Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Write True if the statement is true. Write False if the statement if false, if false write the word/words that makes the statement false.

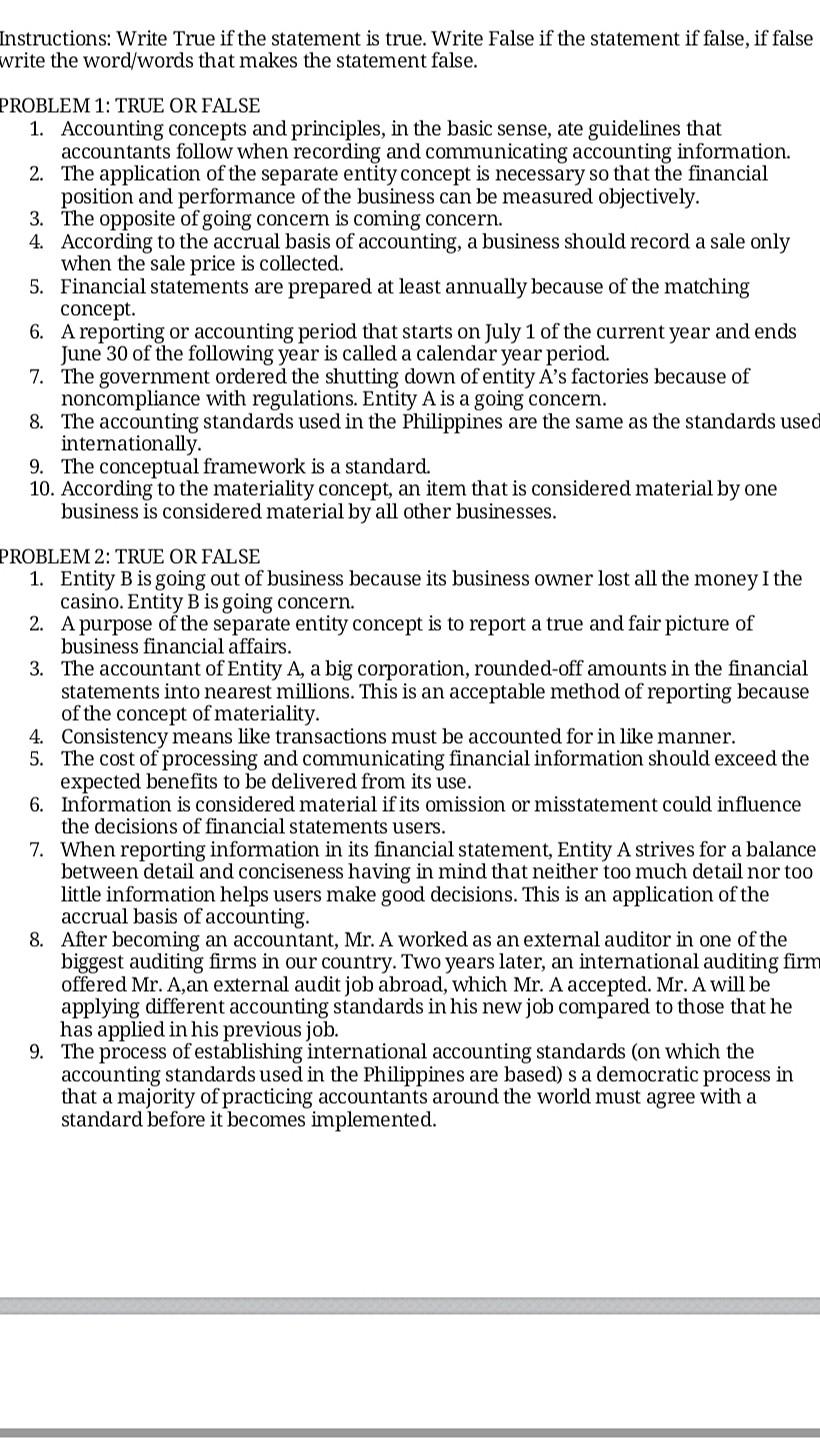

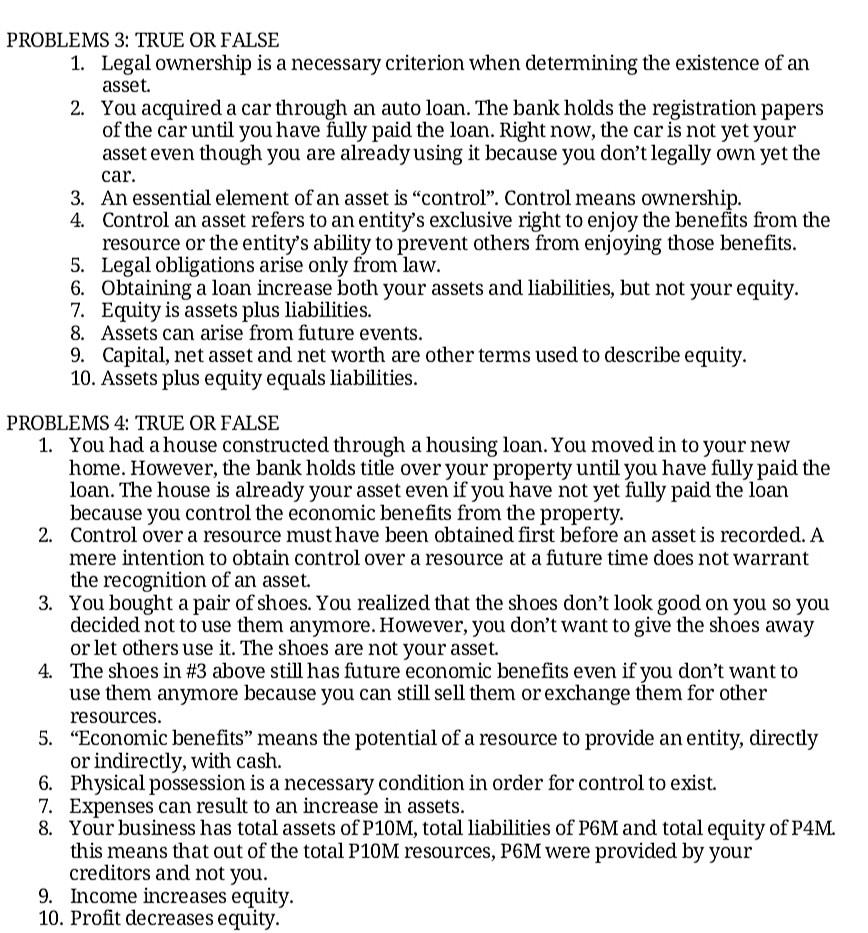

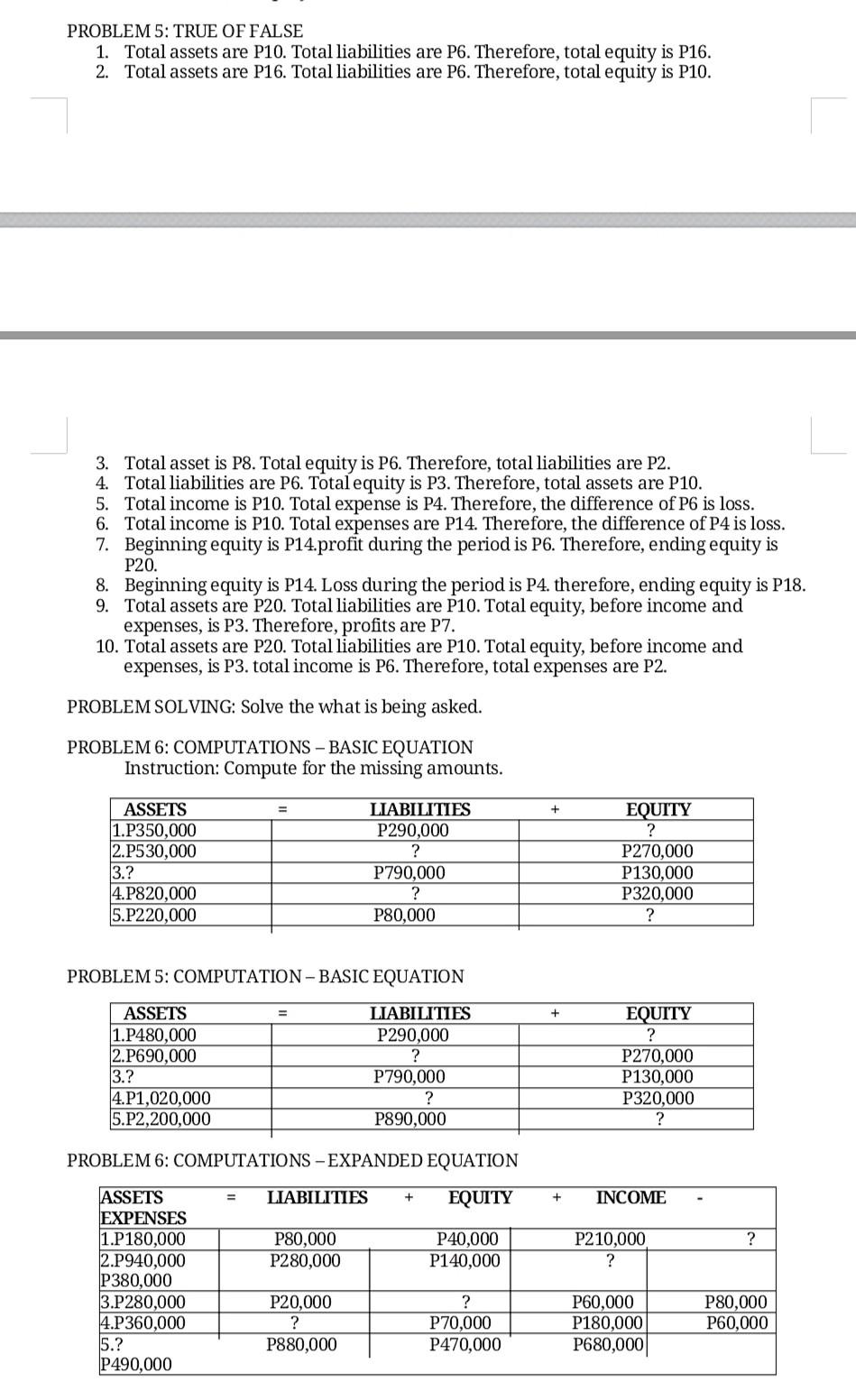

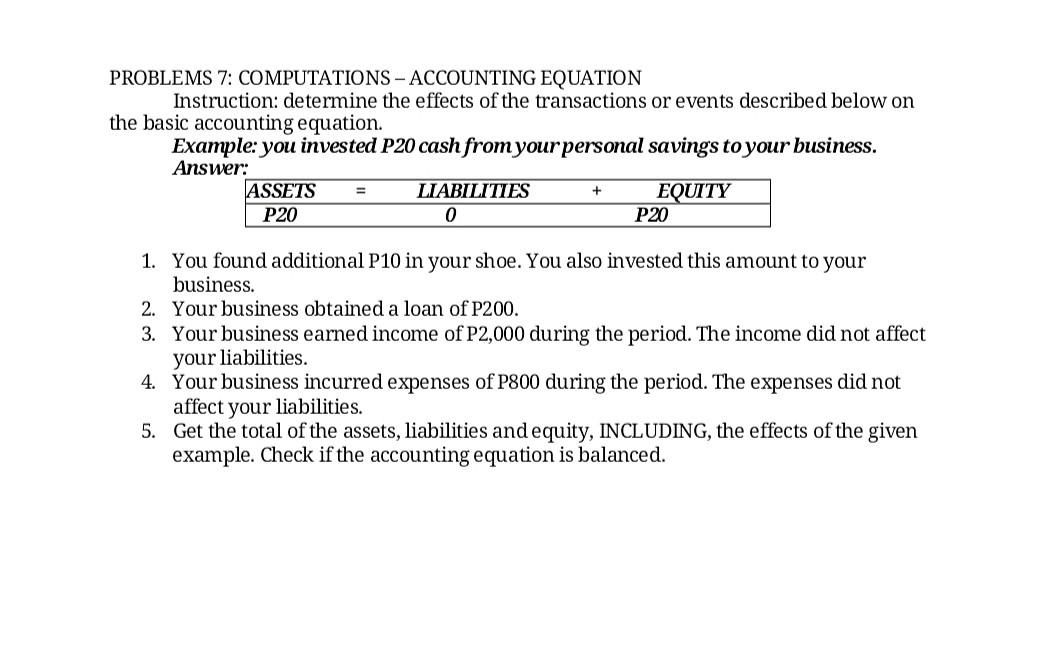

Instructions: Write True if the statement is true. Write False if the statement if false, if false write the word/words that makes the statement false. PROBLEM 1: TRUE OR FALSE 1. Accounting concepts and principles, in the basic sense, ate guidelines that accountants follow when recording and communicating accounting information. 2. The application of the separate entity concept is necessary so that the financial position and performance of the business can be measured objectively. 3. The opposite of going concern is coming concern. 4. According to the accrual basis of accounting, a business should record a sale only when the sale price is collected. 5. Financial statements are prepared at least annually because of the matching concept. 6. A reporting or accounting period that starts on July 1 of the current year and ends June 30 of the following year is called a calendar year period. 7. The government ordered the shutting down of entity A's factories because of noncompliance with regulations. Entity A is a going concern. 8. The accounting standards used in the Philippines are the same as the standards used internationally. 9. The conceptual framework is a standard. 