Answered step by step

Verified Expert Solution

Question

1 Approved Answer

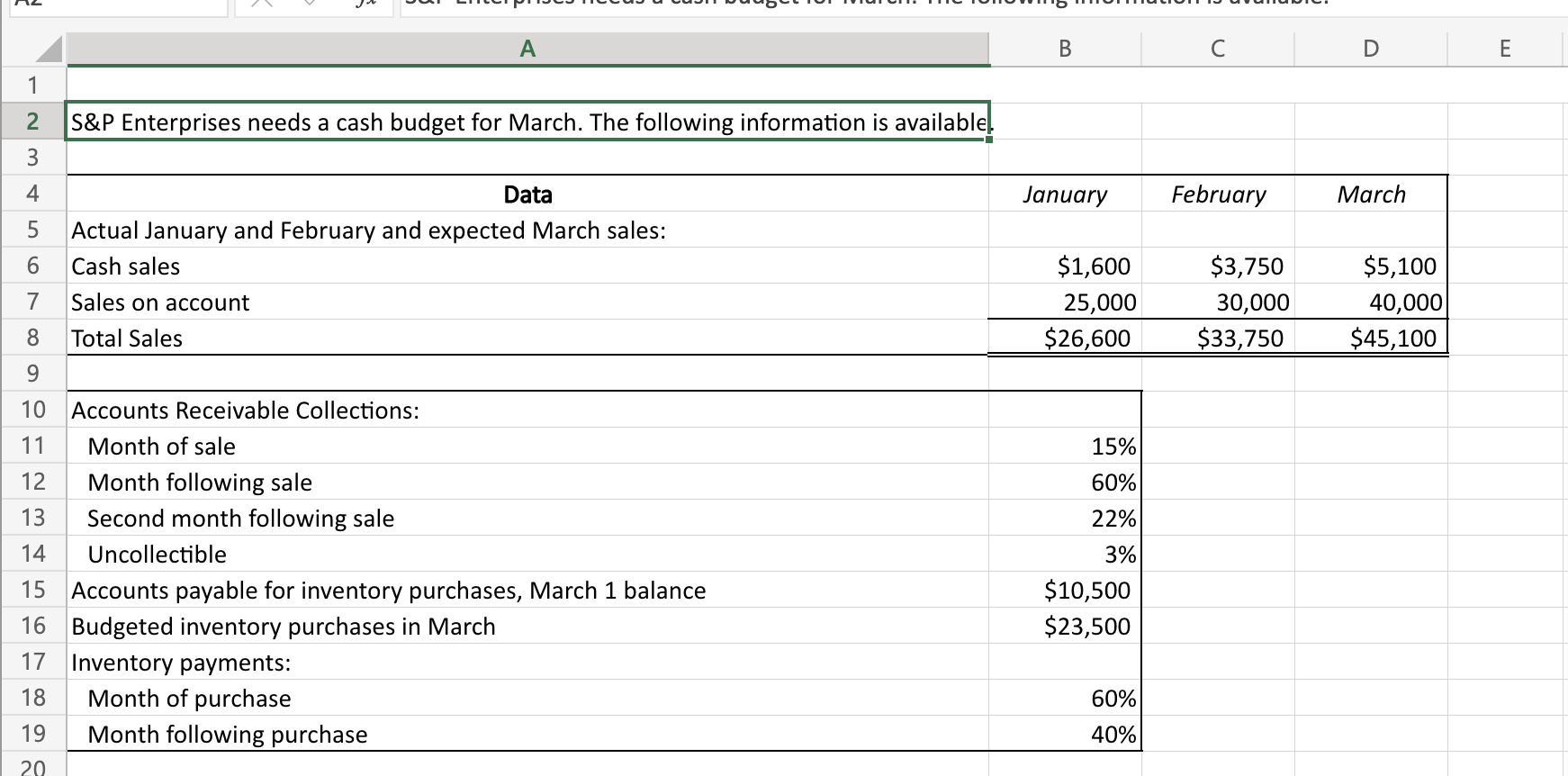

Integrated Excel: Preparing a Cash Budget with Supporting Schedules S&P Enterprises has provided data from the first three months of the year. The Controller has

