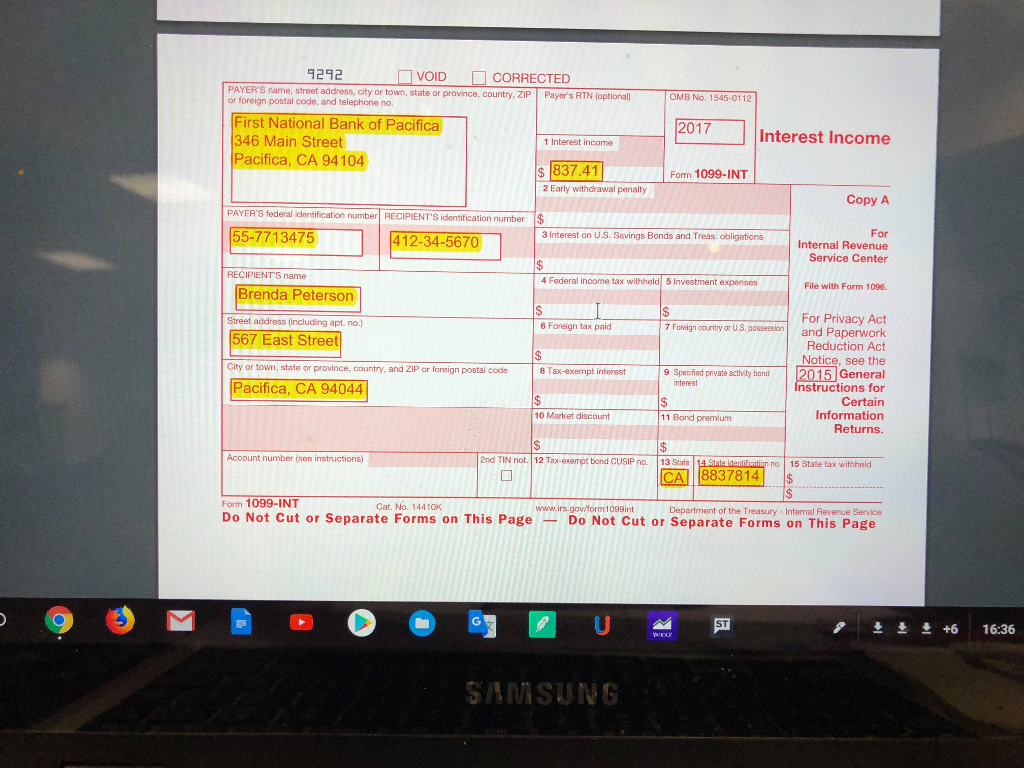

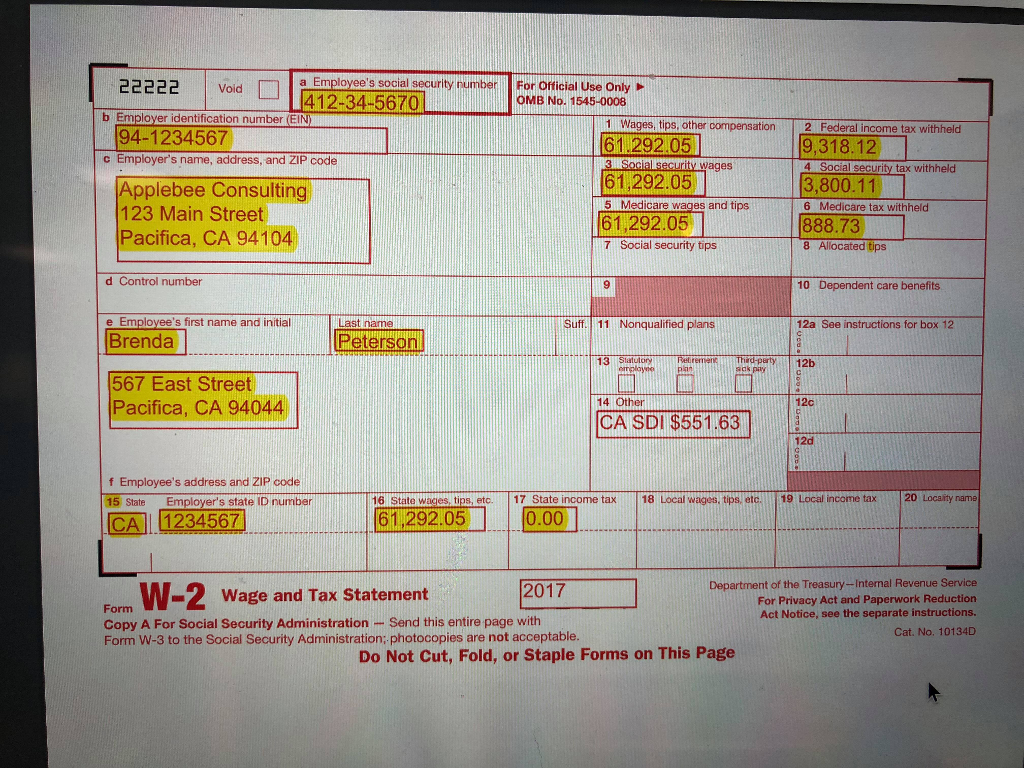

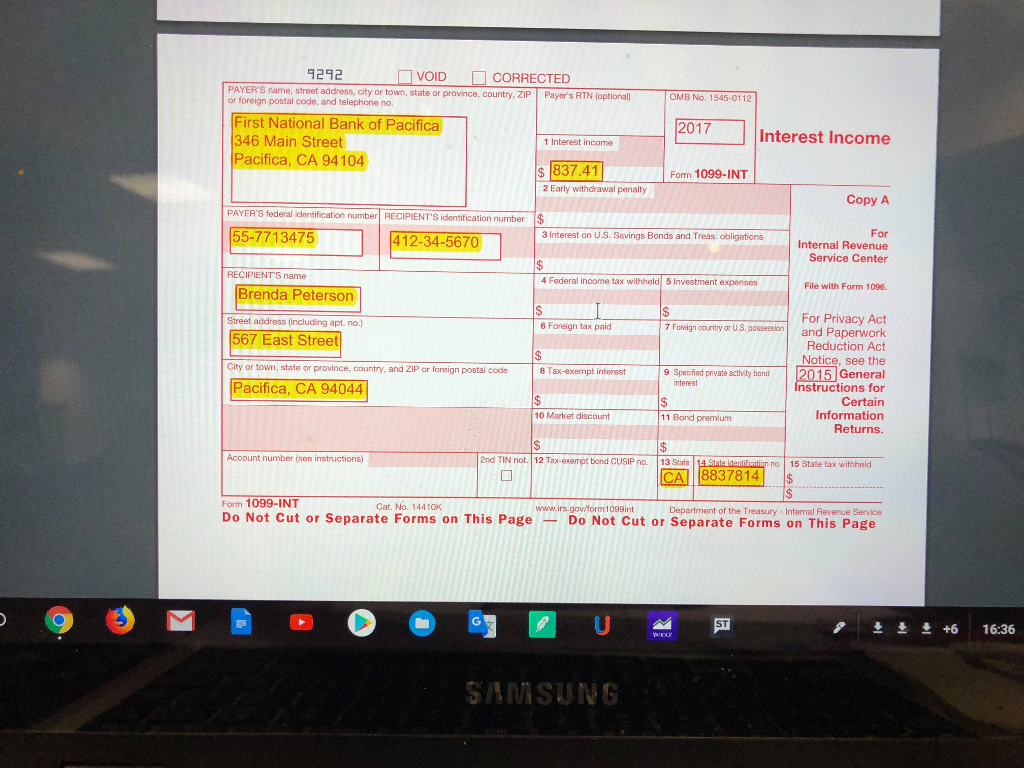

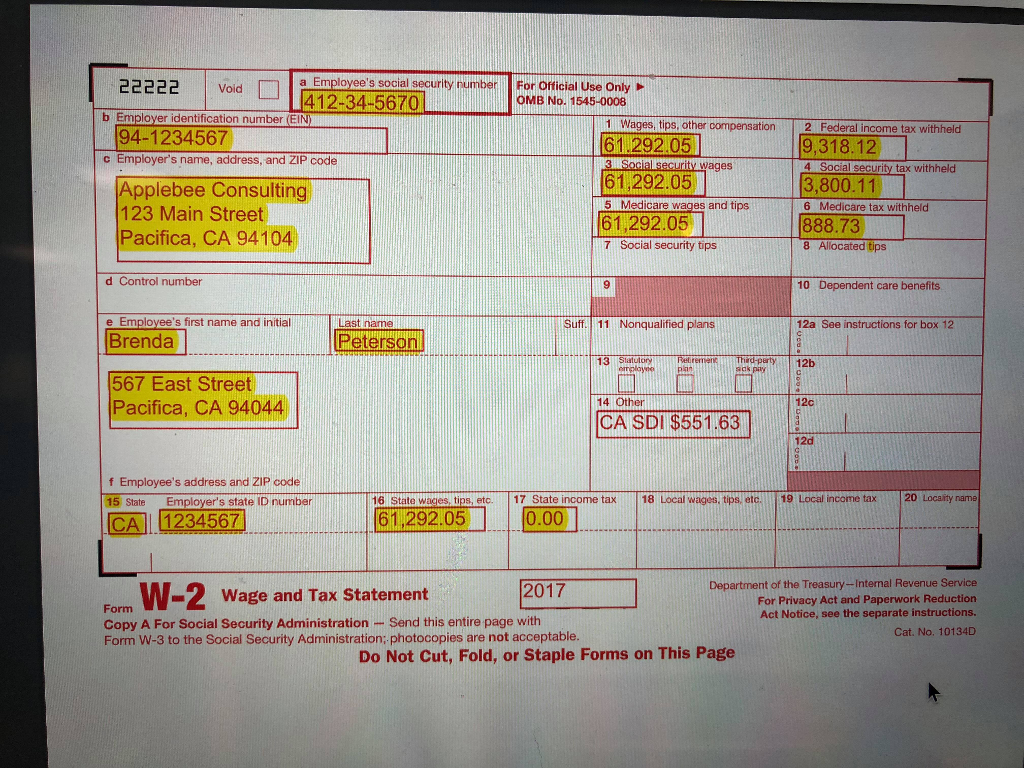

Instructions: Without using a tax software program, prepare the tax returns using form 1040EZ (federal) & 540-2EZ (California) for this problem. Staple the federal and California returns together, with the federal return at the top, and submit the paper copy of these returns in class by January 31, 2018. Do not e-mail these returns to the instructor. State your name as the paid tax preparer. Tax Return Problem Brenda Peterson is single, date of birth is March 1, 1987, and lives at 567 East Street, Pacifica, CA 94044. Her SSN is 412-34-5670. She worked the entire year for Applebee Consulting as a consultant in Pacifica. She has enclosed her form W-2 and one form 1099-INT. Brenda had qualifying health coverage for every month of 2017 and lives with her uncle without paying rent.

9292 VOID PAYER'S name, street address, city or town, state or province or foreign postal code, and telephone no. CORRECTED , country, ZIP Payer's RTN (optional) t OMB No. 1545-0112 First National Bank of Pacific 346 Main Street Pacifica, CA 94104 2017 Interest Income 1 