10. According to the materiality concept, an item that is considered material by one business is considered material by all other businesses. PROBLEM 2: TRUE OR FALSE 1. Entity B is going out of business because its business owner lost all the money I the casino. Entity B is going concern. 2. A purpose of the separate entity concept is to report a true and fair picture of business financial affairs. 3. The accountant of Entity A, a big corporation, rounded-off amounts in the financial statements into nearest millions. This is an acceptable method of reporting because of the concept of materiality. 4. Consistency means like transactions must be accounted for in like manner. 5. The cost of processing and communicating financial information should exceed the expected benefits to be delivered from its use. 6. Information is considered material if its omission or misstatement could influence the decisions of financial statements users. 7. When reporting information in its financial statement, Entity A strives for a balance between detail and conciseness having in mind that neither too much detail nor too little information helps users make good decisions. This is an application of the accrual basis of accounting. 8. After becoming an accountant, Mr. A worked as an external auditor in one of the biggest auditing firms in our country. Two years later, an international auditing firm offered Mr. A,an external audit job abroad, which Mr. A accepted. Mr. A will be applying different accounting standards in his new job compared to those that he has applied in his previous job. 9. The process of establishing international accounting standards (on which the accounting standards used in the Philippines are based) s a democratic process in that a majority of practicing accountants around the world must agree with a standard before it becomes implemented. PROBLEMS 3: TRUE OR FALSE 1. Legal ownership is a necessary criterion when determining the existence of an asset. 