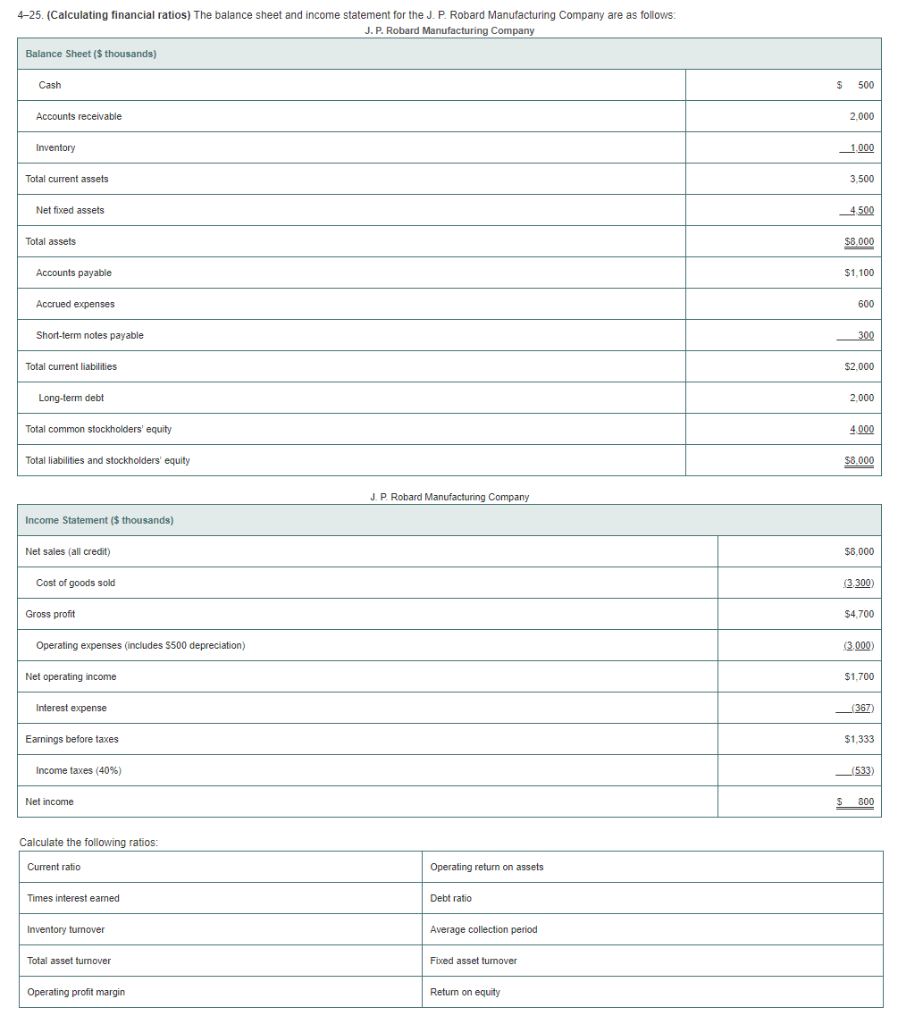

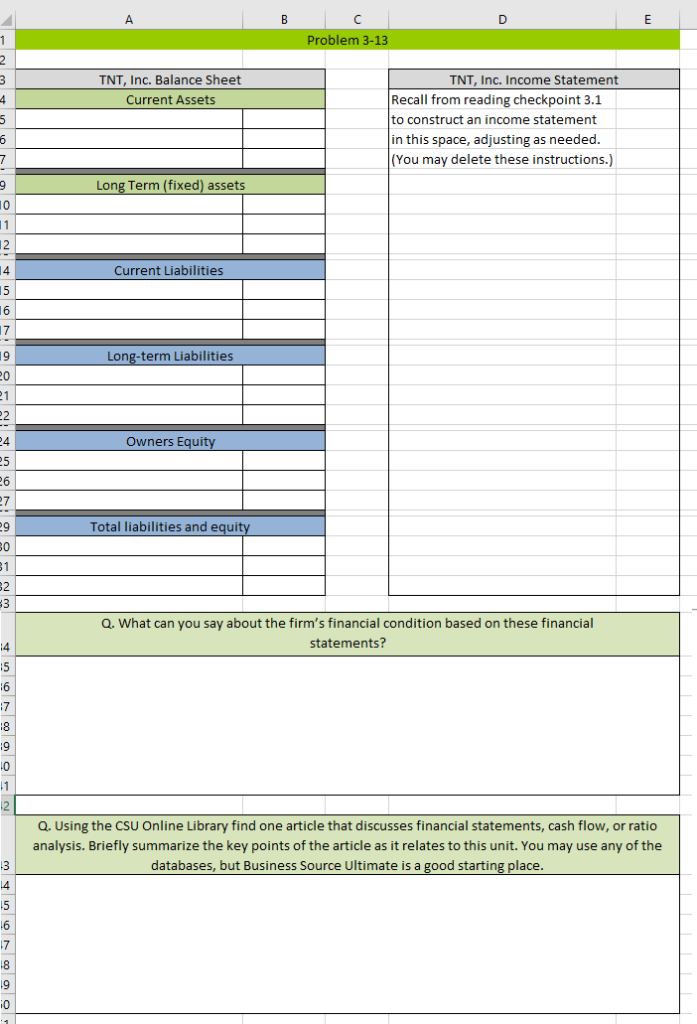

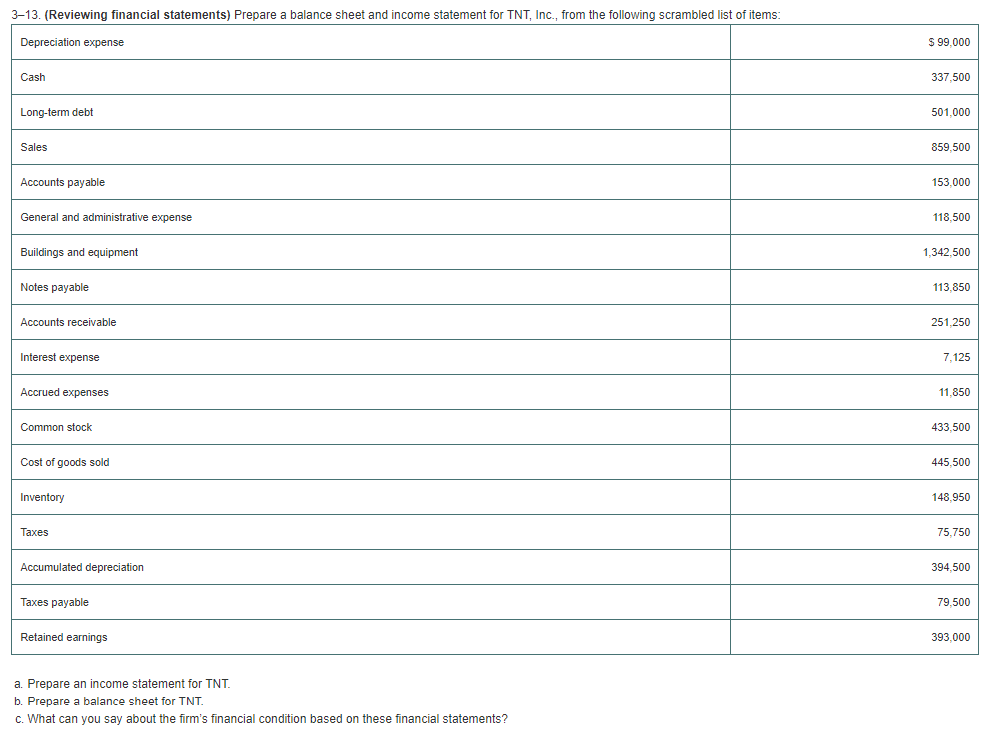

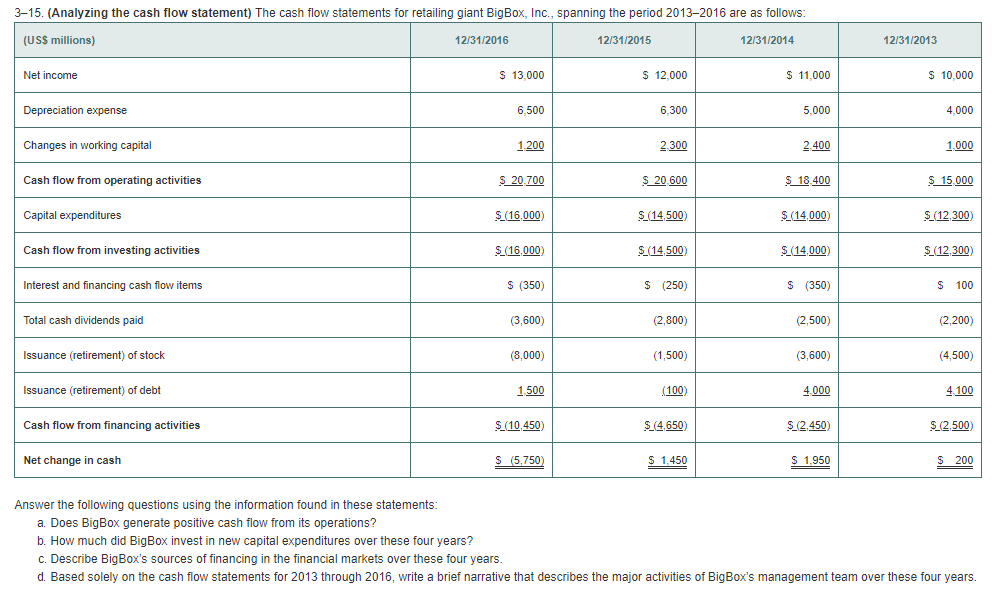

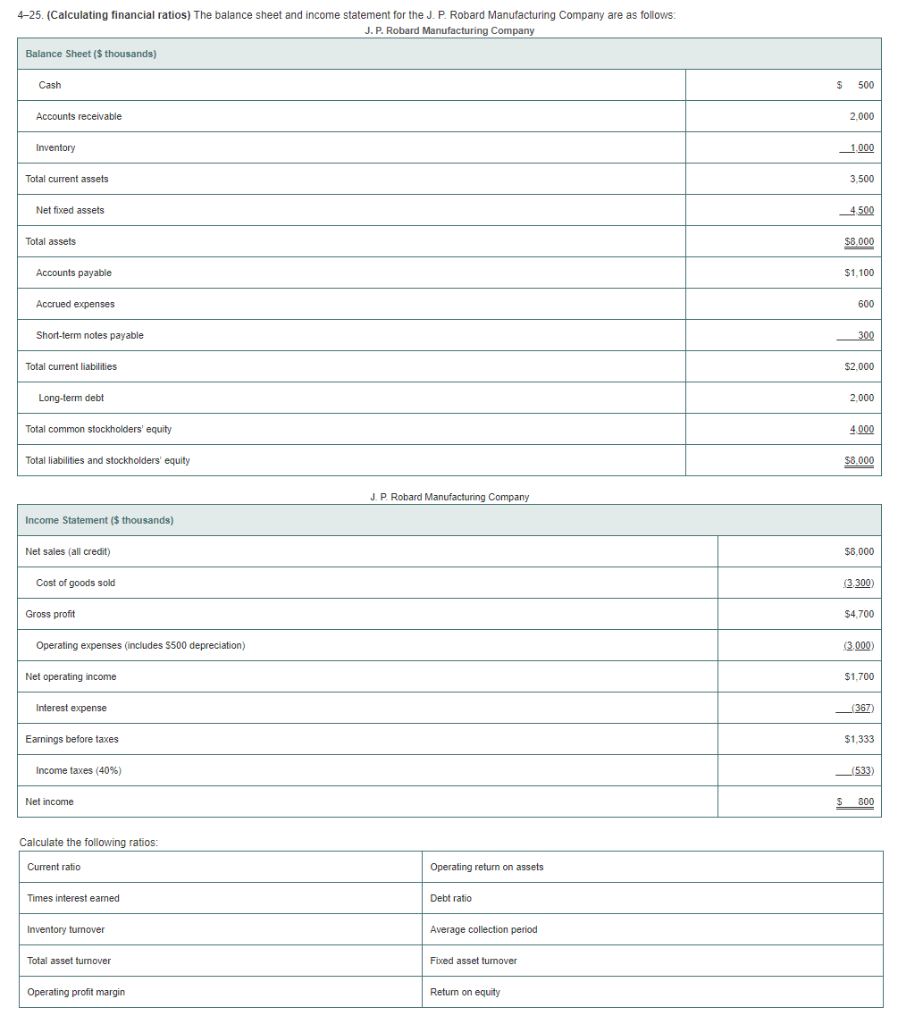

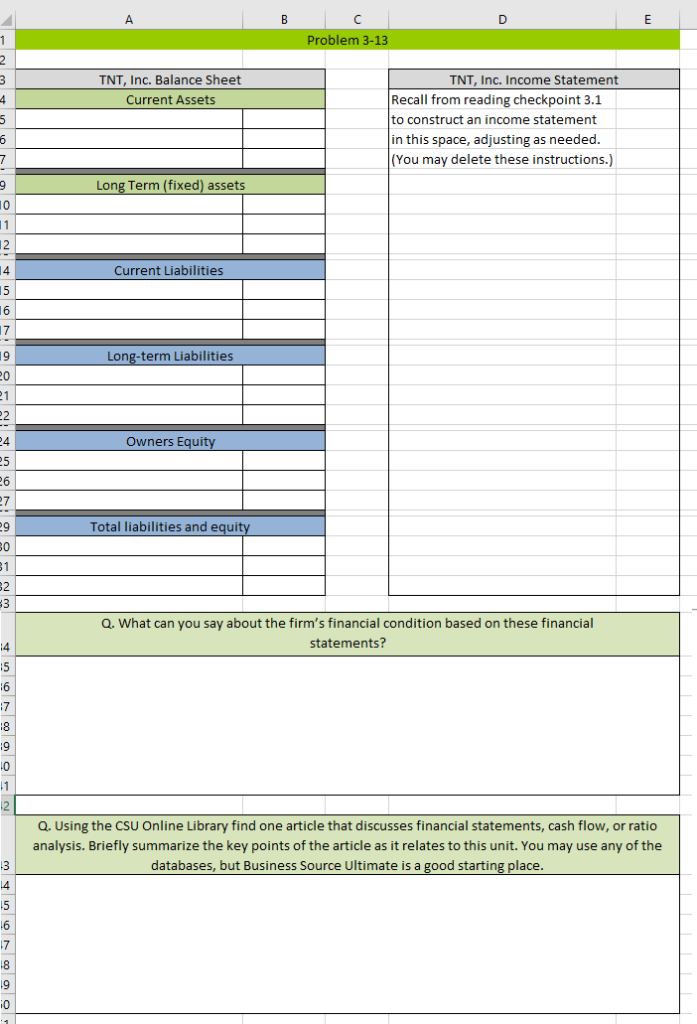

3-13. (Reviewing financial statements) Prepare a balance sheet and income statement for TNT, Inc., from the following scrambled list of items Depreciation expense 99,000 Cash 337,500 501,000 Long-term debt 859,500 Sales Accounts payable General and administrative expense Buildings and equipment Notes payable 153,000 118,500 1,342,500 113,850 Accounts receivable 251,250 7.125 Interest expense Accrued expenses 11,850 Common stock 433,500 Cost of goods sold 445,500 Inventory 148,950 75,750 Taxes Accumulated depreciation Taxes payable Retained earnings 394,500 79,500 393,000 a. Prepare an income statement for TNT b. Prepare a balance sheet for TNT C. What can you say about the firm's financial condition based on these financial statements? 3-15. (Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc., spanning the period 2013-2016 are as follows (USS millions) 12/31/2016 12/31/2015 12/31/2014 12/31/2013 12,000 10,000 Net income S 13,000 S 11,000 6.300 5,000 4.000 Depreciation expense Changes in working capital Cash flow from operating activities Capital expenditures Cash flow from investing activities Interest and financing cash flow items Total cash dividends paid Issuance (retirement) of