Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Wes Bauman is the head of fulfillment for a venture-backed startup company called Foodie, Inc Wes's annual salary is $110,000, but after personal

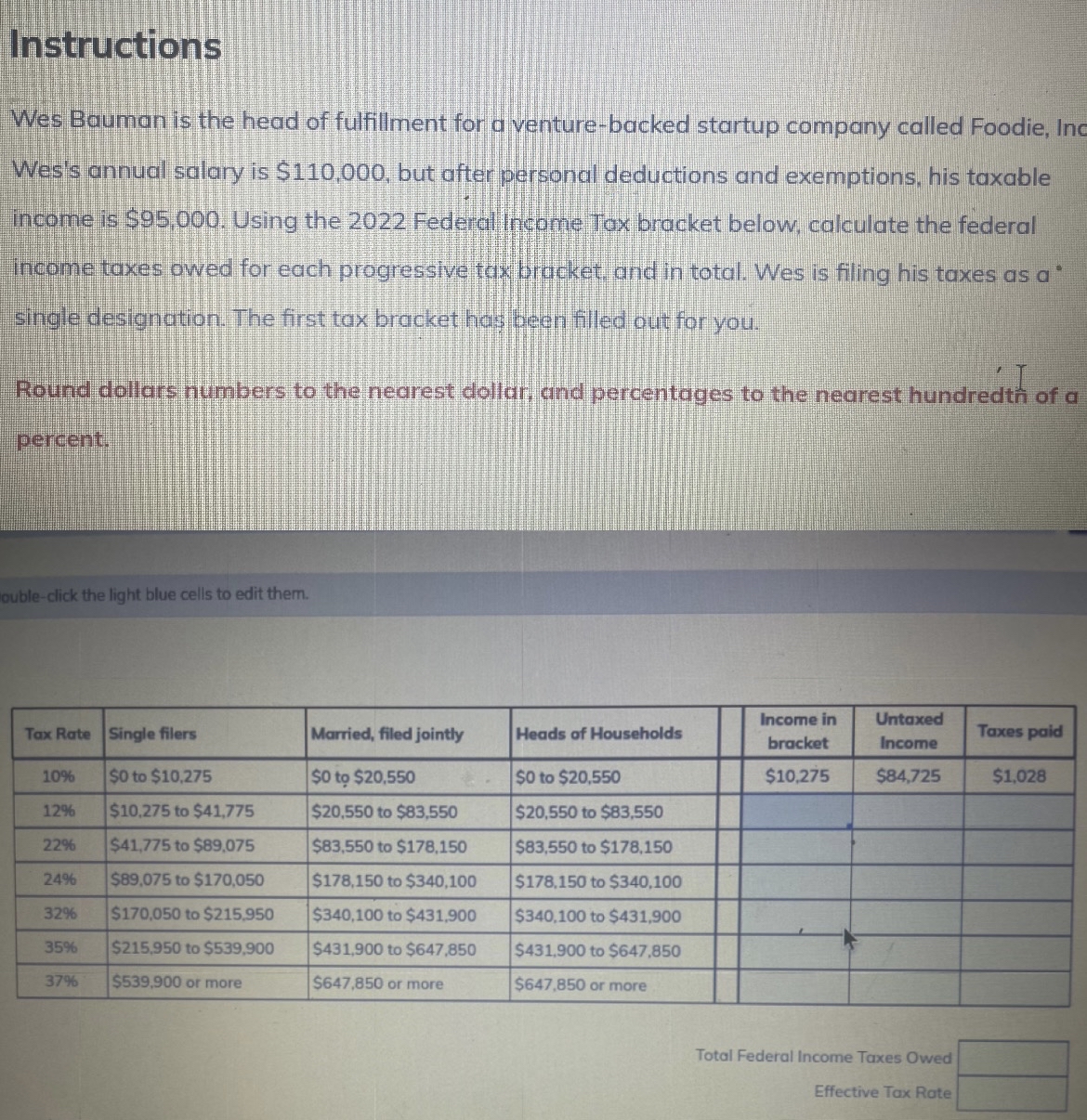

Instructions Wes Bauman is the head of fulfillment for a venture-backed startup company called Foodie, Inc Wes's annual salary is $110,000, but after personal deductions and exemptions, his taxable income is $95,000. Using the 2022 Federal Income Tax bracket below, calculate the federal income taxes owed for each progressive tax bracket, and in total. Wes is filing his taxes as a single designation. The first tax bracket has been filled out for you. Round dollars numbers to the nearest dollar, and percentages to the nearest hundredth of a percent. ouble-click the light blue cells to edit them. Tax Rate Single filers 10% $0 to $10,275 Married, filed jointly $0 to $20,550 Heads of Households Income in bracket Untaxed Income Taxes paid 12% $10,275 to $41,775 22% 24% 32% 35% 37% $41,775 to $89,075 $89,075 to $170,050 $170,050 to $215,950 $215,950 to $539,900 $539,900 or more $20,550 to $83,550 $83,550 to $178,150 $178,150 to $340,100 $340,100 to $431,900 $431,900 to $647,850 $647,850 or more $0 to $20,550 $20,550 to $83,550 $83,550 to $178,150 $178,150 to $340,100 $340,100 to $431,900 $431,900 to $647,850 $647,850 or more $10,275 $84,725 $1,028 Total Federal Income Taxes Owed Effective Tax Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started