2. You acquired a car through an auto loan. The bank holds the registration papers of the car until you have fully paid the loan. Right now, the car is not yet your asset even though you are already using it because you don't legally own yet the car. 3. An essential element of an asset is control". Control means ownership. 4. Control an asset refers to an entity's exclusive right to enjoy the benefits from the resource or the entity's ability to prevent others from enjoying those benefits. 5. Legal obligations arise only from law. 6. Obtaining a loan increase both your assets and liabilities, but not your equity. 7. Equity is assets plus liabilities. 8. Assets can arise from future events. 9. Capital, net asset and net worth are other terms used to describe equity. 10. Assets plus equity equals liabilities. PROBLEMS 4: TRUE OR FALSE 1. You had a house constructed through a housing loan. You moved in to your new home. However, the bank holds title over your property until you have fully paid the loan. The house is already your asset even if you have not yet fully paid the loan because you control the economic benefits from the property. 2. Control over a resource must have been obtained first before an asset is recorded. A mere intention to obtain control over a resource at a future time does not warrant the recognition of an asset. 3. You bought a pair of shoes. You realized that the shoes don't look good on you so you decided not to use them anymore. However, you don't want to give the shoes away or let others use it. The shoes are not your asset. 4. The shoes in #3 above still has future economic benefits even if you don't want to use them anymore because you can still sell them or exchange them for other resources. 5. "Economic benefits" means the potential of a resource to provide an entity, directly or indirectly, with cash. 6. Physical possession is a necessary condition in order for control to exist. 7. Expenses can result to an increase in assets. 8. Your business has total assets of P10M, total liabilities of P6M and total equity of P4M. this means that out of the total P10M resources, P6M were provided by your creditors and not you. 9. Income increases equity. 10. Profit decreases equity. PROBLEM 5: TRUE OF FALSE 1. Total assets are P10. Total liabilities are P6. Therefore, total equity is P16. 2. Total assets are P16. Total liabilities are P6. Therefore, total equity is P10. 3. Total asset is P8. Total equity is P6. Therefore, total liabilities are P2. 4. Total liabilities are P6. Total equity is P3. Therefore, total assets are P10. 5. Total income is P10. Total expense is P4. Therefore, the difference of P6 is loss. 6. Total income is P10. Total expenses are P14. Therefore, the difference of P4 is loss. 7. Beginning equity is P14.profit during the period is P6. Therefore, ending equity is P20. 8. Beginning equity is P14. Loss during the period is P4. therefore, ending equity is P18. 9. Total assets are P20. Total liabilities are P10. Total equity, before income and expenses, is P3. Therefore, profits are P7. 