stock Issuance (retirement) of debt Cash flow from financing activities Net change in cash 6,500 2 400 1200 S20,700 $ (16,000) $ (16,000) S (350) 2300 1.000 $20,600 $18.400 $15,000 $ (14 500) $ (14 500) S (250) $ (14,000) $ (14,000) S (350) $ (12,300) $ (12,300) S 100 (3,600) (8,000) 1.500 $ (10 450) S (5,750 (2,800) (1,500) 100) $ 4,650) (2,500) (2,200) (4,500) 4100 $ (2,500) (3,600) 4.000 $ (2 450) S 200 Answer the following questions using the information found in these statements a. Does BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over these four years? C. Describe BigBox's sources of financing in the financial markets over these four years d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over these four years. 4-25. (Calculating financial ratios) The balance sheet and income statement for the J. P. Robard Manufacturing Company are as follows J. P. Robard Manufacturing Company Balance Sheet ($ thousands) $ 500 Cash Accounts receivable 2.000 Inventory 1.000 3,500 Total current assets Net fixed assets 4 500 Total assets 58,000 Accounts payable $1,100 Accrued expenses 600 Short-term notes payable Total current liabilities $2,000 2,000 Long-term debt Total common stockholders' equity 4.000 $8,000 Total liabilities and stockholders' equity J. P Robard Manufacturing Company Income Statement ($ thousands) Net sales (all credit) $8,000 Cost of goods sold 3300) $4,700 3,000) Gross profit Operating expenses (includes S500 