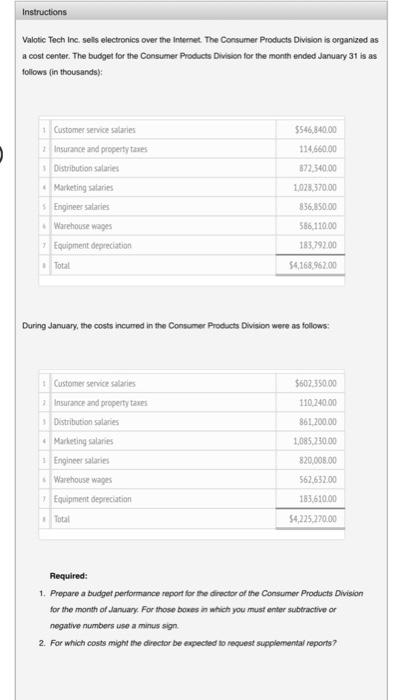

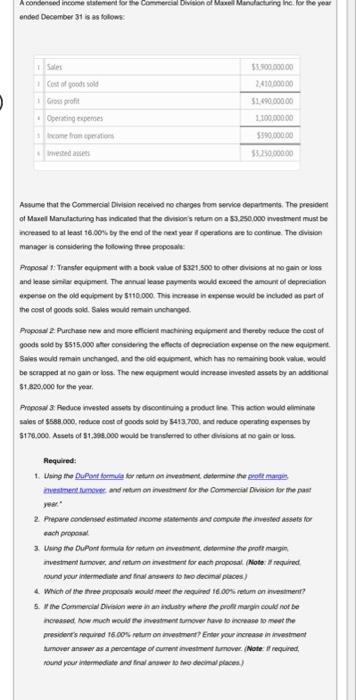

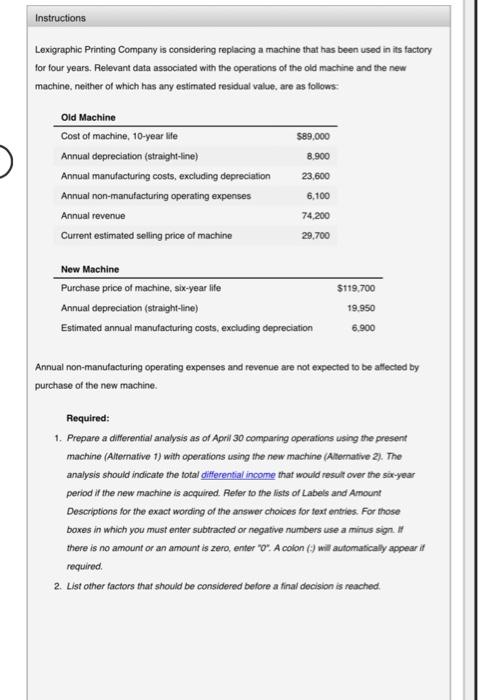

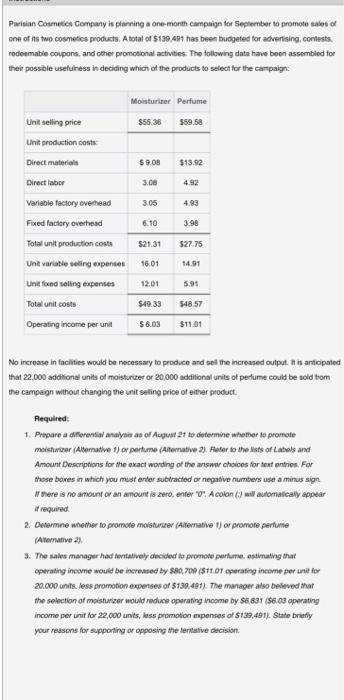

Instructions Valotic Tech Inc. sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended January 31 is as foliows (in thousands) . 5546,840.00 114,660.00 372,340.00 Customer service salaries Insurance and property taxes Distribution salaries Marketing staries Engineer salaries Warehouse wages Equipment depreciation 1,028,370.00 856.650.00 586.110,00 183.792.00 Total 54,168,962.00 During January, the costs incurred in the Consumer Products Division were as follows: $602.350.00 110.240,00 861,200.00 1,085.230.00 Customer service salaries Insurance and property taxes Distribution salaries Marketing salaries 1 Engineer salaries Warehouse wages Equipment depreciation Total 820,000.00 562.632.00 183.610.00 54,225.270.00 Required: 1. Prepare a budget performance report for the director of the Consumer Products Division for the month of January. For those boxes in which you must enter subtractive or negative numbers use a minus sign 2. For which costs might the director be expected to request supplemental reports A condensed income statement for the Commercial Division of Mel Manufacturing Inc. For the your ended December 31 is as follows: I sures Cost of goods sold Gross profit Operating peres become from 33.000.000.00 2.410.000.00 $1490.000.00 1100.000,00 $390,000.00 53.250,000.00 Assume that the Commercial Division received no charges from service departments. The president of Maxell Marutacturing has indicated that the division's return on a 53.250,000 nvestment must be noreased to at least 16.00% by the end of the next year i perators we to continue. The division manager is considering the following three proposal Proposal : Transfer equipment with a book value of 5321.500 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $110.000. This increase inexpense would be included as part of the cost of goods solid. Sales would remain unchanged Proposal 2 Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by 5515.000 ser considering the elects of depreciation expense on the new equipment Sales would remain unchanged, and the old equipment which has no remaining book value would be scrapped at no gain or loss. The new coupment would increase invested assets by an additional $1.820.000 for the year Proposa 3. Reduce mested asset by discontinung a product in This action would eliminate sales of $588.000. reduce cost of goods sold by 5493.700 and reduce operating expenses by $170.000. Assets of 51.390.000 would be transferred to other sons at no gain cross Required: 1. Using the DuPont formula for return on investiment determine the profit mangis inst more and return on investment for the Commercial Division for the past year 2. Prepare condensed estimated income statements and compute the invested assets for cach viet na a ning the DuPont formula for return on investment dietermine the proteger Investment humover, and retum on investment for each proposal Note: required round your intermediate and find answers to the decimal places) 4. Which of the three proposals would meet the required 18.00 retom on vastent? 