Instructions Your client has asked you to prepare the following for the report:

1. Is the company healthy?: Using ratio analysis examine the financial statements for 2018 and 2019 of the company and provide insights on profitability, solvency, ROE and leverage (20%)

2. Transactions planned: Prepare the required journals for transaction and put these in the annex to your report. However, please put a small explanation for each journal in the report. (45%)

3. Understanding Finance (30%): The CEO needs you to explain the following concepts which deeply trouble him:

a. What is advantage and disadvantages between raising money from debt and equity?

b. What is purpose of Treasury shares?

c. Explain the benefits and downside of different depreciation policies such as straight line and declining method?

d. Explain what is financial leverage and its advantage and disadvantage

DATA

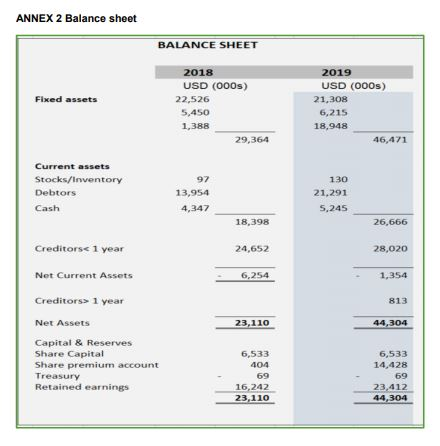

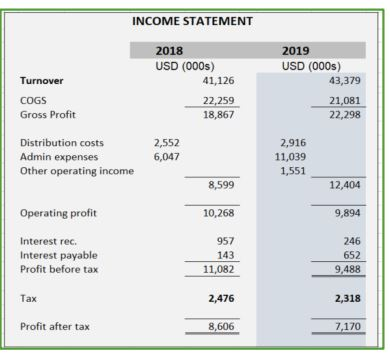

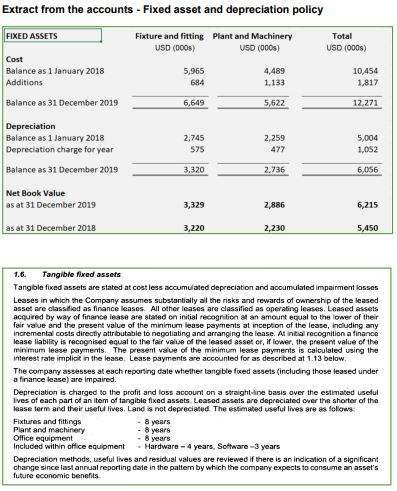

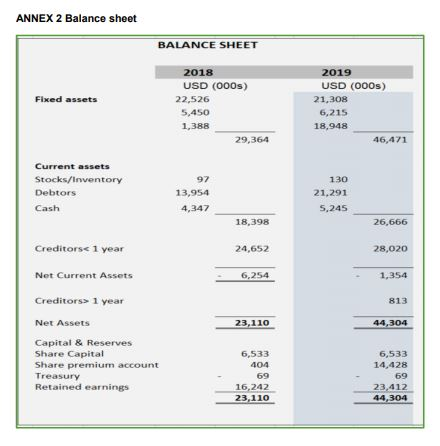

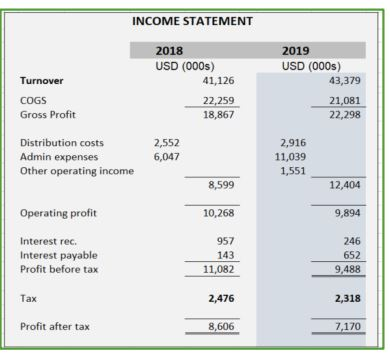

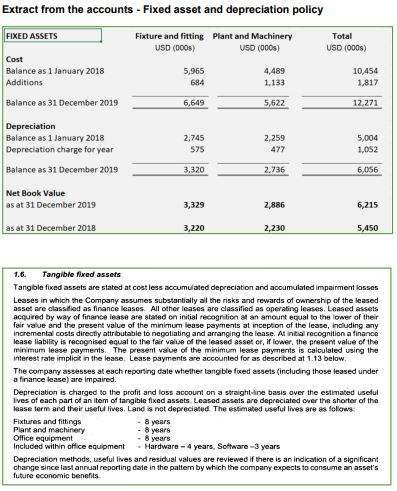

ANNEX 2 Balance sheet BALANCE SHEET Fixed assets 2018 USD (000s) 22,526 5,450 1,388 29,364 2019 USD (000s) 21,308 6,215 18,948 46,471 Current assets Stocks/Inventory Debtors Cash 97 13,954 4,347 130 21,291 5,245 18,398 26,666 Creditors 1 year Net Assets Capital & Reserves Share Capital Share premium account Treasury Retained earnings 6,533 404 69 16,242 23,110 6,533 14,428 69 23,412 44,304 INCOME STATEMENT Turnover COGS Gross Profit 2018 USD (000s) 41,126 22,259 18,867 2019 USD (000s) 43,379 21,081 22,298 Distribution costs Admin expenses Other operating income 2,552 6,047 2,916 11,039 1,551 8,599 12,404 Operating profit 10,268 9,894 Interest rec. Interest payable Profit before tax 957 143 11,082 246 652 9,488 Tax 2,476 2,318 Profit after tax 8,606 7,170 Extract from the accounts - Fixed asset and depreciation policy FIXED ASSETS Fixture and fitting Plant and Machinery USD (000) USD (000) Total USD (0005) Cost Balance as 1 January 2018 Additions Balance as 31 December 2019 5.955 684 4,489 1,133 10,454 1,817 6,649 5,622 12,271 Depreciation Balance as 1 January 2018 Depreciation charge for year Balance as 31 December 2019 2.745 575 2,259 477 5,004 1,052 3,320 2,736 6,056 Net Book Value as at 31 December 2019 3,329 2,886 6,215 as at 31 December 2018 3,220 2,230 5,450 1.6 Tangible fixed assets Tangible fixed assets are stated at cost less accumulated depreciation and accumulated impairment losses Leases in which the Company assumes substantially all the risks and rewards of ownership of the leased asset are classified as finance leases. All other leases are classified as aperating leases. Leased assets acquired by way of finance lease are stated on initial recognition at an amount equal to the lower of their fair value and the present value of the minimum lease payments at inception of the lease, including any incremental costs directly attributable to negotiating and arranging the lease. At initial recognition a finance lease liability is recognised equal to the fair value of the leased asset or, iflower, the present value of the minimum lease payments. The present value of the minimum lease payments is calculated using the interest rate implicit in the lease. Lease payments are accounted for as described at 1.13 below. The company assesses at each reporting date whether tangible foxed assets (including those leased under a finance lease) are impaired. Depreciation is charged to the profit and loss account on a straight-line basis over the estimated useful lives of each part of an item of