depreciation) $1,700 Net operating income Interest expense (367) Earnings before taxes $1,333 Income taxes (40%) 533) Net income Calculate the following ratios Current ratio Operating return on assets Times interest eamed Debt ratio Inventory turnover Average collection period Total asset turnover Fixed asset turnover Operating profit margin Retum on equity ble TNT, Inc. Balance Sheet Current Assets TNT, Inc. Income Statement Recall from reading checkpoint 3.1 to construct an income statement in this space, adjusting as needed (You may delete these instructions.) Long Term (fixed) assets 4 5 6 7 19 Current Liabilities Long-term Liabilities 2 Owners Equity 4 6 Total liabilities and equity_ 32 Q. What can you say about the firm's financial condition based on these financial statements? 6 Q. Using the CSU Online Library find one article that discusses financial statements, cash flow, or ratio analysis. Briefly summarize the key points of the article as it relates to this unit. You may use any of the databases, but Business Source Ultimate is a good starting place. 13 3-13. (Reviewing financial statements) Prepare a balance sheet and income statement for TNT, Inc., from the following scrambled list of items Depreciation expense 99,000 Cash 337,500 501,000 Long-term debt 859,500 Sales Accounts payable General and administrative expense Buildings and equipment Notes payable 153,000 118,500 1,342,500 113,850 Accounts receivable 251,250 7.125 Interest