Integrated Excel: Preparing a Cash Budget with Supporting Schedules

S&P Enterprises has provided data from the first three months of the year. The Controller has asked you to prepare the Cash Budget and the related Schedules for Expected cash collections and Payments to suppliers.

| Data | January | February | March |

|---|---|---|---|

| Actual January and February and expected March sales: | |||

| Cash sales | $ 1,600 | $ 3,750 | $ 5,100 |

| Sales on account | 25,000 | 30,000 | 40,000 |

| Total Sales | $ 26,600 | $ 33,750 | $ 45,100 |

| Accounts Receivable Collections: | |

|---|---|

| Month of sale | 15% |

| Month following sale | 60% |

| Second month following sale | 22% |

| Uncollectible | 3% |

| Accounts payable for inventory purchases, March 1 balance | $ 10,500 |

| Budgeted inventory purchases in March | $ 23,500 |

| Inventory payments: | |

| Month of purchase | 60% |

| Month following purchase | 40% |

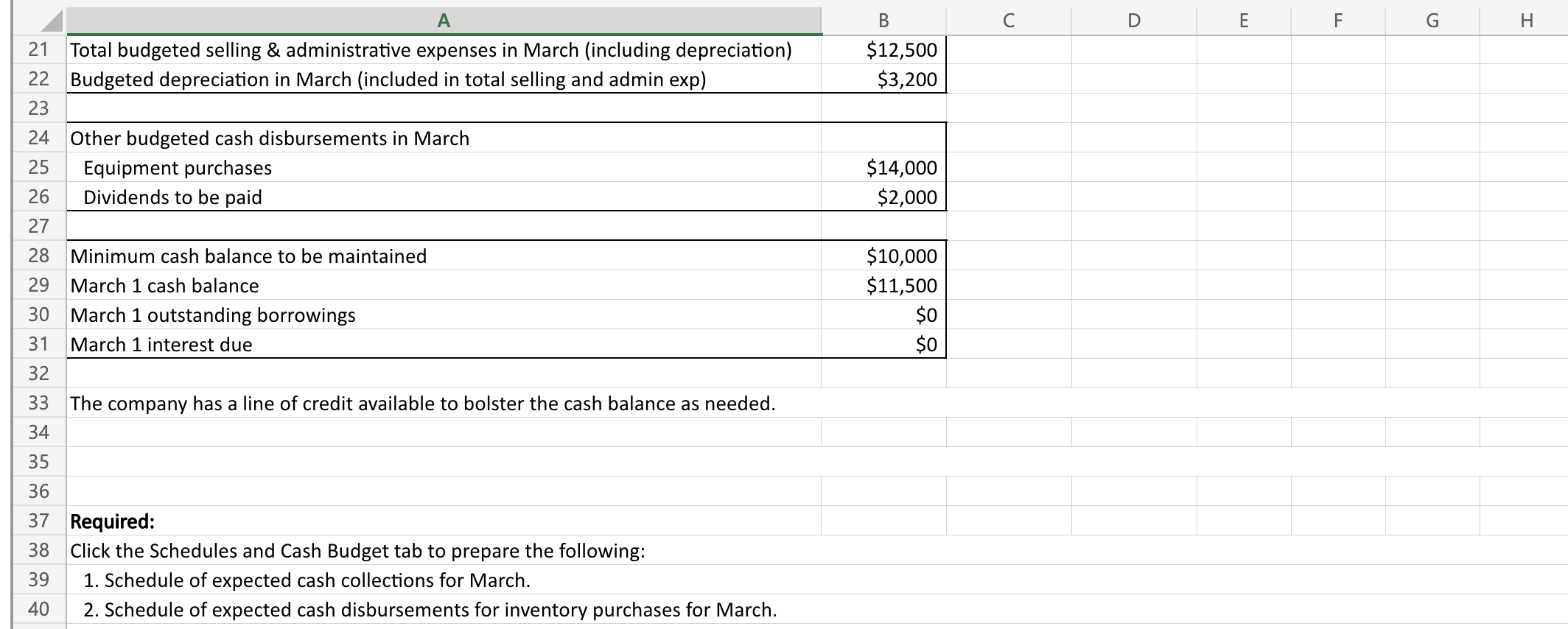

| Total budgeted selling & administrative expenses in March (including depreciation) | $ 12,500 |

