Question

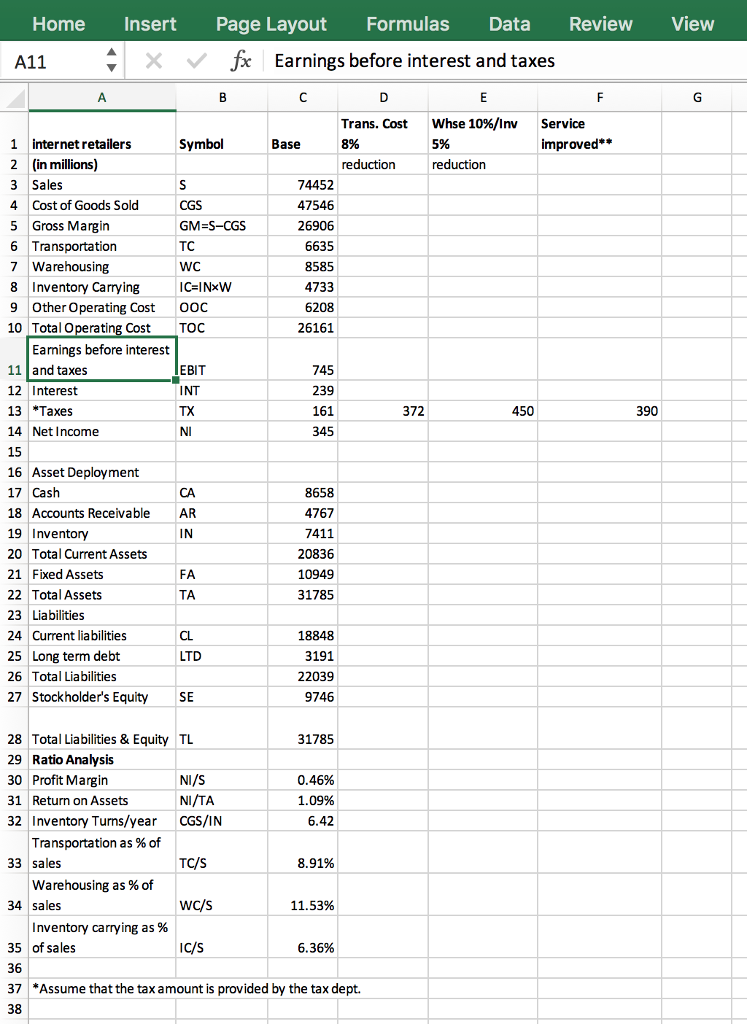

Instuctions : USE THE FAR LEFT COLUMN AS BASE CASE-- MAKE ALL CHANGES FROM THERE Remember to consider BOTH the balance sheet impact and the

| Instuctions: | |||||||

| USE THE FAR LEFT COLUMN AS BASE CASE-- MAKE ALL CHANGES FROM THERE | |||||||

| Remember to consider BOTH the balance sheet impact and the Income statement | |||||||

| Start each with the "base case. First: calculate the impact of a 8% decrease in transport | |||||||

| and then 10% decrease in warehousing AND simultaneously a 5% decrease in inventory. | |||||||

| Last column, | |||||||

| Impact of service failure improvement: | |||||||

| Simultaneously do the following: | |||||||

| Increase net sales by 2% (fewer returns) | |||||||

| Increase COGS by 2% (fewer returns) | |||||||

| Increase inventory by 1% (higher inv. to fill order) Fill out the blank in Excel and answer following questions 1. Help Katie present the profit-leverage effect concept to RR management. How should she explain it to them so that they can truly understand the equivalent sales impact of logistics? 2. Use the Strategic Profit Model to calculate the balance sheet, income statement and key ratio effects for each of the scenarios. Develop a recommendation for Katie to present to top management, including the aspects of the SPM she should present, and why. 3. What potential goal conflicts would your recommendation create among merchandising, logistics, and stores? 4. Identify two common metrics that merchandising, logistics, and the store could share that might reduce existing conflicts. How would these metrics reduce conflict? |

| ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started