expense Accrued expenses 11,850 Common stock 433,500 Cost of goods sold 445,500 Inventory 148,950 75,750 Taxes Accumulated depreciation Taxes payable Retained earnings 394,500 79,500 393,000 a. Prepare an income statement for TNT b. Prepare a balance sheet for TNT C. What can you say about the firm's financial condition based on these financial statements? 3-15. (Analyzing the cash flow statement) The cash flow statements for retailing giant BigBox, Inc., spanning the period 2013-2016 are as follows (USS millions) 12/31/2016 12/31/2015 12/31/2014 12/31/2013 12,000 10,000 Net income S 13,000 S 11,000 6.300 5,000 4.000 Depreciation expense Changes in working capital Cash flow from operating activities Capital expenditures Cash flow from investing activities Interest and financing cash flow items Total cash dividends paid Issuance (retirement) of stock Issuance (retirement) of debt Cash flow from financing activities Net change in cash 6,500 2 400 1200 S20,700 $ (16,000) $ (16,000) S (350) 2300 1.000 $20,600 $18.400 $15,000 $ (14 500) $ (14 500) S (250) $ (14,000) $ (14,000) S (350) $ (12,300) $ (12,300) S 100 (3,600) (8,000) 1.500 $ (10 450) S (5,750 (2,800) (1,500) 100) $ 4,650) (2,500) (2,200) (4,500) 4100 $ (2,500) (3,600) 4.000 $ (2 450) S 200 Answer the following questions using the information found in these statements a. Does BigBox generate positive cash flow from its operations? b. How much did BigBox invest in new capital