Interest income $837.41 2 Early withdrawal penalty Form 1099-INT Copy A ER'S federal identification number RECIPIENT'S identification number 55-7713475 3 For Internal Revenue Service Center Interest on U.S. Savings Bonds and Treas. obligations 412-34-5670 RECIPIENTS name 4 Federal income tax 5 Investment expenses File with Form 1096 Brenda Peterson Street address (including apt. no.) 567 East Street City or towm, state or province, country, and ZIP or foreign postal code For Privacy Act Foreign country or U.S. possessinand Paperwork Reduction Act Notice, see the 5 General nstructions for Certain Information Returns 6 Foreign tax paid 8 Tax-exempt interest 9 Speafied private activity bond 2015 Pacifica, CA 94044 nterest 10 Market discount 11 Bond premium Account number (see instructions) 2nd TIN not. 12 Tax-exampt bond CUSIP no. 13 Staia no 15 State tax withheld 8837814$ Form 1099-INT Do Not Cut or Separate Forms on This PageDo Not Cut or Separate Forms on This Page Cat. No. 14410K www.irs.gov/form 1099int Department of the Treasury Internal Revenue Service ST -- +6 16:36 SAMSUNG 9292 VOID PAYER'S name, street address, city or town, state or province or foreign postal code, and telephone no. CORRECTED , country, ZIP