|---|---|

| Budgeted depreciation in March (included in total selling and admin exp) | $ 3,200 |

| Other budgeted cash disbursements in March | |

|---|---|

| Equipment purchases | $ 14,000 |

| Dividends to be paid | $ 2,000 |

| Minimum cash balance to be maintained | $ 10,000 |

|---|---|

| March 1 cash balance | $ 11,500 |

| March 1 outstanding borrowings | $ 0 |

| March 1 interest due | $ 0 |

The company has a line of credit available to bolster the cash balance as needed.

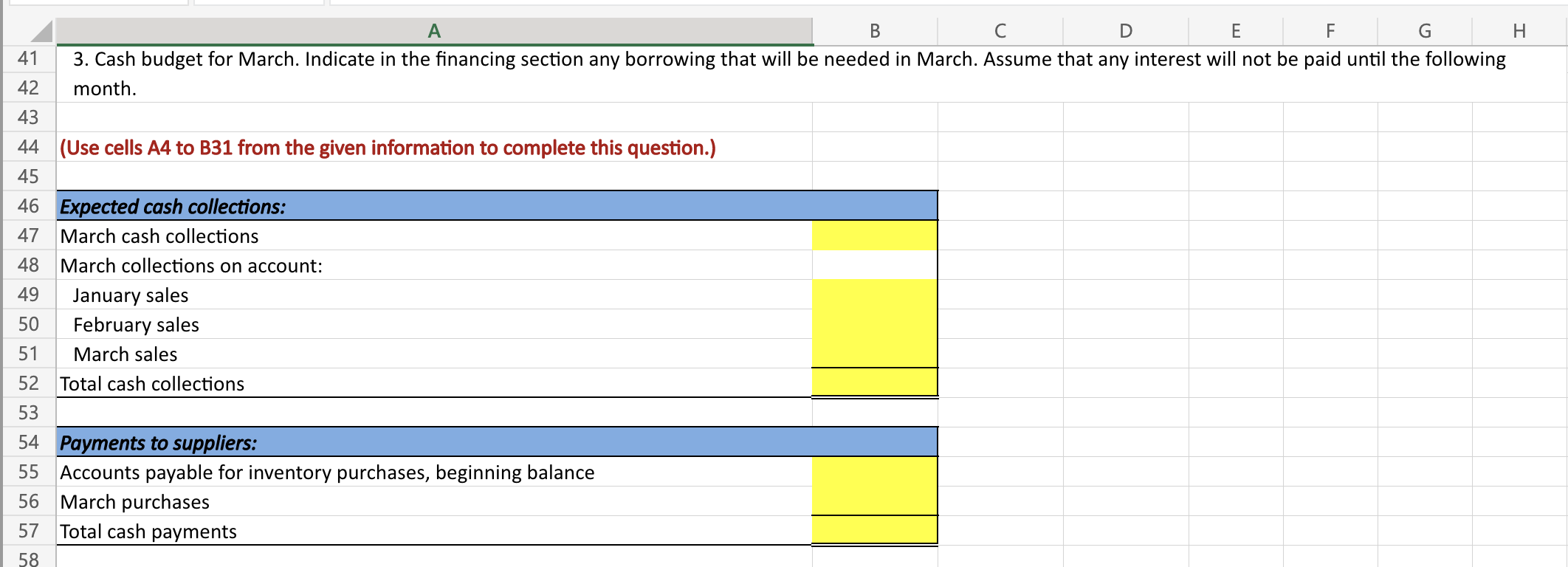