tangible fixed assets. Leased assets are depreciated over the shorter of the lease term and their useful lives. Land is not depreciated. The estimated useful lives are as follows Fixtures and fittings 8 years Plant and machinery 8 years Office equipment 8 years Included within office equipment - Hardware - 4 years. Software - 3 years Depreciation methods, useful lives and residual values are reviewed if there is an indication of a significant change since last annual reporting date in the pattern by which the company expects to consume an asset's future economic benefits ANNEX 2 Balance sheet BALANCE SHEET Fixed assets 2018 USD (000s) 22,526 5,450 1,388 29,364 2019 USD (000s) 21,308 6,215 18,948 46,471 Current assets Stocks/Inventory Debtors Cash 97 13,954 4,347 130 21,291 5,245 18,398 26,666 Creditors 1 year Net Assets Capital & Reserves Share Capital Share premium account Treasury Retained earnings 6,533 404 69 16,242 23,110 6,533 14,428 69 23,412 44,304 INCOME STATEMENT Turnover COGS Gross Profit 2018 USD (000s) 41,126 22,259 18,867 2019 USD (000s) 43,379 21,081 22,298 Distribution costs Admin expenses Other operating income 2,552 6,047 2,916 11,039 1,551 8,599 12,404 Operating profit 10,268 9,894 Interest rec. Interest payable Profit before tax 957 143 11,082 246 652 9,488 Tax 2,476 2,318 Profit after tax 8,606 7,170 Extract from the accounts - Fixed asset and depreciation policy FIXED ASSETS Fixture and fitting Plant and Machinery USD (000) USD (000) Total USD (0005) Cost Balance as 1 January 2018 Additions Balance as 31 December 2019 5.955 684 4,489 1,133 10,454 1,817 6,649 5,622 12,271 Depreciation Balance as 1 January 2018 Depreciation charge for year Balance as 31 December 2019 2.745 575 2,259 477 5,004 1,052 3,320 2,736 6,056 Net Book Value as at 31 December 2019 3,329 2,886 6,215 as at 31 December 2018 3,220 2,230 5,450 1.6 Tangible fixed assets Tangible fixed assets are stated at cost less accumulated depreciation and accumulated impairment losses Leases in which the Company assumes substantially all the risks and rewards of ownership of the leased asset are classified as finance leases. All other leases are classified as aperating leases. Leased assets acquired by way of finance lease are stated on initial recognition at an amount equal to the lower of their fair value and the present value of the minimum lease payments at inception of the lease, including any incremental costs directly attributable to negotiating and arranging the lease. At initial recognition a finance lease liability is recognised equal to the fair value of the leased asset or, iflower, the present value of the minimum lease payments. The present value of the minimum lease payments is calculated using the interest rate implicit in the lease. Lease payments are accounted for as described at 1.13 below. The company assesses at each reporting date whether tangible foxed assets (including those leased under a finance lease) are impaired. Depreciation is charged to the profit and loss account on a straight-line basis over the estimated useful lives of each part of an item of tangible fixed assets. Leased assets are depreciated over the shorter of the lease term and their useful lives. Land is not depreciated. The estimated useful lives are as follows Fixtures and fittings 8 years Plant and machinery 8 years Office equipment 8 years Included within office equipment - Hardware - 4 years. Software - 3 years Depreciation methods, useful lives and residual values are reviewed if there is an indication of a significant change since last annual reporting date in the pattern by which the company expects to consume an asset's future economic benefits