5. the Commercial Division were in an industry where the profil margin could not be resse, how much would the most fumover have to increase to meet the president's required 16.00 rum on investment?Enter your increase in investment tumover answer as a percentage of current investment humover. Note: If required round your intermediate and final a lo lo decimal places! Instructions a Lexigraphic Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows Old Machine Cost of machine, 10-year life Annual depreciation (straight-line) Annual manufacturing costs, excluding depreciation Annual non-manufacturing operating expenses Annual revenue Current estimated selling price of machine $89,000 8.900 23,600 6.100 74.200 29,700 New Machine Purchase price of machine, six-year life Annual depreciation (straight-line) Estimated annual manufacturing costs, excluding depreciation $119,700 19.950 6.900 Annual non-manufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of April 30 comparing operations using the present machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis should indicate the total differential income that would result over the sa-year period if the new machine is acquired. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign 11 there is no amount or an amount is zero, enter "o". A colon () will automatically appear it required. 2. List other factors that should be considered before a final decision is reached Parisian Cosmetics Company is planning a one-morth campaign tot September to promote sales of one of its two cosmetics products. A total of $139,491 has been budgeted for advertising contests redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign Moisturizer Perfume $56.36 $59.58 Unit selling price Unit production cost Direct material $9.08 $13.92 Direct labor 3.08 4.92 Variable factory overhead 3.05 4.93 6.10 3.98 $21.31 $27.75 16.01 14.01 Fixed factory overhead Total unit production costs Unit variable seting expenses Unit fixed selling expenses Total unit com Operating income per unit 12.01 5.91 $49.33 $8.03 548.57 $11.01 No increase in facilities would be necessary to produce and sell the increased output. It is antiopated that 22,000 additional units of moisturizer or 20,000 additional units of perfume could be sold tom the campagn without changing the unit seling price of either product Required: 1. Prepare a differential analysis of August 21 to determine wheter to promote moisturizer (Alternative 1) or perfume (Alternative 2). Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For these boxes in which you must enter subtracted or negative numbers use a minus sign there is no amount or an amount is zero, enter "o". Acolon () will automatically appear if required 2. Determine whether to promote moisture (Aternativo 1) or promote perfume (Alternative 23 3. The sales manager had feritatively decided to promote perfume, estrating that Operating income would be increased by $80.700 ($11.1 operating income per unit for 20.000 units less promotion expenses of $139,491). The manager also believed that the selection of moisturizer would reduce operating income by 56.831 ($6.03 operating income per unit for 22,000 units, less promotion expenses of $139,491). State briefly your reasons for supporting or opposing the tentative decision