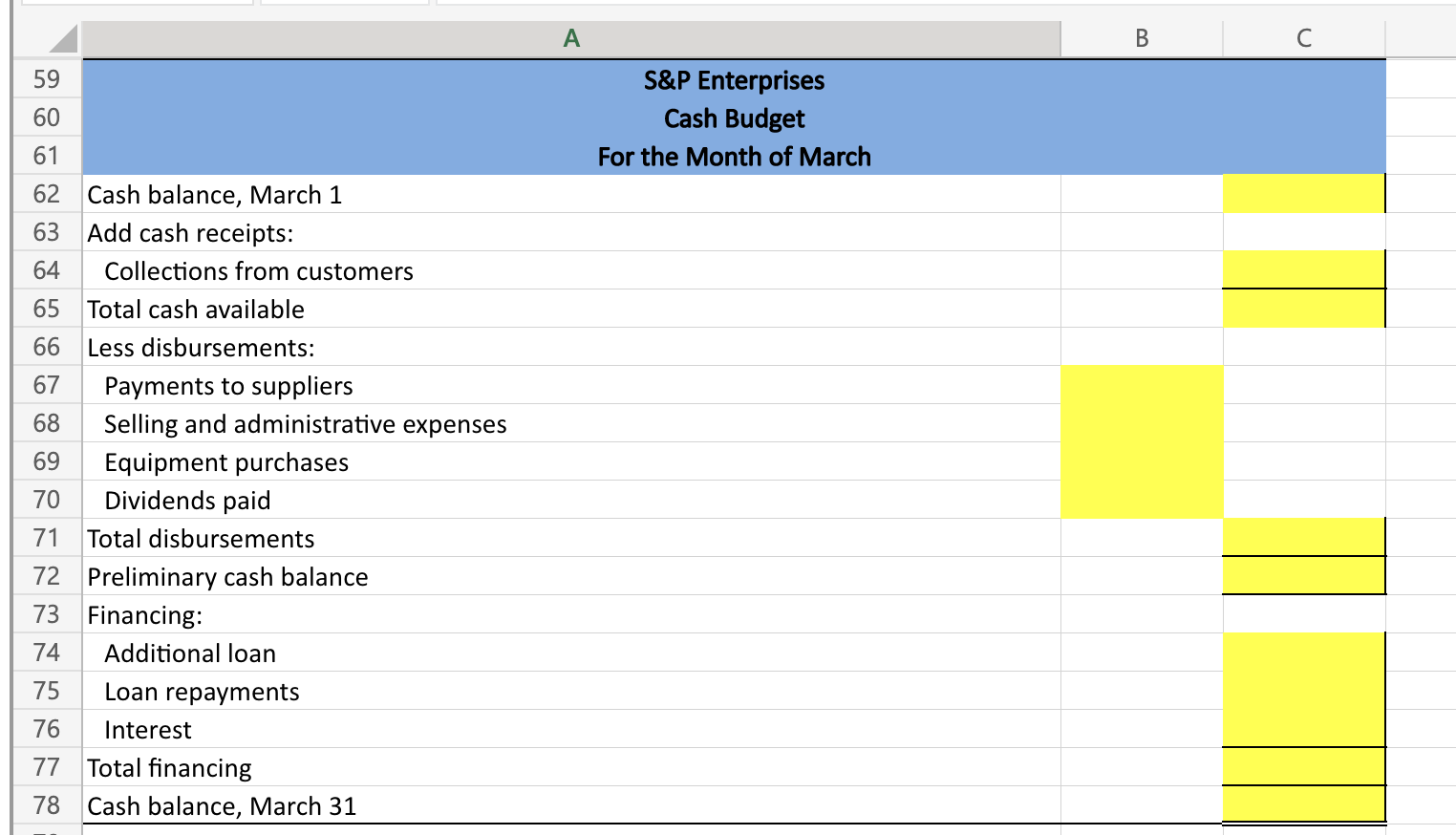

Required:

Click the Schedules and Cash Budget tab to prepare the following:

- Schedule of expected cash collections for March.

- Schedule of expected cash disbursements for inventory purchases for March.

- Cash budget for March. Indicate in the financing section any borrowing that will be needed in March. Assume that any interest will not be paid until the following month.

Navigation:

- Use the Open Excel in New Tab button to launch this question.

- When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started