expenditures over these four years? C. Describe BigBox's sources of financing in the financial markets over these four years d. Based solely on the cash flow statements for 2013 through 2016, write a brief narrative that describes the major activities of BigBox's management team over these four years. 4-25. (Calculating financial ratios) The balance sheet and income statement for the J. P. Robard Manufacturing Company are as follows J. P. Robard Manufacturing Company Balance Sheet ($ thousands) $ 500 Cash Accounts receivable 2.000 Inventory 1.000 3,500 Total current assets Net fixed assets 4 500 Total assets 58,000 Accounts payable $1,100 Accrued expenses 600 Short-term notes payable Total current liabilities $2,000 2,000 Long-term debt Total common stockholders' equity 4.000 $8,000 Total liabilities and stockholders' equity J. P Robard Manufacturing Company Income Statement ($ thousands) Net sales (all credit) $8,000 Cost of goods sold 3300) $4,700 3,000) Gross profit Operating expenses (includes S500 depreciation) $1,700 Net operating income Interest expense (367) Earnings before taxes $1,333 Income taxes (40%) 533) Net income Calculate the following ratios Current ratio Operating return on assets Times interest eamed Debt ratio Inventory turnover Average collection period Total asset turnover Fixed asset turnover Operating profit margin Retum on equity ble TNT, Inc. Balance Sheet Current Assets TNT, Inc. Income Statement Recall from reading checkpoint 3.1 to construct an income statement in this space, adjusting as needed (You may delete these instructions.) Long Term (fixed) assets 4 5 6 7 19 Current Liabilities Long-term Liabilities 2 Owners Equity 4 6 Total liabilities and equity_ 32 Q. What can you say about the firm's financial condition based on these financial statements? 6 Q. Using the CSU Online Library find one article that discusses financial statements, cash flow, or ratio analysis. Briefly summarize the key points of the article as it relates to this unit. You may use any of the databases, but Business Source Ultimate is a good starting place. 13

Instructions Use the provided Excel template to submit your responses to each of the study problems from the textbook below: 313, p. 73. Reviewing financial statements 315, p. 74. Analyzing the cash flow statement 425, p. 118. Calculating financial ratios Each question has a corresponding worksheet (look for the tab along the bottom of the workbook). The cells can be adjusted, added, or removed as necessary.

Instructions Use the provided Excel template to submit your responses to each of the study problems from the textbook below: 313, p. 73. Reviewing financial statements 315, p. 74. Analyzing the cash flow statement 425, p. 118. Calculating financial ratios Each question has a corresponding worksheet (look for the tab along the bottom of the workbook). The cells can be adjusted, added, or removed as necessary.