10. Total assets are P20. Total liabilities are P10. Total equity, before income and expenses, is P3. total income is P6. Therefore, total expenses are P2. PROBLEM SOLVING: Solve the what is being asked. PROBLEM 6: COMPUTATIONS BASIC EQUATION Instruction: Compute for the missing amounts. + ASSETS 1.P350,000 2.P530,000 3.? 4.P820,000 5.P220,000 LIABILITIES P290,000 ? P790,000 ? P80,000 EQUITY ? P270,000 P130,000 P320,000 ? PROBLEM 5: COMPUTATION - BASIC EQUATION + ASSETS 1.P480,000 2.P690,000 3.? 4.P1,020,000 5.P2,200,000 LIABILITIES P290,000 ? P790,000 ? P890,000 EQUITY ? P270,000 P130,000 P320,000 ? PROBLEM 6: COMPUTATIONS - PANDED EQUATION LIABILITIES + EQUITY + INCOME ? P80,000 P280,000 P40,000 P140,000 P210,000 ? ASSETS EXPENSES 1.P180,000 2.P940,000 P380,000 3.P280,000 4.P360,000 5.? P490,000 P20,000 ? P880,000 ? P70,000 P470,000 P60,000 P180,000 P680,000 P80,000 P60,000 PROBLEMS 7: COMPUTATIONS - ACCOUNTING EQUATION Instruction: determine the effects of the transactions or events described below on the basic accounting equation. Example: you invested P20 cash from your personal savings to your business. Answer: ASSETS LIABILITIES EQUITY P20 0 P20 + 1. You found additional P10 in your shoe. You also invested this amount to your business. 2. Your business obtained a loan of P200. 3. Your business earned income of P2,000 during the period. The income did not affect your liabilities. 4. Your business incurred expenses of P800 during the period. The expenses did not affect your liabilities. 5. Get the total of the assets, liabilities and equity, INCLUDING, the effects of the given example. Check if the accounting equation is balanced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started