Payer's RTN (optional) t OMB No. 1545-0112 First National Bank of Pacific 346 Main Street Pacifica, CA 94104 2017 Interest Income 1 Interest income $837.41 2 Early withdrawal penalty Form 1099-INT Copy A ER'S federal identification number RECIPIENT'S identification number 55-7713475 3 For Internal Revenue Service Center Interest on U.S. Savings Bonds and Treas. obligations 412-34-5670 RECIPIENTS name 4 Federal income tax 5 Investment expenses File with Form 1096 Brenda Peterson Street address (including apt. no.) 567 East Street City or towm, state or province, country, and ZIP or foreign postal code For Privacy Act Foreign country or U.S. possessinand Paperwork Reduction Act Notice, see the 5 General nstructions for Certain Information Returns 6 Foreign tax paid 8 Tax-exempt interest 9 Speafied private activity bond 2015 Pacifica, CA 94044 nterest 10 Market discount 11 Bond premium Account number (see instructions) 2nd TIN not. 12 Tax-exampt bond CUSIP no. 13 Staia no 15 State tax withheld 8837814$ Form 1099-INT Do Not Cut or Separate Forms on This PageDo Not Cut or Separate Forms on This Page Cat. No. 14410K www.irs.gov/form 1099int Department of the Treasury Internal Revenue Service ST -- +6 16:36 SAMSUNG