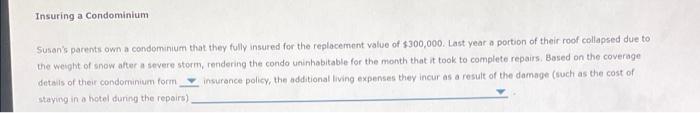

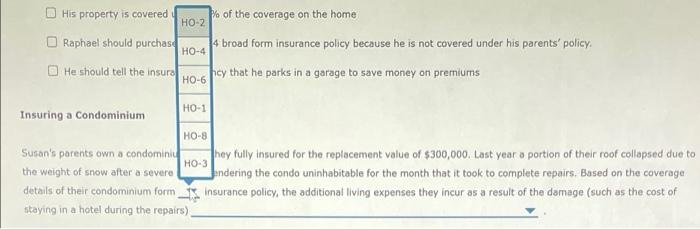

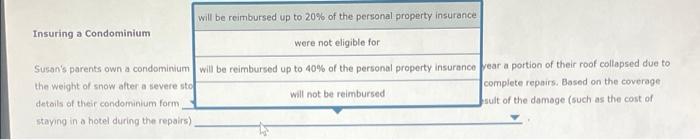

Insuring a Condominium Susan's parents own a condominium that they fully insured for the replacement value of $300,000. Last year a portion of their roof collapsed due to the weight of snow after a severe storm, rendering the condo uninhabitable for the month that it took to complete repairs. Based on the coverage details of their condominium form insurance policy, the additional living expenses they incur as a result of the damage (such as the cost of staying in a hotel during the repairs) His property is covered of the coverage on the home HO-2 Raphael should purchase 4 broad form insurance policy because he is not covered under his parents' policy. HO-4 He should tell the insuro hey that he parks in a garage to save money on premiums HO-6 HO-1 Insuring a Condominium HO-8 Susan's parents own a condominiu hey fully insured for the replacement value of $300,000. Last year a portion of their roof collapsed due to the weight of snow after a severe Jendering the condo uninhabitable for the month that it took to complete repairs. Based on the coverage details of their condominium form_ix Insurance policy, the additional living expenses they incur as a result of the damage (such as the cost of staying in a hotel during the repairs) HO-3 will be reimbursed up to 20% of the personal property insurance Insuring a Condominium were not eligible for Susan's parents own a condominium will be reimbursed up to 40% of the personal property insurance Year a portion of their roof collapsed due to the weight of snow after a severe sto complete repairs. Based on the coverage will not be reimbursed details of their condominium form sult of the damage (such as the cost of staying in a hotel during the repairs) Insuring a Condominium Susan's parents own a condominium that they fully insured for the replacement value of $300,000. Last year a portion of their roof collapsed due to the weight of snow after a severe storm, rendering the condo uninhabitable for the month that it took to complete repairs. Based on the coverage details of their condominium form insurance policy, the additional living expenses they incur as a result of the damage (such as the cost of staying in a hotel during the repairs) His property is covered of the coverage on the home HO-2 Raphael should purchase 4 broad form insurance policy because he is not covered under his parents' policy. HO-4 He should tell the insuro hey that he parks in a garage to save money on premiums HO-6 HO-1 Insuring a Condominium HO-8 Susan's parents own a condominiu hey fully insured for the replacement value of $300,000. Last year a portion of their roof collapsed due to the weight of snow after a severe Jendering the condo uninhabitable for the month that it took to complete repairs. Based on the coverage details of their condominium form_ix Insurance policy, the additional living expenses they incur as a result of the damage (such as the cost of staying in a hotel during the repairs) HO-3 will be reimbursed up to 20% of the personal property insurance Insuring a Condominium were not eligible for Susan's parents own a condominium will be reimbursed up to 40% of the personal property insurance Year a portion of their roof collapsed due to the weight of snow after a severe sto complete repairs. Based on the coverage will not be reimbursed details of their condominium form sult of the damage (such as the cost of staying in a hotel during the repairs)